UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

SCHEDULE 14A

Proxy Statement Pursuant to Section 14(a)

of the Securities Exchange Act of 1934

Filed by the Registrant ☒

Filed by a Party other than the Registrant ☐

Check the appropriate box:

|

☐ |

Preliminary Proxy Statement |

|

|

☐ |

Confidential, for Use of the SEC Only (as permitted by Rule 14a-6(e)(2)) |

|

|

☒ |

Definitive Proxy Statement |

|

|

☐ |

Definitive Additional Materials |

|

|

☐ |

Soliciting Material Pursuant to 14a-12 |

WRAP TECHNOLOGIES, INC.

(Name of Registrant as Specified in Its Charter)

(Name of Person(s) Filing Proxy Statement, if other than the Registrant)

Payment of Filing Fee (Check the appropriate box):

|

☒ |

No fee required. |

|

|

☐ |

Fee paid previously with preliminary materials. |

|

|

☐ |

Fee computed on table in exhibit required by Item 25(b) per Exchange Act Rules 14a‑6(i)(1) and 0‑11. |

Wrap Technologies, Inc.

1817 W 4th Street

Tempe, Arizona 85281

(800) 583-2652

NOTICE OF VIRTUAL ANNUAL MEETING OF STOCKHOLDERS

To Be Held on June 28, 2023

Dear Stockholders of Wrap Technologies, Inc.:

It is our pleasure to invite you to the 2023 Annual Meeting of Stockholders (the “Annual Meeting”) of Wrap Technologies, Inc., a Delaware corporation (the “Company”). The Annual Meeting will be held on Wednesday, June 28, 2023 at 9:00 A.M., Pacific Time in a virtual meeting format only. There will be no physical location for stockholders to attend the Annual Meeting. Stockholders will be able to listen, vote, and submit questions, regardless of their physical location, via the internet by registering at a live webcast www.virtualshareholdermeeting.com/WRAP2023. If you plan to participate in the virtual Annual Meeting, please see the “Instructions for the Virtual Annual Meeting” section in the attached proxy statement for the Annual Meeting (the “Proxy Statement”). The purpose of the Annual Meeting is to vote on the following:

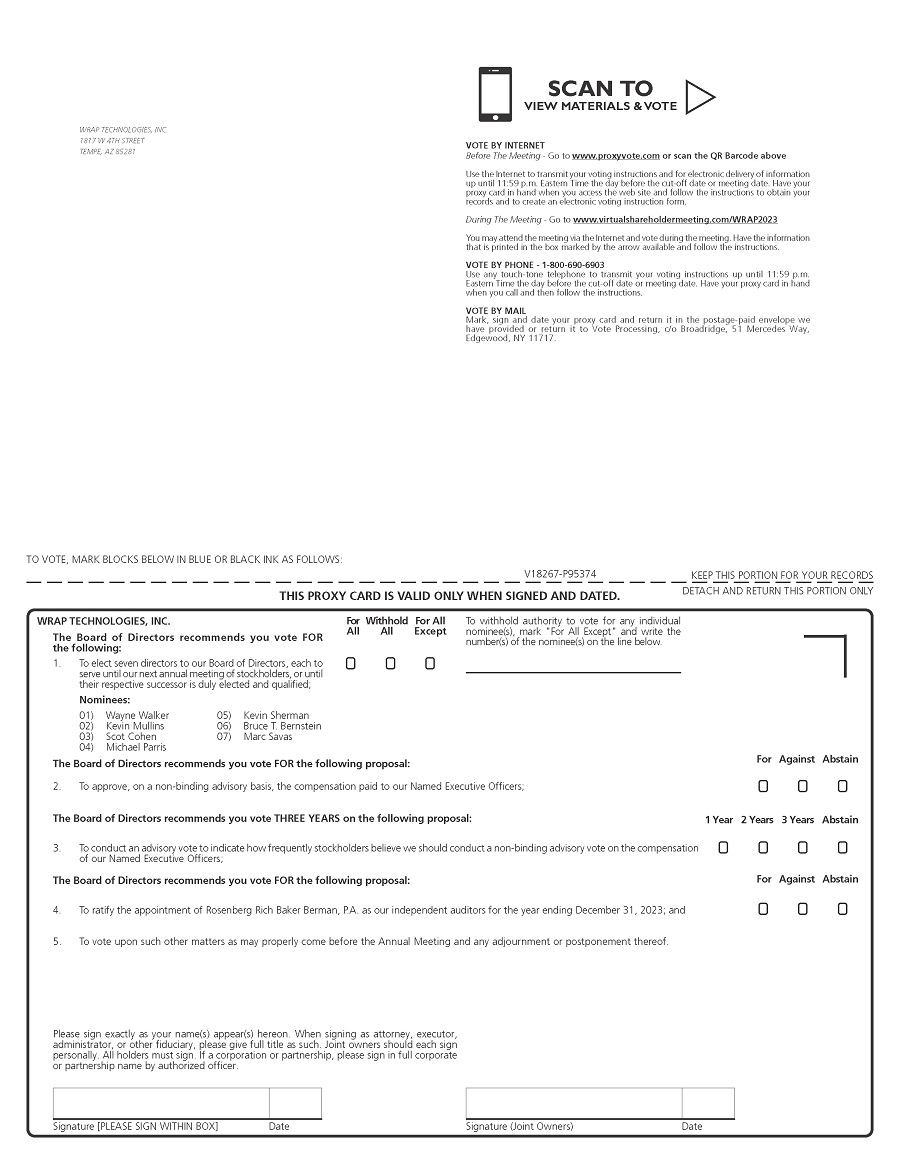

|

1. |

to elect seven directors to our Board of Directors, each to serve until our next annual meeting of stockholders, or until their respective successor is duly elected and qualified; |

|

|

|

||

|

2. |

to approve, on a non-binding advisory basis, the compensation paid to our Named Executive Officers; |

|

|

|

||

|

3. |

to conduct an advisory vote to indicate how frequently stockholders believe we should conduct a non-binding advisory vote on the compensation of our Named Executive Officers; |

|

|

|

||

|

4. |

to ratify the appointment of Rosenberg Rich Baker Berman, P.A. as our independent auditors for the year ending December 31, 2023; and |

|

|

|

||

|

5. |

to vote upon such other matters as may properly come before the Annual Meeting and any adjournment or postponement thereof. |

The foregoing items of business are more fully described in the Proxy Statement accompanying this Notice. Other detailed information about us and our operations, including our audited financial statements, are included in our Annual Report on Form 10-K (the “Annual Report”), a copy of which is enclosed. This Notice, the Proxy Statement and the Annual Report are also available online at: www.proxyvote.com. You will also have the opportunity to hear what has happened in our business in the past year and to ask questions.

We have elected to provide access to our proxy materials primarily over the Internet, pursuant to the Securities and Exchange Commission’s “notice and access” rules. We strongly encourage you to sign up for electronic delivery of our future annual reports and proxy materials in order to conserve natural resources and help us save costs in producing and distributing these materials. For more information, please see “Electronic Delivery of Proxy Materials and Annual Report” on page 1 of the Proxy Statement. The proxy materials are also available from our proxy solicitor, Morrow Sodali LLC, toll-free at 1-800 662-5200 or email at WRAP@investor.morrowsodali.com.

The Board of Directors has fixed the close of business on May 5, 2023 as the record date for the determination of stockholders entitled to notice of and to vote at the Annual Meeting and at any adjournment or postponement thereof. Stockholders of record present via live webcast at the Annual Meeting or who have submitted a valid proxy via the Internet, by telephone or by mail will be deemed to be present, to vote at the Annual Meeting.

Your vote is very important to us. Please act as soon as possible to vote your shares, even if you plan to participate in the virtual Annual Meeting. Regardless of whether you plan to virtually attend the Annual Meeting, please read the Proxy Statement and vote your shares by Internet, telephone or e-mail as promptly as possible. Please refer to the “Instructions for the Virtual Annual Meeting” section of the Proxy Statement for instructions on submitting your vote. Voting promptly will save us additional expense in further soliciting proxies and will ensure that your shares are represented at the Annual Meeting. If you have any questions or need assistance voting, please contact the Company’s proxy solicitor toll-free at 1-800 662-5200 or email at WRAP@investor.morrowsodali.com.

By Order of the Board of Directors,

|

/s/ Wayne Walker Wayne Walker |

/s/ Kevin Mullins Kevin Mullins |

|

Chairman of the Board |

Chief Executive Officer |

Tempe, Arizona

May 19, 2023

YOUR VOTE IS IMPORTANT

ALL STOCKHOLDERS ARE CORDIALLY INVITED TO ATTEND THE ANNUAL MEETING VIA LIVE WEBCAST. HOWEVER, TO ENSURE YOUR REPRESENTATION AT THE ANNUAL MEETING, YOU ARE URGED TO VOTE BY INTERNET, TELEPHONE OR MAIL AS SOON AS POSSIBLE. RETURNING YOUR PROXY WILL HELP US ASSURE THAT A QUORUM WILL BE PRESENT AT THE ANNUAL MEETING AND AVOID THE ADDITIONAL EXPENSE OF DUPLICATE PROXY SOLICITATIONS. EVEN IF YOU HAVE GIVEN YOUR PROXY, YOU MAY STILL VOTE VIA LIVE WEBCAST IF YOU ATTEND THE VIRTUAL ANNUAL MEETING. PLEASE NOTE, HOWEVER, THAT IF YOUR SHARES ARE HELD OF RECORD BY A BROKER, BANK OR OTHER NOMINEE AND YOU WISH TO VOTE AT THE ANNUAL MEETING, YOU MUST OBTAIN FROM THE RECORD HOLDER A PROXY ISSUED IN YOUR NAME.

IMPORTANT NOTICE REGARDING THE AVAILABILITY OF PROXY MATERIALS FOR THE ANNUAL MEETING TO BE HELD ON JUNE 28, 2023: THE ANNUAL REPORT AND PROXY STATEMENT ARE AVAILABLE ONLINE AT: WWW.PROXYVOTE.COM.

Wrap Technologies, Inc.

1817 W 4th Street

Tempe, Arizona 85281

(800) 583-2652

PROXY STATEMENT

This Proxy Statement is furnished in connection with the solicitation of proxies by the Board of Directors (the “Board”) of Wrap Technologies, Inc., a Delaware corporation (the “Company”), for use at the Company’s 2023 Annual Meeting of Stockholders (the “Annual Meeting”) to be held on June 28, 2023 at 9:00 A.M., Pacific Time, via virtual meeting by accessing www.virtualshareholdermeeting.com/WRAP2023 and at any adjournment or postponement thereof.

Instructions for Virtual Annual Meeting

A virtual meeting format offers the same participation opportunities as those opportunities available to stockholders at in-person meetings. Stockholders will be able to listen, vote, and submit questions. To participate in the Annual Meeting webcast, you must register www.virtualshareholdermeeting.com/WRAP2023 by 11:59 P.M., Pacific Time, on June 27, 2023 using your desktop or mobile device.

The Annual Meeting will begin promptly at 9:00 A.M., Pacific Time, on June 28, 2023. We encourage you to access the virtual meeting website prior to the start time. Online check-in will begin 30 minutes prior to the start of the Annual Meeting. You should allow ample time to ensure your ability to access the Annual Meeting.

We will hold our question-and-answer session with management immediately following the conclusion of the Annual Meeting. You may submit a question in advance of the Annual Meeting during the registration process by visiting www.virtualshareholdermeeting.com/WRAP2023. You may also submit a question at any time during the Annual Meeting by typing the questions into the questions box on the screen once the virtual meeting starts. The Chairman of the Annual Meeting has broad authority to conduct the meeting in an orderly manner.

Technicians will be available to assist you if you experience technical difficulties accessing the virtual meeting website. If you encounter any difficulties accessing the virtual meeting during the check-in or meeting time, please call 844-986-0822 for assistance.

Electronic Delivery of Proxy Materials and Annual Report

We have elected to provide access to this year’s proxy materials primarily over the Internet under the Securities and Exchange Commission’s (“SEC”) “notice and access” rules. We intend to mail a Notice of Internet Availability of Proxy Materials (the “Notice”) on or about May 19, 2023 to each of our stockholders entitled to notice of, and to vote at, the Annual Meeting, which will contain instructions for accessing this Proxy Statement, our Annual Report on Form 10-K for the fiscal year ended December 31, 2022 (“Annual Report”) and voting instructions. The Notice will also include instructions on how you can receive a paper copy of your proxy materials.

This Proxy Statement and the Annual Report can also be accessed free of charge online as of May 19, 2023 at: www.proxyvote.com. The proxy materials are also available from our proxy solicitor, Morrow Sodali LLC (“Morrow Sodali”), toll-free at 1 800-662-5200 via email at WRAP@investor.morrowsodali.com.

Voting

The specific proposals to be considered and acted upon at our Annual Meeting are each described in this Proxy Statement. Only holders of our common stock, par value $0.0001 per share (“Common Stock’’), as of the close of business on May 5, 2023 (the “Record Date”) are entitled to notice of and to vote at the Annual Meeting. On the Record Date, there were 41,663,868 shares of Common Stock issued and outstanding. Each holder of Common Stock is entitled to one vote for each share held as of the Record Date. If you have any questions or need assistance voting, please contact the Company’s proxy solicitor Morrow Sodali toll-free at 1 800 662-5200 or email at WRAP@investor.morrowsodali.com.

Quorum

In order for any business to be conducted at the Annual Meeting, a quorum must be present. The presence at the Annual Meeting, either in attendance virtually or by proxy, of holders of a majority of the outstanding shares of the Company entitled to vote will constitute a quorum for the transaction of business. If you submit a properly executed proxy, regardless of whether you abstain from voting on one or more matters, your shares will be counted as present at the Annual Meeting for the purpose of establishing a quorum. Shares that constitute broker non-votes will also be counted as present at the Annual Meeting for the purpose of establishing a quorum. If a quorum is not present at the scheduled time of the Annual Meeting, the Chairman of the Annual Meeting may adjourn the Annual Meeting until a quorum is present. The time and place of the adjourned Annual Meeting will be announced at the time the adjournment is taken, and no other notice will be given. An adjournment will have no effect on the business that may be conducted at the Annual Meeting.

Required Vote for Approval

Proposal No. 1: Election of Directors. Directors are elected by a plurality vote. This means that the seven director nominees who receive the greatest number of affirmative votes cast at the Annual Meeting by the shares present, either in attendance virtually or represented by proxy, and entitled to vote, will be elected (the “Election of Directors”). Abstentions and broker non-votes will have no effect on the outcome of the election of the directors.

Proposal No. 2: Approval, on a Non-Binding Advisory Basis, of the Compensation Paid to our Named Executive Officers. This proposal calls for a non-binding, advisory vote regarding the compensation paid to our Named Executive Officers (“Say-on-Pay”). Accordingly, there is no “required vote” that would constitute approval of this proposal. However, our Board, including the Compensation Committee of the Board, values the opinions of our stockholders and will consider the result of the vote when making future decisions regarding our executive compensation policies and practices. The affirmative “FOR” vote of a majority of the votes cast, in person or by proxy, excluding abstentions, is required to approve this non-binding, advisory proposal.

Proposal No. 3: Advisory Vote to Approve the Frequency of Non-Binding Advisory Votes on Executive Compensation. This proposal provides a choice among three frequency periods (every one, two or three years) for future advisory Say-on-Pay proposals (“Say-on-Frequency”). The frequency period that receives the most votes will be deemed to be the recommendation of our stockholders. However, because this vote is advisory and not binding on our Board of Directors or management, we may decide that it is in the best interests of our stockholders to hold a Say-on-Pay proposals more or less frequently than the frequency period selected by our stockholders. Unless otherwise instructed or unless authority to vote is withheld, shares represented by executed proxies will be voted for “THREE YEARS.”

Proposal No. 4: Ratification of Appointment of Auditors. The affirmative vote of the holders of a majority of the voting securities present, either in attendance virtually or represented by proxy at the Annual Meeting, and entitled to vote on the matter, is necessary to ratify the appointment of Rosenberg Rich Baker Berman, P.A. as our independent auditors for the fiscal year ending December 31, 2023 (the “Ratification Proposal”). A properly executed proxy marked “ABSTAIN” will not be voted, although it will be counted as present and entitled to vote for purposes of the Ratification Proposal. Accordingly, an abstention will have the effect of a vote against the Ratification Proposal. A broker or other nominee will generally have discretionary authority to vote on the Ratification Proposal because it is considered a routine matter, and therefore we do not expect broker non-votes with respect to the Ratification Proposal. However, any broker non-votes received will have no effect on the outcome of the Ratification Proposal.

Proposal No. 5: Vote upon such other matters as may properly come before the Annual Meeting and any adjournment or postponement thereof.

Broker Non-Votes

A “broker non-vote” occurs when a nominee (typically a broker or bank) holding shares for a beneficial owner (typically referred to as shares being held in “street name”) submits a proxy for the Annual Meeting but does not vote on a particular proposal because the nominee has not received voting instructions from the beneficial owner and does not have discretionary authority to vote the shares with respect to that proposal.

Brokers and other nominees may vote on “routine” proposals on behalf of beneficial owners who have not furnished voting instructions, subject to the rules applicable to broker nominees concerning transmission of proxy materials to beneficial owners, and subject to any proxy voting policies and procedures of those firms. The ratification of the independent registered public accountants, for example, is a routine proposal. Brokers and other nominees may not vote on “non-routine” proposals, unless they have received voting instructions from the beneficial owner. The election of directors is considered a “non-routine” proposal. This means that brokers and other firms must obtain voting instructions from the beneficial owner to vote on these matters; otherwise, they will not be able to cast a vote for such “non-routine” proposals. If your shares are held in the name of a broker, bank or other nominee, please follow their voting instructions so you can instruct your broker on how to vote your shares.

Voting and Revocation of Proxies

If your proxy is properly returned to the Company, the shares represented thereby will be voted at the Annual Meeting in accordance with the instructions specified thereon. If you return your proxy without specifying how the shares represented thereby are to be voted, the proxy will be voted (i) FOR the election of the seven director nominees named in this Proxy Statement, (ii) FOR the approval of the compensation paid to our executive officers, (iii) FOR the frequency of non-binding advisory votes on executive compensation to be held every “THREE YEARS” (iv) FOR ratification of the appointment of Rosenberg Rich Baker Berman, P.A. as our independent auditors for the current fiscal year, and (v) at the discretion of the proxy holders on any other matter that may properly come before the Annual Meeting or any adjournment or postponement thereof.

You may revoke or change your proxy at any time before the Annual Meeting by (i) filing, with our Corporate Secretary at our executive offices, located at 1817 W 4th Street, Tempe, Arizona 85281, a notice of revocation or another signed proxy with a later date, or (ii) by voting online at the virtual Annual Meeting. Attendance at the virtual Annual Meeting by itself will not revoke a proxy. Shares can be voted at the Annual Meeting only if the holder is present or represented by proxy. If you are a stockholder whose shares are not registered in your own name, you will need additional documentation from your broker or record holder to vote personally at the Annual Meeting.

No Appraisal Rights

The stockholders of the Company have no dissenter’s or appraisal rights in connection with any of the proposals described herein.

Solicitation

We will bear the entire cost of solicitation, including the preparation, assembly, printing and mailing of the Notice, as well as the preparation and posting of this Proxy Statement, the Annual Report and any additional solicitation materials furnished to stockholders. Copies of any solicitation materials will be furnished to brokerage houses, fiduciaries and custodians holding shares in their names that are beneficially owned by others so that they may forward this solicitation material to such beneficial owners. In addition, we may reimburse such persons for their costs in forwarding the solicitation materials to such beneficial owners. The original solicitation of proxies may be supplemented by a solicitation by telephone, e-mail or other means by our directors, officers or employees. No additional compensation will be paid to these individuals for any such services. Except as described above, we do not presently intend to solicit proxies other than by e-mail, telephone and mail.

We have also retained Morrow Sodali to assist it in the solicitation of proxies for the Annual Meeting. Morrow Sodali will solicit proxies our behalf from individuals, brokers, bank nominees and other institutional holders in the same manner described above. Morrow Sodali will receive a fee of $35,000, plus approved and reasonable out of pocket expenses, for its services for the solicitation of the proxies for our Annual Meeting. We have also agreed to indemnify Morrow Sodali against certain claims. If you have further questions, you may contact the Company’s proxy solicitor, Morrow Sodali, at:

Morrow Sodali LLC

470 West Avenue

Stamford, CT 06902

Telephone: (800) 662-5200

(banks and brokers can call collect at (203) 658-9400)

Toll-free at 1 800 662-5200

WRAP@investor.morrowsodali.com

MATTERS TO BE CONSIDERED AT THE ANNUAL MEETING

PROPOSAL NO. 1

ELECTION OF DIRECTORS

General

Our Bylaws provide that the number of directors that constitute the entire Board of Directors (the “Board”) shall be fixed from time to time by resolution adopted by a majority of the entire Board, but that in no event shall the number be less than three. A director elected by the Board to fill a vacancy shall serve for the remainder of the term of that director and until the director’s successor is duly elected and qualified. Our Board currently consists of eight directors. Ms. Kimberly Sentovich has notified the Company that she will not stand for re-election at the Annual Meeting, and will retire from the Board at that time. Mr. Sentovich has been a Director of the Company since April 2021, and will continue as a Director until her term ends immediately prior to the Annual Meeting. Following Ms. Sentovich's retirement and the Election of Directors at the Annual Meeting, the Board will consist of seven directors, each of whom have been nominated by our Nominating and Governance Committee for re-election at the Annual Meeting.

The seven director nominees for election at the Annual Meeting consist of Messrs. Wayne Walker, Kevin Mullins, Scot Cohen, Michael Parris, Kevin Sherman, Bruce Bernstein and Marc Savas.

Each director nominee, if elected at the Annual Meeting, will hold office for a one-year term until the next annual meeting of stockholders or until their successor is duly elected, unless prior thereto the director resigns, or the director’s office becomes vacant by reason of death or other cause. If any such person is unable or unwilling to serve as a director nominee at the date of the Annual Meeting or any postponement or adjournment thereof, the proxies may be voted for a substitute director nominee, designated by the proxy holders and subject to the rules for shareholder director nominations set forth in the Bylaws, or by the present Board to fill such vacancy, or for the balance of those director nominees named without nomination of a substitute, and the Board may be reduced accordingly. The Board has no reason to believe that any of such director nominees will be unwilling or unable to serve if elected as a director.

Vote Required

The election of directors requires the affirmative vote of a plurality of the voting shares present virtually or represented by proxy and entitled to vote during the Annual Meeting. The six nominees receiving the highest number of affirmative votes will be elected. Abstentions and broker non-votes will have no effect on the outcome of the election of the directors.

Unless otherwise instructed or unless authority to vote is withheld, shares represented by executed proxies will be voted “FOR” the election of the director nominees listed above.

Board of Directors Recommendation

The Board recommends that the stockholders vote “FOR” the election of Messrs. Walker, Mullins, Cohen, Parris, Sherman, Bernstein and Savas.

Director Nominees

The following section sets forth certain information regarding the nominees for election as directors of the Company. There are no family relationships between any of the director nominees and the Company’s executive officers.

|

Name |

Age |

Positions |

Independent |

Director Since |

|

Wayne Walker |

64 |

Chairman of the Board |

X |

November 2018 |

|

Kevin Mullins |

54 |

Chief Executive Officer and Director |

April 2023 |

|

|

Scot Cohen |

53 |

Director |

November 2017 |

|

|

Michael Parris |

63 |

Director |

X |

November 2017 |

|

Kevin Sherman |

52 |

Director |

X |

April 2021 |

|

Bruce T. Bernstein |

59 |

Director |

X |

April 2023 |

|

Marc Savas |

55 |

Director |

X |

April 2023 |

Wayne Walker was appointed as a director of the Company in November 2018, as Lead Independent Director from January 2021 to June 2021, and as Chairman of the Board in January 2022. Mr. Walker has more than 30 years of experience in corporate law, governance and corporate restructuring, including 15 years at the DuPont Company in the Securities and Bankruptcy Group, where he worked in the Corporate Secretary’s office and served as Senior Counsel. In 2003, Mr. Walker founded Walker Nell Partners, Inc. (“Walker Nell”), an international business consulting firm providing corporate governance and restructuring, fiduciary services, litigation support, and other services to client corporations and law firms, where he continues to serve as President. Mr. Walker currently serves on the board of directors of Petro Pharmaceuticals, Inc. (NASDAQ: PTPI), AYRO, Inc. (NASDAQ: AYRO), AMMO, Inc. (NASDAQ: POWW), and Pharmacyte Biotech, Inc. (NASDAQ: PMBC). He is the former Vice President of the Board of Education of the City of Philadelphia, Chairman of the Board of Trustees of National Philanthropic Trust, a public charity that holds over $11.0 billion of assets under management, and Chairman of the Board of Directors for Habitat for Humanity International, a global non-profit, non-governmental housing organization. He holds a Bachelor of Arts Degree from Loyola University New Orleans and a Juris Doctorate from Catholic University of America. He also studied finance for non-financial managers at the University of Chicago’s Graduate School of Business.

The Board believes that Mr. Walker’s substantial knowledge and more than 30 years of experience in corporate governance, restructuring and corporate litigation enhances the Board’s corporate governance and related experience.

Kevin Mullins began serving as the Company’s President on April 18, 2022, as the Company’s Chief Executive Officer on April 14, 2023, and as a director of the Company on April 21, 2023. Prior to being appointed as the Company’s President, Mr. Mullins served as the President and Chief Executive Officer of Intrensic, LLC since 2015, which provides digital evidence and video management software solutions for law enforcement agencies. Mr. Mullins has also served on the board of directors of SaferMobility, LLC since 2013, a provider of a campus security solution that delivers personal safety through an easy-to-use smartphone application that connects directly to your security or law enforcement teams. Mr. Mullins received a Bachelor of Arts in Business Administration from Virginia’s College at Wise, Virginia, and a Masters in Business Administration from the University of Virginia in Charlottesville, Virginia.

The Board believes Mr. Mullins knowledge in the security and law enforcement market, together with his experience with the Company since his appointment as President, provides valuable insight and experience as a member of the Board.

Scot Cohen cofounded the Company with Messrs. James Barnes and Elwood Norris in March 2016, and currently serves as a director of the Company. Mr. Cohen served as Executive Chairman of the Company from July 2017 until June 2021. Prior to July 2017, he served as a Manager until the Company’s incorporation in March 2017 at which time he was appointed as the Company’s Corporate Secretary until January 2018. Mr. Cohen has over 20 years of experience in institutional asset management, wealth management, and capital markets. He currently manages several operating partnerships that actively invest in the energy sector in addition to maintaining an active investment portfolio in various public companies, early-stage private companies, hedge funds and alternative assets including real estate. Some of these include serving as principal of the Iroquois Capital Opportunity Fund, a closed end private equity fund he founded in 2010 which focuses on investments in North American oil and gas assets; as the Manager of V3 Capital, LLC, an investor in public and private companies that he founded in 2015, and was the co-founder of Iroquois Capital Investment Group, LLC. Mr. Cohen currently sits on the board of directors of Charlie’s Holding, Inc., and serves as Executive Chair of the Board of Petro River Oil Corp. since 2012. Mr. Cohen earned his Bachelor of Science degree from Ohio University.

The Board believes Mr. Cohen’s success with multiple private investment firms, his extensive contacts within the investment community and financial expertise strengthens the Company’s efforts to raise capital to fund the continued implementation of its business plan.

Michael Parris was appointed as a director of the Company in November 2017. Mr. Parris has been a partner at Perry Rogers Partners Inc. (“Perry Rogers”), a sports management firm, since 1996, where he primarily oversees the SHAQ Brand and other strategic alliances. His role at Perry Rogers encompasses business development, worldwide brand management, marketing and public relations. Prior to joining Perry Rogers, Mr. Parris had a successful career in law enforcement with the Newark Police Department in Newark, New Jersey, rising to the rank of Lieutenant. During his career in law enforcement, he worked and commanded several specialized units, including Homicide, Robbery, and Internal Affairs. Mr. Parris holds a Bachelor of Science degree in Business Management from the University of Phoenix.

The Board believes that given his background in law enforcement and worldwide marketing and brand experience, Mr. Parris’ broad experience and insights into the markets served by the Company benefits the Board and the Company.

Kevin Sherman was appointed as a director of the Company in April 2021. Mr. Sherman currently serves as the Chief Executive Officer of Tractor Beverages, Inc. (“Tractor”). Prior to his appointment as Chief Executive Officer, Mr. Sherman served as Chief Marketing Officer and Chief Revenue Officer, positions he held since 2018. Mr. Sherman has served as a member of the board of directors of Tractor since 2015. From 2012 to 2017, Mr. Sherman served as a member of the board of directors, Chief Executive Officer, President, and Chief Marketing Officer of True Drinks, Inc. Mr. Sherman holds a Bachelor of Arts in Philosophy from Gordon College and a Master of Arts in Educational Administration from Loyola Marymount University.

The Board believes that Mr. Sherman's extensive experience in marketing products, building brands and driving revenue growth enhances the Board's experience and makes him a valuable member of the Board and as a resource for the management team.

Bruce Bernstein was appointed as a director of the Company in April 2023. Mr. Bernstein has over thirty-five years of experience in the securities industry, primarily as senior portfolio manager for two alternative finance funds as well as in trading and structuring of arbitrage strategies. Mr. Bernstein has served as President of Rockmore Capital, LLC since 2006, the manager of a direct investment and lending fund with peak assets under management of $140 million. Previously, he served as Co-President of Omicron Capital, LP, an investment firm based in New York, which he joined in 2001. Omicron Capital focused on direct investing and lending to public small cap companies and had peak assets under management of $260 million. Prior to joining Omicron Capital, Mr. Bernstein was with Fortis Investments Inc., where he was Senior Vice President in the bank’s Global Securities Arbitrage business unit, specializing in equity structured products and equity arbitrage and then President in charge of the bank’s proprietary investment business in the United States. Prior to Fortis, Mr. Bernstein was Director in the Equity Derivatives Group at Nomura Securities International specializing in cross-border tax arbitrage, domestic equity arbitrage and structured equity swaps. Mr. Bernstein started his career at Kidder Peabody, where he rose to the level of Assistant Treasurer. Mr. Bernstein serves as a member of the Board of Directors of Xwell, Inc. (Formerly XpresSpa Holdings, Inc.) the leading airport spa company in the world, based in New York, serves as a Director for Neurotrope since November 14, 2016 and, Petros Pharmaceuticals, Inc. Mr. Bernstein holds a Bachelor of Business Administration from City University of New York (Baruch).

The Board believes that Mr. Bernstein’s experience in finance, audit, capital markets and in advising public companies provides significant benefit to the Company and as a member of the Board.

Marc Savas was appointed as a director of the Company in April 2023. Mr. Savas has over thirty-five years of experience in accelerating revenue for companies, and is skilled in developing and guiding leadership teams, executing tactical, strategic and technical plans, and brings a comprehensive understanding of organizational efficiency. Mr. Savas currently serves as President of Vector97, a privately held waste hauling and recycling consulting firm, since February 2012. He has overseen Vector97 from a startup company through engineering its sale to SIB in June of 2022. Mr. Savas remains President of Vector97 and has joined the SIB leadership team. He currently serves as a Director of SRAX since October 2015. Previously, he founded Unfair Advantage, Inc. and Living Full Blast, Inc., a management and efficiency consulting firm serving the Venture Capital and Legal vertical markets serving as Chief Executive officer until January 2012. Mr. Savas has also served as a member of the Board of Directors of Motivational, Inc., a charitable organization, from July 2020 to present, and as a member of the Board of Directors of RMP, a charitable organization, from December 2022 to present. Mr. Savas holds a Bachelor of Science in Marketing from Northern Arizona University of Flagstaff Arizona, and completed the Executive Development Program of the Marshall School of Business of the University of Southern California.

The Board believes that Mr. Savas’ experience in organizational efficiency and effectiveness, together with his extensive knowledge in finance, scalability and implementing successful business strategies, makes him a valuable member of the Board.

Board Diversity

The Nominating and Governance Committee of the Board (the “NGC”) reviews the requisite skills and characteristics of Board members as well as the composition of the Board as a whole when recommending nominees for the Board. Diversity is one of the factors the NGC considers in identifying nominees for director. The NGC has no predefined minimum criteria for selecting director nominees, although it believes that all directors should share qualities such as business experience, excellent decision-making ability, good judgment, personal integrity and outstanding reputation. In any given search, the NGC may also define particular characteristics for candidates to balance the overall skills and characteristics of the Company’s Board and its perceived needs. However, during any search, the NGC reserves the right to modify its stated search criteria for exceptional candidates.

The tables below provide certain highlights of the composition of our Board members and nominees as of the dates indicated. Each of the categories listed in the below table has the meaning as it is used in Nasdaq Rule 5605(f) We comply with Nasdaq Listing Rule 5605(f), which requires Nasdaq-listed companies to have at least two diverse directors. Each of the categories listed in the table below has the meaning as it is used in Nasdaq Listing Rule 5605(f).

|

Board Diversity Matrix (As of May 19, 2023) |

||||

|

Total Number of Directors |

7 |

|||

|

Female |

Male |

Non-Binary |

Did Not Disclose Gender |

|

|

Gender Identity |

||||

|

Directors |

1 |

6 |

— |

— |

|

Demographic Background |

||||

|

African American or Black |

— |

2 |

— |

— |

|

Alaskan Native or Native American |

— |

— |

— |

— |

|

Asian |

— |

— |

— |

— |

|

Hispanic or Latinx |

— |

— |

— |

— |

|

Native Hawaiian or Pacific Islander |

— |

— |

— |

— |

|

White |

1 |

3 |

— |

— |

|

Two or More Races or Ethnicities |

— |

— |

— |

— |

|

LGBTQ+ |

— |

— |

— |

— |

|

Did Not Disclose Demographic Background |

1* |

|||

* Did not disclose with respect to LGBTQ+ background.

|

Board Diversity Matrix (As of April 25, 2022) |

|

Total Number of Directors |

6 |

|||

|

Female |

Male |

Non-Binary |

Did Not Disclose Gender |

|

|

Gender Identity |

||||

|

Directors |

1 |

5 |

— |

— |

|

Demographic Background |

||||

|

African American or Black |

— |

2 |

— |

— |

|

Alaskan Native or Native American |

— |

— |

— |

— |

|

Asian |

— |

— |

— |

— |

|

Hispanic or Latinx |

— |

— |

— |

— |

|

Native Hawaiian or Pacific Islander |

— |

— |

— |

— |

|

White |

1 |

3 |

— |

— |

|

Two or More Races or Ethnicities |

— |

— |

— |

— |

|

LGBTQ+ |

— |

— | — | — |

|

Did Not Disclose Demographic Background |

1* |

|||

* Did not disclose with respect to LGBTQ+ background.

Director Nominations

The Board nominates directors for election at each annual meeting of stockholders, appoints new directors to fill vacancies when they arise, and has the responsibility to identify, evaluate and recruit qualified director candidates to the Board for such nomination or appointment.

The Nominating and Governance Committee identifies director nominees by first considering those current members of the Board who are willing to continue service. Current members of the Board with skills and experience that are relevant to our business and who are willing to continue service are considered for re-election, balancing the value of continuity of service by existing members of the Board with that of obtaining a new perspective. After being nominated by the Nominating and Governance Committee, director nominees are selected by a majority of the members of the Board. Although the Company does not have a formal diversity policy, in considering the suitability of director nominees, both the Nominating and Governance Committee and the Board consider such factors as they deem appropriate to develop a Board that is diverse in nature and comprised of experienced and seasoned advisors. Factors considered by the Nominating and Governance Committee and the Board include judgment, knowledge, skill, diversity, integrity, experience with businesses and other organizations of comparable size, including experience in law enforcement, the use of force product industry, intellectual property, business, corporate governance, marketing, finance, administration or public service, the relevance of a candidate’s experience to our needs and experience of other Board members, experience with accounting rules and practices, the desire to balance the considerable benefit of continuity with the periodic injection of the fresh perspective provided by new members, and the extent to which a candidate would be a desirable addition to the Board and any committees of the Board.

A stockholder who wishes to suggest a prospective director nominee for the Board may notify the Corporate Secretary of the Company in writing with any supporting material the stockholder considers appropriate. Director nominees suggested by stockholders are considered in the same way as director nominees recommended by other sources.

Director Independence

Our Board has reviewed the independence of our directors based on the listing standards of the Nasdaq Stock Market (“Nasdaq”). Based on this review, the Board of Directors determined that Messrs. Walker, Sherman, Parris, Bernstein, Savas and Ms. Sentovich are independent, as defined in Rule 5605(a)(2) of the Nasdaq rules. In making this determination, our Board considered the relationships that each of these non-employee directors has with us and all other facts and circumstances our Board deemed relevant in determining their independence.

Board Meetings

Directors hold office until the next annual meeting of the stockholders or until their successors have been elected or appointed and duly qualified. Vacancies on the Board that are created by the retirement, resignation or removal of a director may be filled by the vote of the majority of the remaining members of the Board, with such new director serving the remainder of the term or until his/her successor shall be elected and qualified.

The Board is elected by and is accountable to our stockholders. The Board establishes Company policy and provides strategic direction, oversight, and control. The Board met ten times during the year ended December 31, 2022, and all incumbent directors attended at least 75% of the aggregate number of meetings of the Board and of the committees on which each of the directors served. The Board also acted by unanimous written consent three times during the year ended December 31, 2022.

Committees of the Board of Directors

Our Board currently has three standing committees which consist of the Audit Committee, Compensation Committee and Nominating and Governance Committee. Our Board has adopted written charters for each of the Audit Committee, Compensation Committee, and Nominating and Governance Committee, copies of which are publicly available on our website at https://ir.wrap.com/ under the “Governance” tab. Our Board may establish other committees from time to time as it deems necessary or appropriate. The chart below reflects the standing committees of our Board and the composition of each committee as of the date of this Proxy Statement:

|

Committees |

||||||

|

Director Name |

Audit |

Compensation |

Nominating and Governance |

|||

|

Kevin Mullins |

||||||

|

Scot Cohen |

||||||

|

Michael Parris |

X |

X |

X |

|||

|

Kevin Sherman |

X |

CC |

X |

|||

|

Wayne Walker |

X |

|||||

|

Kimberly Sentovich |

CC |

CC |

||||

|

Bruce Bernstein |

X |

|||||

|

Marc Savas |

X |

|||||

CC – Committee Chair

X – Member

Audit Committee

The Audit Committee assists our Board in fulfilling its legal and fiduciary obligations in matters involving our accounting, auditing, financial reporting, internal control and legal compliance functions by approving the services performed by our independent accountants and reviewing their reports regarding our accounting practices and systems of internal accounting controls. The Audit Committee also oversees the audit efforts of our independent accountants and takes those actions as it deems necessary to satisfy that the accountants are independent of management. The Audit Committee currently consists of Messrs. Michael Parris, Bruce Bernstein, Kevin Sherman and Kimberly Sentovich, with Ms. Sentovich serving as Chair, each of whom is a non-management member of our Board that we believe meets the criteria for independence under the applicable Nasdaq rules and SEC rules and regulations. Ms. Sentovich is also our designated Audit Committee financial expert, as defined under SEC rules. We believe that the composition of our Audit Committee meets the criteria for independence under the applicable Nasdaq rules and SEC rules and regulations, and the functioning of our Audit Committee complies with the applicable Nasdaq rules and SEC rules and regulations.

The Audit Committee met four times during the year ended December 31, 2022, with all members of the Audit Committee in attendance. The Audit Committee met with our Chief Financial Officer and with our independent registered public accounting firm and evaluated the responses by the Chief Financial Officer, both to the facts presented and to the judgments made by our independent registered public accounting firm.

Compensation Committee

The Compensation Committee determines our general compensation policies and the compensation provided to our directors and officers. The Compensation Committee also reviews and determines bonuses for our officers and other employees. In addition, the Compensation Committee reviews and determines equity-based compensation for our directors, officers, employees and consultants and administers the 2017 Plan. The Compensation Committee currently consists of Messrs. Michael Parris, Marc Savas, Kevin Sherman and Wayne Walker, with Kevin Sherman serving as Chair, each of whom is a non-management member of our Board that we believe meets the criteria for independence under the applicable Nasdaq rules and SEC rules and regulations. We believe that the composition of our Compensation Committee meets the criteria for independence under the applicable Nasdaq rules and SEC rules and regulations, and the functioning of our Compensation Committee complies with the applicable Nasdaq rules and SEC rules and regulations.

The Compensation Committee met informally numerous times during the year ended December 31, 2022, and all action recommended or taken with respect to executive compensation was subsequently presented to and approved by the full Board, with all members of the Compensation Committee in attendance. The Compensation also acted by Unanimous Written Consent three times during the year ended December 31, 2022.

Nominating and Governance Committee

The Nominating and Governance Committee is responsible for making recommendations to our Board regarding candidates for directorships and the size and composition of our Board. In addition, the Nominating and Governance Committee is responsible for overseeing our corporate governance guidelines and reporting and making recommendations to the full Board concerning corporate governance matters. The Nominating and Governance Committee currently consists of Ms. Kimberly Sentovich and Messrs. Michael Parris and Kevin Sherman, with Kimberly Sentovich serving as Chair.

The Nominating and Governance Committee held two meetings during the year ended December 31, 2022, with all members of the Nominating and Governance Committee in attendance.

Board Role in Risk Assessment

Management, in consultation with outside professionals, as applicable, identifies risks associated with the Company’s operations, strategies and financial statements. Risk assessment will also be performed through periodic reports received by the Audit Committee from management, counsel and the Company’s independent registered public accountants relating to risk assessment and management. Audit Committee members meet privately in executive sessions with representatives of the Company’s independent registered public accountants. The Board also provides risk oversight through its periodic reviews of the financial and operational performance of the Company.

Board Leadership Structure

Wayne Walker serves as the Chair of the Board as an independent director. Our Board believes the Company is best served by having an independent Chair of the Board of Directors and it will review and consider the continued appropriateness of this structure at least annually.

Indemnification of Officers and Directors

As permitted by the Delaware General Corporation Law, the Company will indemnify its directors and officers against expenses and liabilities they incur to defend, settle, or satisfy any civil or criminal action brought against them on account of their being or having been Company directors or officers unless, in any such action, they are adjudged to have acted with gross negligence or willful misconduct.

Code of Business Conduct and Ethics

We have adopted a Code of Business Conduct and Ethics (the “Code”) applicable to all of our employees, including our principal executive officer, principal financial officer and principal accounting officer. We will provide any person, without charge, a copy of our Code upon written request to Investor Relations, Wrap Technologies, Inc., at 1817 W 4th Street, Tempe, Arizona 85281. A copy of the Code is publicly available by visiting our website at www.wrap.com.

Stockholder Communications

If you wish to communicate with the Board, you may send your communication in writing to:

Wrap Technologies, Inc.

1817 W 4th Street

Tempe, Arizona 85281

Attn: Corporate Secretary

You must include your name and address in the written communication and indicate whether you are a stockholder of the Company. Our Corporate Secretary will review any communication received from a stockholder, and all material and appropriate communications from stockholders will be forwarded to the appropriate director or directors or committee of the Board based on the subject matter.

Section 16(a) Beneficial Ownership Reporting Compliance

Section 16(a) of the Securities Exchange Act of 1934, as amended (the “Exchange Act”) requires our officers, directors, and persons who beneficially own more than 10% of our Common Stock to file reports of ownership and changes in ownership with the SEC. Officers, directors, and greater-than-ten-percent stockholders are also required by the SEC to furnish us with copies of all Section 16(a) forms that they file.

Based solely on a review of copies of such reports furnished to our Company and representation that no other reports were required during the year ended December 31, 2022, we believe that all persons subject to the reporting requirements pursuant to Section 16(a) filed the required reports on a timely basis with the SEC, other than the below:

|

● |

one late Form 4 filed by L.W. Varner Jr, the Company’s former Interim Chief Executive Officer; |

|

● |

one late Form 4 filed by TJ Kennedy, the Company’s former Chief Executive Officer; |

|

● |

one late Form 4 filed by Kevin Mullins; |

|

● |

one late Form 4 filed by Glenn Hickman, the Company’s former Chief Operating Officer; and |

|

● |

one late Form 4 filed by Chris DeAlmeida. |

PROPOSAL NO. 2

NON-BINDING ADVISORY VOTE TO APPROVE EXECUTIVE COMPENSATION

General

We are providing our stockholders with the opportunity to approve, on a non-binding advisory basis, the compensation of our Named Executive Officers as disclosed in this Proxy Statement in accordance with the SEC’s rules. This Say-on-Pay proposal is required by the Dodd-Frank Wall Street Reform and Consumer Protection Act of 2010 (the Dodd-Frank Act), which added Section 14A to the Exchange Act.

Our executive compensation program is designed to attract key employees and to retain, motivate and reward our executive officers for their performance and contribution to our long-term success. Under these programs, our executive officers are rewarded for the achievement of corporate and individual performance objectives, and our executive officers’ incentives are aligned with stockholder value creation. These goals may include the achievement of specific financial or business development goals. Also, when possible and appropriate taking into account the Company’s financial condition and other related facts and circumstances, the Compensation Committee seeks to set performance goals that reach across all business areas and include achievements in finance/business development and corporate development.

The “Executive Compensation” section beginning on page 13 below describes, in detail, our executive compensation programs and the decisions made by our Board’s Compensation Committee with respect to the fiscal years ended December 31, 2022 and 2021. Although we have no formal policy for a specific allocation between current and long-term compensation, or cash and non-cash compensation, when possible and appropriate considering the Company’s financial condition and other related facts and circumstances, we seek to implement a pay mix for our officers with a relatively equal balance of both, providing a competitive salary with a significant portion of compensation awarded on both corporate and personal performance.

Vote Required

As an advisory vote, the outcome of this proposal is not binding. The outcome of this Say-on-Pay proposal does not overrule any prior or future decision by the Company or the Board, including decisions made by the Compensation Committee, create or imply any change to the fiduciary duties of the Company or the Board, or create or imply any additional fiduciary duties for the Company or the Board. However, the Compensation Committee values the opinions expressed by our stockholders in their vote on this proposal and will consider the outcome of the vote when making future compensation decisions for Named Executive Officers.

Board of Directors Recommendation

The Board recommends that the stockholders vote “FOR” the following advisory resolution:

RESOLVED, that the compensation paid to the Company’s Named Executive Officers, as disclosed in the Company’s proxy statement for the Annual Meeting pursuant to Item 402 of Regulation S-K, including the compensation tables and narrative discussion, is hereby approved.

PROPOSAL NO. 3

ADVISORY VOTE ON THE FREQUENCY OF FUTURE NON-BINDING EXECUTIVE COMPENSATION ADVISORY VOTES

General

In Proposal No. 2, we are providing our stockholders the opportunity to approve, on an advisory, non-binding basis, the compensation of our Named Executive Officers. In this Proposal No. 3, we are asking our stockholders to cast a non-binding advisory vote regarding the frequency of future executive compensation advisory votes. Stockholders may vote for a frequency of every one, two, or three years, or may abstain.

The Board will take into consideration the outcome of this vote in determining the frequency of future Say-on-Pay proposals. However, because this vote is advisory and non-binding, the Board may decide that it is in the best interests of our stockholders and the Company to hold the required Say-on-Pay vote more or less frequently, but no less frequently than once every three years, as required by the Dodd-Frank Act. In the future, we will propose an advisory vote on the frequency of the Say-on-Pay Vote at least once every six calendar years as required by the Dodd-Frank Act.

After careful consideration, the Board believes that a Say-on-Pay vote should be held every three years, and therefore our Board recommends that you vote for a frequency of THREE YEARS for future Say-on-Pay proposals. The proxy card provides stockholders with the opportunity to choose among four options (holding the vote once every year, every two years or every three years, or abstaining) and, therefore, stockholders will not be voting to approve or disapprove the recommendation of the Board.

Vote Required and Recommendation

On this non-binding matter, a stockholder may vote to set the frequency of the Say-on-Pay votes to occur every year, every two years, or every three years, or the stockholder may vote to abstain. The choice among those four choices that receives the highest number of votes will be deemed the choice of the stockholders. Abstentions and broker non-votes will have no effect on the Say-on-Pay vote.

The Board recommends that stockholders vote to hold advisory Say-on-Pay votes on executive compensation “THREE YEARS”.

EXECUTIVE OFFICERS AND EXECUTIVE COMPENSATION

Executive Officers

Our executive officers are appointed by the Board and serve at the discretion of the Board, subject to the terms of any employment agreements they may have with the Company. The following is a brief description of the present and past business experience of each of the Company’s current executive officers.

|

Name |

Age |

Positions |

|

Kevin Mullins |

54 |

Chief Executive Officer and Director |

|

Chris DeAlmeida |

45 |

Chief Financial Officer, Treasurer and Secretary |

Kevin Mullins’ present and past business experience is set forth in the preceding section under the heading “Director Nominees” on page 4.

Chris DeAlmeida began serving as the Company’s Chief Financial Officer and Treasurer on July 25, 2022, and was appointed Secretary on April 21, 2023. Mr. DeAlmeida is an accomplished senior financial executive, with experience in financial management and analysis, financial reporting, investor relations, and mergers and acquisitions activity. Prior to his appointment, Mr. DeAlmeida was Chief Financial Officer of Encore Dredging Partners since January 2020, and acted as a consulting partner at BCH Group since 2018. Additional roles include Executive Vice President, Chief Financial Officer, Chief Accounting Officer and Treasurer at Orion Group Holdings, Inc. (NYSE: ORN) from 2012 to 2018, Vice President Accounting and Finance at Orion Group Holdings, Inc. from 2007 to 2012 and Investor Relations at Continental Airlines, Inc. (NYSE:UAL) from 2005 to 2007. Prior to Continental, Mr. DeAlmeida held various progressing roles in accounting and finance with BMC Software, Inc. and Moody Review. Mr. DeAlmeida holds a Bachelor of Science in Finance from the University of Houston at Clear Lake.

There are no arrangements or understandings between our Company and any other person pursuant to which he was or is to be selected as a director, executive officer or nominee.

Summary Compensation Table

The following table sets forth information regarding the compensation awarded to or earned by the current and former executive officers listed below during the years ended December 31, 2022, and 2021. We have opted to comply with the reduced executive compensation disclosure rules applicable to “smaller reporting companies,” as such term is defined in the rules promulgated under the Securities Act of 1933, as amended (the “Securities Act”), which require compensation disclosure for only our principal executive officers, the two most highly compensated executive officers other than our principal executive officer and up to two additional executive officers during the year. Throughout this document, the six officers below are referred to as our “Named Executive Officers or “NEOs”.

|

Name and Principal Position |

Year |

Salary |

Bonus |

Stock Awards(1) |

Option Awards(2) |

All Other Compensation(3) |

Total |

||||||||||||||||||

|

Kevin Mullins (4) Chief Executive Officer and Director |

2022 |

$ |

200,000 |

$ |

- |

$ |

506,250 |

$ |

1,721,691 |

$ |

- |

$ |

2,427,941 |

||||||||||||

|

Chris DeAlmeida (5) Chief Financial Officer, Treasurer and Secretary |

2022 |

$ |

103,125 |

$ |

- |

$ |

227,500 |

$ |

318,500 |

$ |

- |

$ |

649,125 |

||||||||||||

|

TJ Kennedy (6) Former Chief Executive Officer and Director |

2022 |

$ |

276,667 |

$ |

50,000 |

$ |

742,982 |

$ |

2,293,879 |

$ |

- |

$ |

3,363,528 |

||||||||||||

|

Glenn Hickman (7) |

2022 |

$ |

225,000 |

$ |

25,000 |

$ |

106,500 |

$ |

- |

$ |

- |

$ |

356,500 |

||||||||||||

|

Former Chief Operating Officer |

2021 |

$ |

112,500 |

$ |

25,000 |

$ |

165,000 |

$ |

183,164 |

$ |

41,918 |

$ |

527,582 |

||||||||||||

|

LW Varner, Jr. (8) Former Interim Chief Executive Officer |

2022 |

$ |

- |

$ |

- |

$ |

50,000 |

$ |

- |

$ |

150,000 |

$ |

200,000 |

||||||||||||

|

Thomas P. Smith (9) |

2022 |

$ |

33,333 |

$ |

100,000 |

$ |

- |

$ |

- |

$ |

300,000 |

$ |

433,333 |

||||||||||||

|

Former Chief Executive Officer and President |

2021 |

$ |

400,000 |

$ |

100,000 |

$ |

- |

$ |

994,043 |

$ |

- |

$ |

1,494,043 |

||||||||||||

|

(1) |

Amounts reported in this column do not reflect the amounts actually received by our named executive officers. Instead, these amounts reflect the aggregate grant date fair value of restricted stock units (“RSUs”) granted to the named executive officers during the fiscal year ended December 31, 2022, as computed in accordance with the Financial Accounting Standards Board Accounting Standards Codification 718 (“ASC 718”). Assumptions used in the calculation of these amounts are included in the notes to our financial statements included in our Annual Report. As required by SEC rules, the amounts shown exclude the impact of estimated forfeitures related to service-based vesting conditions. Specifically, the number in the table above includes: |

|

● |

for Mr. Mullins, RSU granted in April 2022, as part of an Inducement grant in connection with begin named President.; |

|

● |

for Mr. DeAlmeida, RSUs granted in July 2022, in connection with being named Chief Financial Officer; |

|

● |

for Mr. Kennedy, $725,000 for RSUs granted in April, in connection with being named Chief Executive Officer and $17,982 for RSUs granted for Board responsibilities from January 1, 2022 through April 17, 2022; |

|

● |

for Mr. Hickman, RSUs granted March 2022 and March 2021 for continued service; and |

|

● |

for Mr. Varner, RSUs granted February 19, 2022 in connection with being named Interim Chief Executive Officer. |

|

(2) |

Amounts reported in this column do not reflect the amounts actually received by our named executive officers. Instead, these amounts reflect the aggregate grant date fair value of each stock option granted to the named executive officers during each fiscal year, as computed in accordance with ASC 718. Assumptions used in the calculation of these amounts are included in the notes to our financial statements included in our Annual Report. As required by SEC rules, the amounts shown exclude the impact of estimated forfeitures related to service-based vesting conditions. Our named executive officers will only realize compensation to the extent the trading price of our Common Stock is greater than the exercise price of such stock options. Specifically, the number in the table above includes: |

|

● |

for Mr. Mullins, $856,193 for options granted in April 2022 and $865,498 for Performance Options granted in April. 2022 in connection with begin named President.; |

|

● |

for Mr. DeAlmeida, options granted in July 2022, in connection with being named Chief Financial Officer; |

|

● |

for Mr. Kennedy, $1,141,589 for options granted in April 2022 and $1,152,290 for Performance Options granted in April 2022 in connection with being named Chief Executive Officer; |

|

● |

for Mr. Hickman, options granted in March 2021 for continued service; and |

|

● |

for. Mr. Smith, options granted in connection with his Separation Agreement in January 2022 and options granted in March 2021. |

|

(3) |

Amounts reported in this column represent other compensation paid to executive officers. Amounts for Mr. Hickman include $41,918 for his consulting agreement in 2021. For Mr. Varner, the amount reflects the consulting payments made to his consulting firm, LWV Consulting, LLC. For his services as Interim Chief Executive Officer during 2022. Amounts for Mr. Smith represent the severance payments made per his Separation Agreement. |

|

|

|

|

(4) |

Kevin Mullins was appointed as the Company’s President on April 18, 2022, as the Company’s Chief Executive Officer on April 14, 2023, and was appointed as a member of the Board of Directors on April 21, 2023. |

|

|

|

|

(5) |

Chris DeAlmeida was appointed as the Company’s Chief Financial Officer and Treasurer effective July 25, 2022, and was appointed Secretary on April 21, 2023. |

|

|

|

|

(6) |

TJ Kennedy served as the Company’s Chief Executive Officer from April 18, 2022, to April 14, 2023. |

|

|

|

|

(7) |

Glenn Hickmann served as the Company’s Chief Operating Officer from July 2021 to April 17, 2023. He was paid $41,918 for consulting services in 2021 prior to becoming an employee, and this amount is included as Other Compensation in the table above. |

|

|

|

|

(8) |

LW Varner, Jr. served as the Company’s Interim Chief Executive Officer from January 24, 2022, until his resignation effective April 18, 2022. LW Varner was paid as a consultant through LWV Consulting, LLC. And was not an employee of the Company. |

|

|

|

|

(9) |

Mr. Smith served as the Company’s Interim Chief Executive Officer from October 2020 through March 2021, and as Chief Executive Officer from March 2021 through January 2022. |

Employment Arrangements

Thomas Smith. Mr. Smith and the Company were parties to an At-Will Employment, Confidential Information, Non-Compete/Non-Solicitation, Invention Assignment, and Arbitration Agreement, dated September 9, 2020 (the “Smith Agreement”). Under the terms of the Smith Agreement, Mr. Smith’s employment by the Company was at-will and was for no specified period. The Smith Agreement also provided for the payment to Mr. Smith of $150,000 in consideration for Mr. Smith’s agreement to, among other covenants, not to compete with the Company following his termination of employment with the Company for a period of 12 months, or solicit customers, employees or others. The $150,000 required to be paid to Mr. Smith under the terms of the Smith Agreement was paid to Mr. Smith in September 2020.

Effective January 24, 2022, Mr. Smith resigned as the Company’s President and Chief Executive Officer, and as a director of the Company (the “Resignation Date”), pursuant to a separation agreement entered into by the Company and Mr. Smith on the Resignation Date (the “Separation Agreement”). Under the terms of the Separation Agreement, Mr. Smith is entitled to (i) a one-time bonus payment of $100,000 for the achievement of certain business objectives in 2021, (ii) severance in an amount equal to nine months of his base salary paid in installments over a period of nine months following the Resignation Date, (iii) continued vesting of equity-based awards granted pursuant to the Company’s 2017 Plan and outstanding as of the Resignation Date through and until December 31, 2022, (iv) an extension of the time period during which Mr. Smith may exercise outstanding vested stock options through the first anniversary of the Resignation Date (or, if earlier, through the original expiration date of the applicable stock option), and (v) reimbursement for the Company portion of any healthcare premiums provided to Mr. Smith and any covered dependents under COBRA through December 31, 2022, subject to Mr. Smith’s election of coverage under COBRA. As part of the Separation Agreement, Mr. Smith has entered into a general release of claims in favor of the Company, affirmed his obligations to abide by restrictive covenants, and agreed to a mutual non-disparagement covenant with the Company.

LW Varner, Jr. Effective on the date of Mr. Smith’s resignation, January 24, 2022, the Company announced the appointment of LW Varner, Jr., 71, as Interim Chief Executive Officer of the Company. Mr. Varner served as Interim Chief Executive Officer under the terms of a Consulting Agreement dated January 24, 2022, by and between the Company and LWV Consulting, LLC (the “Interim CEO Consulting Agreement”), pursuant to which LWV Consulting, LLC engaged Mr. Varner to provide consulting services for a term of four weeks (the “Initial Term”), which term automatically renewed for two additional consecutive four-week periods (each additional four-week period being a “Renewal Term”), unless notice of non-renewal was delivered by either LWV Consulting, LLC or the Company to the other party. The Interim CEO Consulting Agreement provided that LWV Consulting or Mr. Varner was entitled to receive: (i) a weekly consulting cash fee of $15,000 during the Initial Term, pro-rated for any partial week; and (ii) an equity-based award for each full week completed during the Initial CEO Term in a form determined at the Board’s discretion with a value as of the grant date equal to $5,000. During any Renewal Term, Mr. Varner was entitled to receive (1) a weekly consulting cash fee of $11,250 during the Renewal Term, pro-rated for any partial week; and (2) an equity-based award for each full week completed during the Renewal Term in a form determined at the Board’s discretion with a value as of the grant date equal to $3,750, which Renewal Term amounts remained subject to change upon certain conditions as provided by the Interim CEO Consulting Agreement. The Interim CEO Consulting Agreement terminated pursuant to its terms on April 18, 2022.

TJ Kennedy. On April 13, 2022, the Company entered into an employment agreement with Mr. Kennedy (the “Kennedy Employment Agreement”) for Mr. Kennedy to serve as the Company’s Chief Executive Officer, effective April 18, 2022.

Effective April 13, 2023 (the “Resignation Date”), TJ Kennedy resigned as Chief Executive Officer and as a member of the Board of Directors of the Company pursuant to a separation agreement entered into by and between the Company and Mr. Kennedy (the “Separation Agreement”). Under the terms of the Separation Agreement, Mr. Kennedy is entitled to (i) a one-time payment of $115,625 for the achievement of certain business objectives in 2022; (ii) severance in an amount equal to six months of his base salary paid in installments over a period of six months following the Resignation Date; (iii) the issuance of 122,670 shares of the Company’s common stock, $0.0001 par value per share (“Common Stock”), in connection with the continued vesting of certain equity-based awards previously granted to Mr. Kennedy; (iv) the immediate vesting of nonqualified options to purchase 158,554 shares of Common Stock, (v) an extension of the time period during which Mr. Kennedy may exercise outstanding vested stock options through the first anniversary of the Resignation Date (or, if earlier, through the original expiration date of the applicable stock option); and (vi) reimbursement for the Company portion of any healthcare premiums provided to Mr. Kennedy and any covered dependents under the Consolidated Omnibus Reconciliation Act of 1986, as amended (“COBRA”), for a period of 12 months following the Resignation Date, subject to Mr. Kennedy’s election of coverage under COBRA. As part of the Separation Agreement, Mr. Kennedy has entered into a general release of claims in favor of the Company and affirmed his obligations to abide by restrictive covenants.

Kevin Mullins. On April 13, 2022, the Company entered into an employment agreement with Mr. Mullins (the “Mullins Employment Agreement”) for Mr. Mullins to serve as the Company’s President, effective April 18, 2022. Mr. Mullins was appointed as Chief Executive Officer on April 14, 2023 and was appointed as a member of the Company’s Board of Directors on April 21, 2023.

Pursuant to the Mullins Employment Agreement, unless earlier terminated pursuant to the terms therein, Mr. Mullins will serve as the Company’s President for a term of two years from the effective date of his appointment. On the second anniversary of such effective date of appointment (if Mr. Mullins’s employment has not been earlier terminated or a written notice of non-renewal has not been provided in the time provided to do so), and on each subsequent anniversary thereafter, the Mullins Employment Agreement will automatically renew and extend for a period of 12 months, unless otherwise terminated in accordance with its terms. As compensation for Mr. Mullins’s services to the Company, the Mullins Employment Agreement entitles Mr. Mullins to the following cash payments: (i) an annualized base salary of $300,000 (the “Mullins Base Salary”) and (ii) eligibility for a discretionary cash bonus, with a target amount initial set at 75% of the Mullins Base Salary, but with the final amount to be determined at the sole discretion of the Board.

In addition, and subject to Board approval within ten business days following the Commence Date, Mr. Mullins will be granted the following equity awards, which will be awarded as an inducement for Mr. Mullins appointment as the Company’s President in accordance with Nasdaq Listing Rule 5635(c)(4) (the “Inducement Awards”). The Inducement Awards consist of:

|

● |

175,173 RSUs computed as a grant date fair value of $506,250, which will vest in substantially equal installments on each of the first through third anniversaries of the Commencement Date, subject to Mr. Mullins’s continued employment through each of the vesting dates. Vesting of the RSUs will accelerate upon the occurrence of certain conditions, as more specifically set forth in the Mullins Employment Agreement; |

|

● |

A nonqualified option (the “Mullins Option”) to purchase up to 356,747 shares of Common Stock computed at a grant date fair market value of $506,250, at an exercise price of $2.89 per share. The Mullins Option will vest in substantially equal installments on each of the first through third anniversaries of the effective date of Mr. Mullins’s employment, subject to Mr. Mullins’s continued employment through each of the vesting dates. Vesting of the Mullins Option will accelerate upon certain events, as more specifically set forth in the Mullins Employment Agreement; and |

|

● |

A nonqualified option (the “Mullins Performance Option”) to purchase up to 692,398 shares of Common Stock equal to 1.69% of the number of shares of Common Stock issued and outstanding on the Commencement Date, at an exercise price of $2.89 per share. The Mullins Performance Option will vest, subject to Mr. Mullins’s continued employment with the Company through each vesting date, as follows: (i) 1/3rd of the Mullins Performance Option will vest on the date on which the Company’s market capitalization meets or exceeds $250 million for each trading day during three consecutive months, (ii) 1/3rd of the Mullins Performance Option will vest on the date on which the Company’s market capitalization meets or exceeds $500 million for each trading day during three consecutive months, and (iii) the remaining 1/3rd of the Mullins Performance Option will vest on the date on which the Company’s market capitalization meets or exceeds $1 billion for each trading day during three consecutive months. |

In the event Mr. Mullins’ employment is terminated by either party for any reason, Mr. Mullins will be entitled to: (i) any earned but unpaid Base Salary earned during his employment with the Company and applicable to all pay periods prior to the termination date; (ii) any unreimbursed business expenses properly incurred, so long as Mr. Mullins makes any reimbursement request within 30 days following termination; and (iii) any employee benefits to which Mr. Mullins may be entitled under the Company’s employee benefit plans or programs which Mr. Mullins participates as of the date of termination of Mr. Mullins’ employment.

If Mr. Mullins’ employment is terminated by the Company without Cause (as defined below), or by Mr. Mullins for Good Reason (as defined below), or upon the end of the initial two-year term or a subsequent renewal term as the result of the Company’s issuance of a notice of non-renewal, then, subject to certain conditions set forth in the Mullins Employment Agreement (including the execution and non-revocation of a general release of claims), Mr. Mullins will be entitled to: (i) severance payments in a total amount equal to 12 months’ worth of the Mullins Base Salary; (ii) any earned but unpaid annual bonus in respect of any completed year that has ended prior to the date of termination; and (iii) receive reimbursement, for a period of up to 12 months, for a portion of the premiums that Mr. Mullins elects to pay for continuation coverage under the Company’s group health plans.