UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

SCHEDULE 14A

Proxy Statement Pursuant to Section 14(a)

of the Securities Exchange Act of 1934

Filed by the Registrant ☒

Filed by a Party other than the Registrant ☐

Check the appropriate box:

☒ Preliminary Proxy Statement

☐ Confidential, for Use of the SEC Only (as permitted by Rule 14a-6(e)(2))

☐ Definitive Proxy Statement

☐ Definitive Additional Materials

☐ Soliciting Material Pursuant to 14a-12

WRAP TECHNOLOGIES, INC.

(Name of Registrant as Specified in Its Charter)

(Name of Person(s) Filing Proxy Statement, if other than the Registrant)

Payment of Filing Fee (Check the appropriate box):

☒ No fee required.

☐ Fee paid previously with preliminary materials.

☐ Fee computed on table in exhibit required by Item 25(b) per Exchange Act Rules 14a‑6(i)(1) and 0‑11.

Wrap Technologies, Inc.

1817 W 4th Street

Tempe, Arizona 85281

(800) 583-2652

NOTICE OF VIRTUAL SPECIAL MEETING OF STOCKHOLDERS

TO BE HELD ON SEPTEMBER 19, 2023

Dear Stockholders of Wrap Technologies, Inc.:

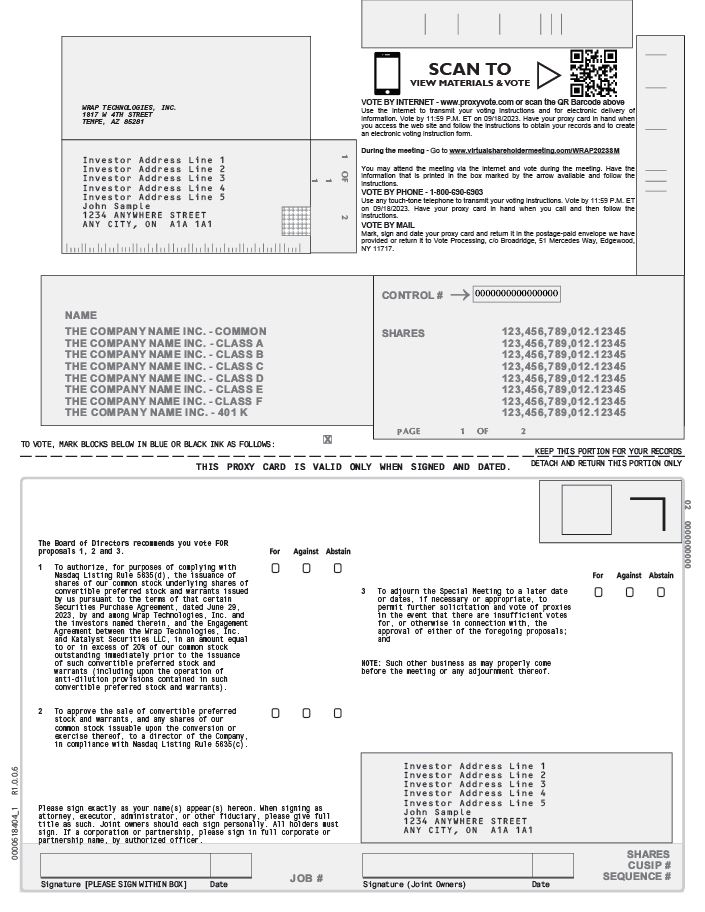

It is our pleasure to invite you to a special meeting of stockholders (the “Special Meeting”) of Wrap Technologies, Inc., a Delaware corporation (the “Company”). The Special Meeting will be held on September 19, 2023 at 9:00 A.M., Pacific Time in a virtual meeting format only. There will be no physical location for stockholders to attend the Special Meeting. Stockholders will be able to listen, vote, and submit questions, regardless of their physical location, via the internet by registering at a live webcast at www.virtualshareholdermeeting.com/WRAP2023SM. If you plan to participate in the virtual Special Meeting, please see the “About the Special Meeting—How Can I Access the Virtual Special Meeting?” section in the attached proxy statement for the Special Meeting (the “Proxy Statement”). The purpose of the Special Meeting is to vote on the following:

|

1. |

A proposal to authorize, for purposes of complying with Nasdaq Listing Rule 5635(d), the issuance of shares of our common stock underlying shares of convertible preferred stock and warrants issued by us pursuant to the terms of that certain Securities Purchase Agreement, dated June 29, 2023, by and among the Company and the investors named therein and the Engagement Agreement between the Company and Katalyst Securities LLC , in an amount equal to or in excess of 20% of our common stock outstanding immediately prior to the issuance of such convertible preferred stock and warrants (including upon the operation of anti-dilution provisions contained in such convertible preferred stock and warrants) (the “Issuance Proposal”); |

|

2. |

A proposal to approve the sale of convertible preferred stock and warrants, and any shares of our common stock issuable upon the conversion or exercise thereof, to a director of the Company, in compliance with Nasdaq Listing Rule 5635(c) (the “Director Participation Proposal”); |

|

3. |

A proposal to adjourn the Special Meeting to a later date or dates, if necessary or appropriate, to permit further solicitation and vote of proxies in the event that there are insufficient votes for, or otherwise in connection with, the approval of the Issuance Proposal or the Director Participation Proposal; and |

|

4. |

to vote upon such other matters as may properly come before the Special Meeting and any adjournment or postponement thereof. |

The foregoing items of business are more fully described in the Proxy Statement accompanying this Notice. This Notice and the Proxy Statement are also available online at: www.proxyvote.com. The proxy materials are also available from our proxy solicitor, Morrow Sodali LLC, toll-free at +1 (800) 662-5200 or email at WRAP@investor.morrowsodali.com. The Proxy Statement and this Notice are expected to be first sent or given to stockholders on or about , 2023.

The Board of Directors has fixed the close of business on August 9, 2023 as the record date for the determination of stockholders entitled to notice of and to vote at the Special Meeting and at any adjournment or postponement thereof. Stockholders of record present via live webcast at the Special Meeting or who have submitted a valid proxy via the Internet, by telephone or by mail will be deemed to be present, to vote at the Special Meeting.

Your vote is very important to us. Please act as soon as possible to vote your shares, even if you plan to participate in the virtual Special Meeting. Regardless of whether you plan to virtually attend the Special Meeting, please read the Proxy Statement and vote your shares by Internet, telephone or e-mail as promptly as possible. Please refer to the “the “About the Special Meeting – How Do I Vote My Shares?” section of the Proxy Statement for instructions on submitting your vote. Voting promptly will save us additional expense in further soliciting proxies and will ensure that your shares are represented at the Special Meeting. If you have any questions or need assistance voting, please contact the Company’s proxy solicitor toll-free at +1 (800) 662-5200 or email at WRAP@investor.morrowsodali.com.

By Order of the Board of Directors,

| Scot Cohen | Kevin Mullins | |

| Chairman of the Board | Chief Executive Officer | |

Tempe, Arizona

, 2023

YOUR VOTE IS IMPORTANT

ALL STOCKHOLDERS ARE CORDIALLY INVITED TO ATTEND THE SPECIAL MEETINGVIA LIVE WEBCAST. HOWEVER, TO ENSURE YOUR REPRESENTATION AT THE SPECIAL MEETING, YOU ARE URGED TO VOTE BY INTERNET, TELEPHONE OR MAIL AS SOON AS POSSIBLE. RETURNING YOUR PROXY WILL HELP US ASSURE THAT A QUORUM WILL BE PRESENT AT THE SPECIAL MEETING AND AVOID THE ADDITIONAL EXPENSE OF DUPLICATE PROXY SOLICITATIONS. EVEN IF YOU HAVE GIVEN YOUR PROXY, YOU MAY STILL VOTE VIA LIVE WEBCAST IF YOU ATTEND THE VIRTUAL SPECIAL MEETING. PLEASE NOTE, HOWEVER, THAT IF YOUR SHARES ARE HELD OF RECORD BY A BROKER, BANK OR OTHER NOMINEE AND YOU WISH TO VOTE AT THE SPECIAL MEETING, YOU MUST OBTAIN FROM THE RECORD HOLDER A PROXY ISSUED IN YOUR NAME.

|

IMPORTANT NOTICE REGARDING THE AVAILABILITY OF PROXY MATERIALS FOR THE SPECIAL MEETINGTO BE HELD ON SEPTEMBER 19, 2023:

THE PROXY STATEMENT ARE AVAILABLE ONLINE AT: WWW.PROXYVOTE.COM.

|

TABLE OF CONTENTS

|

Proxy Statement |

1 |

|

About the Special Meeting |

2 |

|

Proposal No. 1 — The Issuance Proposal |

10 |

|

Proposal No. 2 — The Director Participation Proposal |

19 |

|

Proposal No. 3 — The Adjournment Proposal |

22 |

|

Security Ownership of Certain Beneficial Owners and Management and Related Stockholders’ Matters |

23 |

|

Where You Can Find More Information |

24 |

|

Stockholder Proposals for the 2024 Annual Meeting of Stockholders |

25 |

|

Householding of Proxy Materials |

26 |

|

Other Matters |

27 |

Wrap Technologies, Inc.

1817 W 4th Street

Tempe, Arizona 85281

(800) 583-2652

PROXY STATEMENT

FOR

SPECIAL MEETING OF STOCKHOLDERS

Unless the context otherwise requires, references in this Proxy Statement to “we,” “us,” “our,” the “Company,” or “Wrap” refer to Wrap Technologies, Inc., a Delaware corporation, and its consolidated subsidiaries as a whole. In addition, unless the context otherwise requires, references to “stockholders” are to the holders of our voting securities, which consist of our common stock, par value $0.0001 per share (the “Common Stock”), entitled to vote at the special meeting of stockholders of the Company (the “Special Meeting”).

This Proxy Statement is furnished in connection with the solicitation of proxies by the Board of Directors (the “Board”) for use at our Special Meeting to be held on September 19, 2023 at 9:00 A.M., Pacific Time, via virtual meeting by accessing www.virtualshareholdermeeting.com/WRAP2023SM and at any adjournment or postponement thereof, and for the purposes set forth in the accompanying Notice of Virtual Special Meeting of Stockholders (the “Notice”). Stockholders will not be able to attend the Special Meeting in person; however, stockholders of record will be able to participate, vote electronically and submit questions during the live webcast of the Special Meeting.

This Proxy Statement summarizes information about the proposals to be considered at the Special Meeting and other information you may find useful in determining how to vote. The proxy card is a means by which you actually authorize the proxies to vote your shares in accordance with your instructions. Hard copies of this Proxy Statement, along with the Notice and a proxy card, are being mailed to our stockholders of record as of the close of business on August 9, 2023, beginning on or about , 2023. See “About the Special Meeting” beginning on page 2 for more information.

Our executive offices are located at, and our mailing address is, Wrap Technologies, Inc., 1817 W 4th Street, Tempe, Arizona 85281.

|

IMPORTANT NOTICE REGARDING THE AVAILABILITY OF PROXY MATERIALS FOR THE MEETING OF STOCKHOLDERS TO BE HELD ON SEPTEMBER 19, 2023:

Our official Notice and Proxy Statement are available at www.proxyvote.com.

|

ABOUT THE SPECIAL MEETING

What is a proxy?

A proxy is another person that you legally designate to vote your stock. If you designate someone as your proxy in a written document, that document is also called a “proxy” or a “proxy card.” If you are a “street name” holder, you must obtain a proxy from your broker or nominee in order to vote your shares in person at the Special Meeting.

What is a proxy statement?

A proxy statement is a document that regulations of the Securities and Exchange Commission (the “SEC”) require that we give to you when we ask you to sign a proxy card to vote your stock at the Special Meeting.

What is the purpose of the Special Meeting?

At the Special Meeting, stockholders will act upon the matters outlined in the Notice, which include the following:

|

1. |

A proposal to authorize, for purposes of complying with Nasdaq Listing Rule 5635(d), the issuance of shares of our common stock, par value $0.0001 per share (the “Common Stock”) underlying shares of convertible preferred stock and warrants issued by us pursuant to the terms of the Securities Purchase Agreement, dated June 29, 2023, by and among the Company and the investors named therein (the “Purchase Agreement”) and the Engagement Agreement between the Company and Katalyst Securities LLC, in an amount equal to or in excess of 20% of our Common Stock outstanding immediately prior to the issuance of such convertible preferred stock and warrants (including upon the operation of anti-dilution provisions contained in such convertible preferred stock and warrants) (the “Issuance Proposal”); |

|

2. |

A proposal to approve the sale of convertible preferred stock and warrants, and any shares of our Common Stock issuable upon the conversion or exercise thereof, to a director of the Company, in compliance with Nasdaq Listing Rule 5635(c) (the “Director Participation Proposal”); and |

|

3. |

A proposal to adjourn the Special Meeting to a later date or dates, if necessary or appropriate, to permit further solicitation and vote of proxies in the event that there are insufficient votes for, or otherwise in connection with, the approval of the Issuance Proposal or the Director Participation Proposal. |

What is the record date and what does it mean?

The record date to determine the stockholders entitled to notice of and to vote at the Special Meeting is the close of business on August 9, 2023 (the “Record Date”). On the Record Date, shares of Common Stock were issued and outstanding. Each holder of Common Stock is entitled to one vote for each share held as of the Record Date.

How can I access the virtual Special Meeting?

A virtual meeting format offers the same participation opportunities as those opportunities available to stockholders at in-person meetings. Stockholders will be able to listen, vote, and submit questions. To participate in the Special Meeting webcast, you must register by visiting www.virtualshareholdermeeting.com/WRAP2023SM by 11:59 P.M., Eastern Time, on September 18, 2023 using your desktop or mobile device.

The Special Meeting will begin promptly at 9:00 A.M., Pacific Time, on September 19, 2023. We encourage you to access the virtual meeting website prior to the start time. Online check-in will begin 15 minutes prior to the start of the Special Meeting. You should allow ample time to ensure your ability to access the Special Meeting.

How can I ask questions during the virtual Special Meeting?

We will hold our question-and-answer session with management immediately following the conclusion of the Special Meeting. You may submit a question in advance of the Special Meeting during the registration process by visiting www.virtualshareholdermeeting.com/WRAP2023SM. You may also submit a question at any time during the Special Meeting by typing the questions into the questions box on the screen once the virtual Special Meeting starts. The Chairman of the Special Meeting has broad authority to conduct the meeting in an orderly manner.

What if I have technical difficulties or trouble accessing the Special Meeting?

Technicians will be available to assist you if you experience technical difficulties accessing the virtual meeting website. If you encounter any difficulties accessing the virtual meeting during the check-in or meeting time, please call 844-986-0822 for assistance.

What are the voting rights of the stockholders at the Special Meeting?

The specific proposals to be considered and acted upon at the Special Meeting are each described in this Proxy Statement. Only holders of our Common Stock as of the Record Date are entitled to notice of and to vote at the Special Meeting. On the Record Date, there were shares of Common Stock issued and outstanding. Each holder of Common Stock is entitled to one vote for each share held as of the Record Date; provided, however, that any holder of shares of Series A Convertible Preferred Stock will not be entitled to vote any shares of Common Stock issued in respect thereof on the Issuance Proposal, and provided further that no director who participated in the Offering (as defined below) will be entitled to vote on the Director Participation Proposal. If you have any questions or need assistance voting, please contact our proxy solicitor Morrow Sodali LLC (“Morrow Sodali”) toll-free at +1 (800) 662-5200 or email at WRAP@investor.morrowsodali.com.

Certain stockholders, who beneficially held approximately % of our outstanding Common Stock as of the Record Date, are party to a voting agreement pursuant to which, among other things, each such stockholder agreed, solely in their capacity as a stockholder, to vote all of their shares of Common Stock in favor of the approval of the Issuance Proposal and against any actions that could adversely affect our ability to perform our obligations under the Purchase Agreement.

What constitutes a quorum for the Special Meeting?

In order for any business to be conducted at the Special Meeting, a quorum must be present. The presence at the Special Meeting of a majority of the outstanding shares of the Company entitled to vote, represented in person or by proxy, shall constitute a quorum at the Special Meeting. If you submit a properly executed proxy, regardless of whether you abstain from voting on one or more matters, your shares will be counted as present at the Special Meeting for the purpose of establishing a quorum. If you hold your shares in “street name” and you do not instruct your bank, broker or other nominee how to vote, your broker will be unable to vote your shares on any proposal being presented at the Special Meeting, and your shares will not be counted as present at the Special Meeting for the purpose of establishing a quorum. If a quorum is not present at the scheduled time of the Special Meeting, the Chairman of the Special Meeting may adjourn the Special Meeting until a quorum is present. The time and place of the adjourned Special Meeting will be announced at the time the adjournment is taken, and no other notice will be given. An adjournment will have no effect on the business that may be conducted at the Special Meeting.

What votes are required to approve each proposal?

Proposal No. 1: the Issuance Proposal.

The affirmative vote of the holders of a majority of the voting securities present, either in attendance virtually or represented by proxy, at the Special Meeting and entitled to vote on the Issuance Proposal is necessary to approve such proposal; provided, however, that any holder of shares of Series A Convertible Preferred Stock will not be entitled to vote any shares of Common Stock issued in respect thereof on the Issuance Proposal.

Proposal No. 2: the Director Participation Proposal.

The affirmative vote of the holders of a majority of the voting securities present, either in attendance virtually or represented by proxy, at the Special Meeting and entitled to vote on the Director Participation Proposal is necessary to approve such proposal; provided, however, that no director who participated in the Offering (as defined herein) will be entitled to vote any shares of Common Stock issued to such director in respect of Series A Convertible Preferred Stock on the Director Participation Proposal.

Proposal No. 3: the Adjournment Proposal.

The affirmative vote of the holders of a majority of the voting securities present, either in attendance virtually or represented by proxy, at the Special Meeting and entitled to vote on the Adjournment Proposal is necessary to approve such proposal.

How are abstentions treated?

Proposal No. 1: the Issuance Proposal.

A properly executed proxy marked “ABSTAIN” will not be voted, although it will be counted as present and entitled to vote for purposes of the Issuance Proposal Accordingly, an abstention will have the effect of a vote against the Issuance Proposal. If you hold your shares in “street name” and you do not instruct your bank, broker or other nominee how to vote, your broker will be unable to vote your shares on the Issuance Proposal, and your shares will not be included in the determination of the number of shares present at the Special Meeting for determining a quorum and will have no effect on the outcome of the vote with respect to the Issuance Proposal.

Proposal No. 2: the Director Participation Proposal.

A properly executed proxy marked “ABSTAIN” will not be voted, although it will be counted as present and entitled to vote for purposes of the Director Participation Proposal. Accordingly, an abstention will have the effect of a vote against the Director Participation Proposal. If you hold your shares in “street name” and you do not instruct your bank, broker or other nominee how to vote, your broker will be unable to vote your shares on the Director Participation Proposal, and your shares will not be included in the determination of the number of shares present at the Special Meeting for determining a quorum and will have no effect on the outcome of the vote with respect to the Director Participation Proposal.

Proposal No. 3: the Adjournment Proposal.

A properly executed proxy marked “ABSTAIN” will not be voted, although it will be counted as present and entitled to vote for purposes of the Adjournment Proposal. Accordingly, an abstention will have the effect of a vote against the Adjournment Proposal. If you hold your shares in “street name” and you do not instruct your bank, broker or other nominee how to vote, your broker will be unable to vote your shares on the Adjournment Proposal, and your shares will not be included in the determination of the number of shares present at the Special Meeting for determining a quorum and will have no effect on the outcome of the vote with respect to the Adjournment Proposal.

What is a broker non-vote?

A “broker non-vote” occurs when a nominee (typically a broker or bank) holding shares for a beneficial owner (typically referred to as shares being held in “street name”) submits a proxy for the Special Meeting but does not vote on a particular proposal because the nominee has not received voting instructions from the beneficial owner and does not have discretionary authority to vote the shares with respect to that proposal.

How are broker non-votes treated?

Brokers and other nominees may vote on “routine” proposals on behalf of beneficial owners who have not furnished voting instructions, subject to the rules applicable to broker nominees concerning transmission of proxy materials to beneficial owners, and subject to any proxy voting policies and procedures of those firms. Each of the proposals being presented at this Special Meeting is considered a “non-routine” proposal. This means that brokers and other firms must obtain voting instructions from the beneficial owner to vote on any of these matters; otherwise, they will not be able to cast a vote for such “non-routine” proposals. If your shares are held in the name of a broker, bank or other nominee, please follow their voting instructions so you can instruct your broker on how to vote your shares.

How do I vote my shares?

If you are a record holder, you may vote your shares at the Special Meeting as follows:

|

● |

You may submit your proxy on the Internet or by phone. Stockholders may vote via the Internet at www.proxyvote.com or by phone (as per instructions on the proxy card), 24 hours per day and seven days per week. You will need the control number included on your proxy card. Votes submitted via the Internet or phone must be received by 11:59 p.m., Eastern Time, on September 18, 2023. |

|

● |

You may submit your proxy by mail. Stockholders may vote by signing and dating the proxy card and mailing it in the enclosed prepaid and addressed envelope. If you mark your choices on the card, your shares will be voted as you instruct. |

|

● |

You may vote during the Special Meeting. Instructions on how to vote while participating in the Special Meeting via live webcast are posted at www.virtualshareholdermeeting.com/WRAP2023SM. |

The proxy is fairly simple to complete, with specific instructions on the electronic ballot, telephone or card. By completing and submitting your proxy, you will direct the designated person (known as a “proxy”) to vote your stock at the Special Meeting in accordance with your instructions. The Board has appointed each of Chris DeAlmeida and Kevin Mullins to serve as the proxy for the Special Meeting.

Your proxy will be valid only if you complete and return it before the Special Meeting. If you properly complete and transmit your proxy but do not provide voting instructions with respect to a proposal, then the designated proxies will vote your shares “FOR” for the Issuance Proposal and the Director Participation Proposal. We do not anticipate that any other matters will come before the Special Meeting, but if any other matters properly come before the meeting, then the designated proxies will vote your shares in accordance with applicable law and their judgment.

If you hold your shares in “street name,” your bank, broker or other nominee should provide to you a request for voting instructions along with the Company’s proxy solicitation materials. By completing the voting instruction card, you may direct your nominee how to vote your shares. If you partially complete the voting instruction but fail to complete one or more of the voting instructions, then your nominee may be unable to vote your shares with respect to the proposal as to which you provided no voting instructions. See “What is a broker non-vote?” Alternatively, if you want to vote your shares during the Special Meeting, you must contact your nominee directly in order to obtain a proxy issued to you by your nominee holder. Note that a broker letter that identifies you as a stockholder is not the same as a nominee-issued proxy.

What if I do not specify how I want my shares voted?

If you return your proxy without specifying how the shares represented thereby are to be voted, the proxy will be voted (i) “FOR” the Issuance Proposal, (ii) “FOR” the Director Participation Proposal, (iii) “FOR” the Adjournment Proposal, and (iv) at the discretion of the proxy holders on any other matter that may properly come before the Special Meeting or any adjournment or postponement thereof.

Can I change my vote?

You may revoke or change your proxy at any time before the Special Meeting by (i) filing, with our Corporate Secretary at our executive offices, located at 1817 W 4th Street, Tempe, Arizona 85281, a notice of revocation or another signed proxy with a later date, or (ii) by voting online at the virtual Special Meeting. Attendance at the virtual Special Meeting by itself will not revoke a proxy. Shares can be voted at the Special Meeting only if the holder is present or represented by proxy. If you are a stockholder whose shares are not registered in your own name, you will need additional documentation from your broker or record holder to vote personally at the Special Meeting.

Who counts the votes?

All votes will be tabulated by Daniel Ramsey, the inspector of election appointed for the Special Meeting.

Do I have any dissenters’ or appraisal rights with respect to any of the matters to be voted on at the Special Meeting?

The stockholders of the Company have no dissenter’s or appraisal rights in connection with any of the proposals described herein.

What are the solicitation expenses and who pays the cost of this proxy solicitation?

We will bear the entire cost of solicitation, including the preparation, assembly, printing and mailing of the Notice, as well as the preparation and posting of this Proxy Statement and any additional solicitation materials furnished to stockholders. Copies of any solicitation materials will be furnished to brokerage houses, fiduciaries and custodians holding shares in their names that are beneficially owned by others so that they may forward this solicitation material to such beneficial owners. In addition, we may reimburse such persons for their costs in forwarding the solicitation materials to such beneficial owners. The original solicitation of proxies may be supplemented by a solicitation by telephone, e-mail or other means by our directors, officers or employees. No additional compensation will be paid to these individuals for any such services. Except as described above, we do not presently intend to solicit proxies other than by e-mail, telephone and mail.

Is this Proxy Statement the only way that proxies are being solicited?

No. In addition to the solicitation of proxies by use of the mail, telephone, officers and employees of the Company, we have also retained Morrow Sodali to assist it in the solicitation of proxies for the Special Meeting. Morrow Sodali will solicit proxies our behalf from individuals, brokers, bank nominees and other institutional holders in the same manner described above. Morrow Sodali will receive a fee of $20,000, plus approved and reasonable out of pocket expenses, for its services for the solicitation of the proxies for our Special Meeting. We have also agreed to indemnify Morrow Sodali against certain claims.

What is “householding” and how does it affect me?

With respect to eligible stockholders who share a single address, we may send only one copy of the proxy materials to that address unless we receive instructions to the contrary from any stockholder at that address. This practice, known as “householding,” is designed to reduce our printing and postage costs. However, if a stockholder of record residing at such address wishes to receive a separate proxy materials in the future, he or she may contact Wrap Technologies, Inc., by sending a request to Morrow Sodali at 333 Ludlow Street, 5th Floor, South Tower, Stamford, CT 06902, or contacting them at +1 (800) 662-5200. Eligible stockholders of record receiving multiple copies of our proxy materials can request householding by contacting us in the same manner. Stockholders who own shares through a bank, broker or other intermediary can request householding by contacting the intermediary or by contacting the Company at the above address or phone number.

We hereby undertake to deliver promptly, upon written or oral request, a copy of the proxy materials to a stockholder at a shared address to which a single copy of the document was delivered. Requests should be directed to the address or phone number set forth above.

Where can I find voting results?

We expect to publish the voting results in a Current Report on Form 8-K, which we expect to file with the SEC within four business days after the Special Meeting.

Who can help answer my questions?

The information provided above in this “question and answer” format is for your convenience only and is merely a summary of the information contained in this Proxy Statement. We urge you to carefully read this entire Proxy Statement, including the documents we refer to in this Proxy Statement. If you have further questions, or need additional materials, please feel free to contact our proxy solicitor, Morrow Sodali, at:

Morrow Sodali LLC

470 West Avenue

Stamford, CT 06902

Telephone: +1 (800) 662-5200

(banks and brokers can call collect at (203) 658-9400)

Toll-free at +1 (800) 662-5200

WRAP@investor.morrowsodali.com

MATTERS TO BE CONSIDERED AT THE SPECIAL MEETING

PROPOSAL NO. 1

THE ISSUANCE PROPOSAL

Background and Description of Proposal

Financing Transaction

On June 29, 2023, we entered into the Purchase Agreement with certain directors of the Company and certain accredited and institutional investors (collectively, the “Investors”), pursuant to which we sold to the Investors in a registered direct offering (the “Offering”) (i) an aggregate of 10,000 shares (the “Preferred Shares”) of our newly-designated Series A Convertible Preferred Stock, with par value $0.0001 per share and a stated value of $1,000 per share (the “Preferred Stock”), convertible into shares of our Common Stock, and (ii) warrants (the “Investor Warrants”) to acquire up to an aggregate of 6,896,553 shares of Common Stock (the “Investor Warrant Shares”). We engaged Katalyst Securities LLC (the “Placement Agent”) as our exclusive placement agent in connection with the Offering and, pursuant to an Engagement Agreement, dated June 29, 2023, between us and the Placement Agent (the “Engagement Agreement”), we issued to the Placement Agent or its designees warrants (the “Placement Agent Warrants”) to purchase an aggregate of 551,725 shares of Common Stock (the “Placement Agent Warrant Shares”) at an exercise price of $1.45 per share. The Preferred Shares are convertible into shares of Common Stock (the “Conversion Shares”) at the election of the holder at any time at an initial conversion price of $1.45 (the “Conversion Price”), which is subject to customary adjustments for stock dividends, stock splits, reclassifications and the like, and subject to price-based adjustment in the event of any issuances of Common Stock, or securities convertible, exercisable or exchangeable for Common Stock, at a price below the then-applicable Conversion Price (subject to certain exceptions). The holders of the Preferred Shares are entitled to dividends payable in cash or, at the election of the Company, in shares of Common Stock (“Dividend Shares”), or in a combination of cash and Dividend Shares, in each case, in accordance with the terms of the Certificate of Designations of the Preferred Stock (the “Certificate of Designations”). The Investor Warrants and the Placement Agent Warrants are referred to collectively herein as the “Warrants,” and the Investor Warrant Shares and the Placement Agent Warrant Shares are referred to collectively herein as the “Warrant Shares.” The Dividend Shares, the Conversion Shares, and the Warrant Shares are referred to collectively herein as the “Common Shares.”

The Preferred Shares, the Warrants, and the Common Shares were issued pursuant to a registration statement on Form S‑3 (Registration No. 333‑260612), declared effective by the SEC on November 12, 2021, and a prospectus supplement, dated June 29, 2023, filed pursuant to Rule 424(b) under the Securities Act of 1933, as amended.

In connection with the Offering, we agreed to seek the approval of our stockholders for the issuance of (i) Dividend Shares upon payment of dividends in respect of the Preferred Shares, (ii) Conversion Shares upon conversion of the Preferred Shares, or (iii) Warrant Shares upon exercise of the Warrants, as applicable, including any additional shares of Common Stock issuable as Dividend Shares, Conversion Shares, or Warrant Shares as a result of the anti-dilution adjustments discussed herein.

Reasons for the Financing Transaction

As of March 31, 2023, our cash and cash equivalents were approximately $9.5 million. In June 2023, our Board determined that it was necessary to raise additional funds for general corporate purposes.

We believe that the Offering, which yielded gross proceeds of $10 million, was necessary in light of our cash and funding requirements at the time. We also believe that the anti-dilution protections contained in the Certificate of Designations and the Warrants were reasonable in light of market conditions and the size and type of the Offering and that we would not have been able to complete the sale of the Preferred Shares and Warrants unless such anti-dilution provisions were offered. In addition, at the time of the Offering, our Board considered numerous alternatives to the transaction, none of which proved to be feasible or, in the opinion of our Board, would have resulted in aggregate terms equivalent to, or more favorable than, the terms obtained in the Offering.

Purchase Agreement

The Preferred Shares and Investor Warrants were issued on July 6, 2023 (the “Closing Date”) pursuant to the terms of the Purchase Agreement and the Engagement Agreement. The Purchase Agreement provided for the sale of the Preferred Shares and the Warrants on the Closing Date for gross proceeds of approximately $10 million.

The Purchase Agreement obligates us to indemnify the Investors and various related parties for certain losses including those resulting from (i) any misrepresentation or breach of any representation or warranty made by us, (ii) any breach of any obligation of ours, and (iii) certain claims by third parties.

The Purchase Agreement contains representations and warranties of us and the Investors that are typical for transactions of this type. In addition, the Purchase Agreement contains customary covenants on our part that are typical for transactions of this type as well as the following additional covenants: (i) until the earlier of (x) such date that no Warrants remain outstanding and (y) two years from the Closing Date, we agreed not to enter into any variable rate transactions; (ii) until the 18 months anniversary of the Closing Date, we agreed not to issue any share of Common Stock or convertible security at a purchase price or conversion price, as applicable, below the applicable Conversion Price until an aggregate of eighty percent (80%) of the Preferred Shares have been converted into shares of Common Stock, subject to certain exceptions; (iii) we agreed to offer to the Investors who purchased securities in the Offering for aggregate consideration equal to or in excess of $1 million until two years from the Closing Date, the opportunity to participate in any subsequent securities offerings by us; and (iv) we agreed to hold a stockholder meeting no later than October 1, 2023, at which we would use our best efforts to solicit our stockholders’ affirmative vote for approval of our issuance of the maximum number of Common Shares issuable upon the payment of dividends in respect of the Preferred Shares, the conversion of the Preferred Shares, and the exercise of the Warrants, each in accordance with applicable law and the rules and regulations of the Nasdaq Stock Market. This Issuance Proposal is intended to fulfill this last covenant.

Engagement Agreement

The Placement Agent Warrants were issued on the date of the Closing pursuant to the terms of the Engagement Agreement. The Engagement Agreement provided for the issuance of the Placement Agent Warrants to the Placement Agent or its designees as compensation for the Placement Agent’s services in connection with the Offering.

Voting Agreement

Certain stockholders, who beneficially held approximately % of our outstanding Common Stock as of the Record Date, are party to a voting agreement pursuant to which, among other things, each such stockholder agreed, solely in their capacity as a stockholder, to vote all of their shares of Common Stock in favor of the approval of the Issuance Proposal and against any actions that could adversely affect our ability to perform our obligations under the Purchase Agreement. The voting agreement also places certain restrictions on the transfer of the shares of Common Stock held by the signatories thereto.

Preferred Shares

The terms of the Preferred Shares are as set forth in a Certificate of Designations, which was filed with the Secretary of State for the State of Delaware on July 3, 2023. The Certificate of Designations was filed as Exhibit 3.1 to our Current Report on Form 8-K, filed with the SEC on June 30, 2023, and is incorporated herein by reference.

The Preferred Shares are convertible into shares of Common Stock at the option of the respective holders at any time at the Conversion Price. The initial Conversion Price, subject to adjustment as set forth in the Certificate of Designations, is $1.45 per share. The Conversion Price is subject to customary adjustment for stock dividends, stock splits, reclassifications and the like. The Conversion Price is also subject to “full ratchet” price-based adjustment in the event of any issuances of Common Stock, or securities convertible, exercisable or exchangeable for Common Stock, at a price below the then-applicable Conversion Price (subject to certain exceptions).

The holders of the Preferred Shares are entitled to dividends of 8% per annum, compounded monthly, which are payable in cash or, at our election, shares of Common Stock, or a combination thereof, in each case, in accordance with the terms of the Certificate of Designations. If we elect to pay any dividends in shares of Common Stock, the Conversion Price used to calculate the number of shares issuable will equal to the lower of (i) the then applicable Conversion Price and (ii) 85% of the arithmetic average of the three (3) lowest closing prices of the Common Stock during the twenty (20) consecutive trading day period ending on the trading day immediately preceding the dividend payment date, provided that such price shall not be lower than the lower of (x) 0.2828 (subject to adjustment for stock splits, stock dividends, stock combinations, recapitalizations or other similar events ) and (y) 20% of the “Minimum Price” (as defined in Nasdaq Stock Market Rule 5635) on the date the stockholders approve this Issuance Proposal (subject to adjustment for stock splits, stock dividends, stock combinations, recapitalizations or other similar events) or, in any case, such lower amount as permitted, from time to time, by the Nasdaq Stock Market. Upon conversion or redemption, the holders of shares of Preferred Stock are also entitled to receive a dividend make-whole payment.

The Certificate of Designations includes certain Triggering Events (as defined in the Certificate of Designations), including, among other things, the failure by us to pay any amounts due to the holders of the Preferred Shares when due. Upon the occurrence and during the continuance of a Triggering Event, Preferred Shares will accrue dividends at the rate of 20% per annum.

If on any day after the issuance of the shares of Preferred Stock (i) the closing price of the Common Stock equals or exceeds $4.35 per share (subject to adjustment for stock splits, stock dividends, stock combinations, recapitalizations or other similar events) for 20 consecutive trading days (the “Mandatory Conversion Measuring Period”), (ii) the daily dollar trading volume of the Common Stock has exceeded $2 million per trading day during the same period, and (iii) certain equity conditions described in the Certificate of Designations are satisfied, then we will have the right to deliver written notice (“Mandatory Conversion Notice”) of the Mandatory Conversion (as defined below) to all holders setting forth (x) the date on which Mandatory Conversion shall occur (which date shall be the second trading day following the date on which holders received Mandatory Conversion Notice) and (y) the aggregate number of Preferred Stock which we elect to be subject to such Mandatory Conversion from the holder, and, on such Mandatory Conversion Date, we shall convert all or any portion of each holder’s shares of Preferred Stock into Conversion Shares at the then effective Conversion Price (the “Mandatory Conversion”). If any of the Equity Conditions shall cease to be satisfied at any time during Mandatory Conversion Measuring Period, then, at the option of the holder of Preferred Stock, the Mandatory Conversion shall be deemed withdrawn and void ab initio.

At any time beginning 18 months after the closing of the Offering, provided that certain equity conditions described in the Certificate of Designations are satisfied, we have the right to redeem in cash all or some of the Preferred Shares outstanding at such time at a redemption price equal to the product of (x) 125% multiplied by (y) the Conversion Amount (as defined in the Certificate of Designations) of the Preferred Shares being redeemed.

Notwithstanding the foregoing, our ability to settle conversions and make dividend make-whole payments using shares of Common Stock is subject to certain limitations set forth in the Certificate of Designations, including a limit on the number of shares that may be issued until the time, if any, that our stockholders have approved the issuance of more than 19.9% of our outstanding shares of Common Stock in accordance with the Nasdaq Listing Rules (the “Nasdaq Stockholder Approval”). We agreed to seek Nasdaq Stockholder Approval of these matters at a meeting to be held no later than October 1, 2023. The Special Meeting is being held and this Issuance Proposal is being submitted to our stockholders in order to obtain the Nasdaq Stockholder Approval. Further, the Certificate of Designations contains certain beneficial ownership limitations after giving effect to the issuance of shares of Common Stock issuable upon conversion of, or as part of any dividend make-whole payment under, the Certificate of Designations.

We are subject to certain affirmative and negative covenants regarding the incurrence of indebtedness, the existence of liens, the repayment of indebtedness, the payment of cash in respect of dividends (other than dividends pursuant to the Certificate of Designations), distributions or redemptions, and the transfer of assets, among other matters.

Warrants

The Warrants will become exercisable after the date that is six months from the date of issuance (except that any Warrant issued to one of our directors may not be exercised prior to date that is the later of (x) the date on which we receive Nasdaq Stockholder Approval and (y) the date that is six months from the date of issuance) at an initial exercise price of $1.45 per share (the “Exercise Price”) and expire five years from the date of issuance. The Exercise Price is subject to customary adjustments for stock dividends, stock splits, reclassifications and the like, and subject to price-based adjustment, on a “full ratchet” basis, in the event of any issuances of Common Stock, or securities convertible, exercisable or exchangeable for Common Stock, at a price below the then-applicable Exercise Price but not less than the lower of (i) $0.2828 and (ii) 20% of the “Minimum Price” (as defined in Nasdaq Stock Market Rule 5635) on the date the stockholders approve this Issuance Proposal (subject to certain exceptions). The Warrants may be exercised for cash, provided that, if there is no effective registration statement available registering the exercise of the Warrants, the Warrants may be exercised on a cashless basis.

As long as 85% of the Preferred Stock is outstanding, if there is a reconstitution of our board of directors of whereby three or more members of such board of directors resign or are replaced (a “Board Reconstitution”), we shall, at the holder’s option, exercisable at any time concurrently with, or within 30 days after, the Board Reconstitution, purchase the Warrant from the holder by paying to the holder an amount of cash equal to the Board Reconstitution Black Scholes Value (as defined in the Warrant) of the remaining unexercised portion of the Warrant on the date of the Board Reconstitution; provided, however, that a change in the composition of our board of directors shall not constitute a “Board Reconstitution”, so long as continuing directors constitute at least a majority of our board of directors. For purposes of the foregoing sentence, a “continuing director” shall mean any member of our board of directors (a) who is a member of that board of directors on the closing date, (b) who was nominated for election by the board of directors a majority of whom were directors on the closing date or (c) whose election or nomination for election was approved by one or more of such directors.

Effect of Issuance of Securities

The potential issuance of the Common Shares, including any Common Shares issued pursuant to the anti-dilution provisions contained in the Certificate of Designations and the Warrants, would result in an increase in the number of shares of Common Stock outstanding, and our stockholders would incur dilution of their percentage ownership to the extent that the holders thereof convert their Preferred Shares or exercise their Warrants or to the extent that additional Common Shares are issued pursuant to the anti-dilution provisions of the Certificate of Designations or the Warrants. Because of potential adjustments to the number of Common Shares issuable upon conversion of the Preferred Shares and exercise of the Warrants, the exact magnitude of the dilutive effect of the Preferred Shares and Warrants cannot be conclusively determined. However, the dilutive effect may be material to our current stockholders.

Reasons for Nasdaq Stockholder Approval

Nasdaq Stock Market Rule 5635(d) requires us to obtain Nasdaq Stockholder Approval prior to a transaction, other than a public offering, involving the sale, issuance or potential issuance by the Company of Common Stock (or securities convertible into or exercisable for Common Stock), which equals 20% or more of the Common Stock or 20% or more of the voting power outstanding immediately prior to the issuance at a price that is less than the lower of: (i) the Nasdaq Official Closing Price (as reflected on Nasdaq.com) immediately preceding the signing of the binding agreement in connection with such transaction or (ii) the average Nasdaq Official Closing Price of the Common Stock (as reflected on Nasdaq.com) for the five trading days immediately preceding the signing of such binding agreement. In the case of the Offering, the 20% threshold is determined based on the shares of our Common Stock outstanding immediately preceding the execution of the Purchase Agreement, which was signed on June 29, 2023.

Immediately prior to the execution the Purchase Agreement, we had 41,935,676 shares of Common Stock outstanding. Therefore, the potential issuance of 14,344,831 shares of our Common Stock (consisting of 6,896,553 Conversion Shares (assuming issuance at the initial Conversion Price), 6,896,553 Investor Warrant Shares, and 551,725 Placement Agent Warrant Shares) would have constituted approximately 34% of the shares of Common Stock outstanding prior to the Offering. In addition, if a holders of the Preferred Shares elect to convert their Preferred Shares, the effective Conversion Price may be significantly lower than the initial Conversion Price, resulting in the issuance of a greater number of shares of Common Stock than would be issuable at the initial Conversion Price. Further, if we elect to pay each monthly dividend payment in the form of Dividend Shares, we will issue shares of Common Stock in addition to those into which the Preferred Shares are initially convertible, and the effective Dividend Conversion Price may be significantly lower than the initial Conversion Price, resulting in the issuance of a greater number of shares of Common Stock than would be issuable at the initial Conversion Price. We are seeking Nasdaq Stockholder Approval under Nasdaq Listing Rule 5635(d) for the sale, issuance or potential issuance by us of shares of our Common Stock (or securities convertible into or exercisable for shares of our Common Stock) in excess of 8,387,135 shares, which is 20% of the shares of Common Stock outstanding immediately prior to the execution of the Purchase Agreement, including, without limitation, as a result of the anti-dilution provisions of the Certificate of Designations or the Warrants, since such provisions may reduce the per share conversion price or exercise price, as the case may be, and result in the issuance of shares at less than the greater of market price or book value per share.

We intend to make the dividend payments due to holders of the Preferred Shares in the form of Dividend Shares to the extent allowed under the Certificate of Designations and applicable law, in order to preserve our cash resources. Because the effective Dividend Conversion Price used to determine the number of Dividend Shares issuable depends in part on the market price of our Common Stock at the time that a Dividend payment is due, we cannot predict how many Dividend Shares we will be required to issue in connection with such Dividend payments. In addition, we generally have no control over whether the holders of Preferred Shares convert their Preferred Shares (other than pursuant to the mandatory exercise feature of the Preferred Shares) or whether the Warrant holders exercise their Warrants. For these reasons, we are unable to accurately forecast or predict with any certainty the total amount of Common Shares that may be issued to the holders of the Preferred Shares or Warrants. Under certain circumstances, however, it is possible, that we may have to issue more than 20% of our outstanding shares of Common Stock to the Preferred Share and Warrant holders under the terms of the Certificate of Designations and the Warrants, respectively. Therefore, we are seeking Nasdaq Stockholder Approval under this proposal to issue more than 20% of our outstanding shares of Common Stock, if necessary, to the Preferred Share and Warrant holders under the Certificate of Designations and the Warrants, respectively.

Nasdaq Stockholder Approval of this Issuance Proposal is also one of the conditions for us to receive up to an additional approximately $10.8 million upon the exercise of the Warrants, if exercised for cash. Loss of these potential funds could jeopardize our ability to execute our business plan.

Any transaction requiring approval by our stockholders under Nasdaq Listing Rule 5635(d) would likely result in a significant increase in the number of shares of our Common Stock outstanding, and, as a result, would likely lead to our current stockholders owning a smaller percentage of our outstanding shares of Common Stock.

Future issuances of securities in connection with the Offering, if any, may cause a significant reduction in the percentage interests of our current stockholders in voting power, any liquidation value, our book and market value, and any future earnings. Further, the issuance or resale of Common Shares issued to the Preferred Share and Warrant holders could cause the market price of our Common Stock to decline. In addition to the foregoing, the increase in the number of issued shares of Common Stock in connection with the Offering may have an incidental anti-takeover effect in that additional shares could be used to dilute the stock ownership of parties seeking to obtain control of us. The increased number of issued shares could discourage the possibility of, or render more difficult, certain mergers, tender offers, proxy contests or other change of control or ownership transactions.

Under the Nasdaq Listing Rules, we are not permitted (without risk of delisting) to undertake a transaction that could result in a change in control of us without seeking and obtaining separate stockholder approval. We are not required to obtain stockholder approval for the Offering under Nasdaq Listing Rule 5635(b) because the Preferred Share and Warrant holders have agreed that, for so long as they hold any shares of our Common Stock, neither they nor any of their affiliates will acquire shares of our Common Stock which result in them and their affiliates, collectively, beneficially owning or controlling more than 4.99% (which percentage can be increased to 9.99% upon the holder’s election) of the total outstanding shares of our Common Stock.

Potential Consequences if the Issuance Proposal is Not Approved

After extensive efforts to raise capital on more favorable terms, we believed that the Offering was the only viable financing alternative available to us at the time. If our stockholders do not approve this proposal, we will not be able to issue more than 20% of our outstanding shares of Common Stock to the Preferred Share and Warrant holders in connection with the Offering. As a result, we may be unable to make the dividend payments due to the holders of the Preferred Shares in shares of our Common Stock or issue sufficient shares upon conversion of the Preferred Shares or exercise of the Warrants. If we are unable to make such payments in shares of our Common Stock, we will have to satisfy such payment obligations by means of cash dividend or redemption payments to the holders of the Preferred Shares. If we do not have sufficient cash resources to make these payments, we may need to delay, reduce or eliminate certain research and development programs or other operations, sell some or all of our assets, or merge with another entity.

Interests of Certain Persons

When you consider our Board’s recommendation to vote in favor of this proposal, you should be aware that our directors and executive officers and existing stockholders may have interests that may be different from, or in addition to, the interests of other of our stockholders. In particular, Scot Cohen (“Mr. Cohen”), one of our directors and the owner of more than 5% of our voting securities, and V4 Global LLC (“V4”), an entity over which Mr. Cohen exercises control and whose securities are beneficially owned by Mr. Cohen, participated in the Offering. Mr. Cohen may by unable to convert all of the Preferred Shares and exercise all of the Warrants issued to him in connection with the Offering if this proposal is not approved by our stockholders. Mr. Cohen will not, by virtue of the issuance of the Common Shares to which he is entitled upon the payment of dividends in respect of the Preferred Shares, the conversion of the Preferred Shares, and the exercise of the Warrants at the initial Conversion Price and Exercise Price, as applicable, acquire rights to a majority of the voting power of the Company, based on the number of shares of Common Stock outstanding as of the Record Date. For further information about Mr. Cohen’s participation in the Offering, see the section titled “Proposal No. 2” below, the relevant portions of which are incorporated herein by reference.

Further Information

The terms of the Purchase Agreement, the Certificate of Designations and the Warrants are only briefly summarized above. For further information, please refer to the forms of the Purchase Agreement, the Certificate of Designations, and the Warrants, which were filed with the SEC as exhibits to our Current Report on Form 8-K filed on June 30, 2023, and are incorporated herein by reference. The discussion herein is qualified in its entirety by reference to the filed documents.

Vote Required

If a quorum is present and voting, the affirmative vote of a majority of the voting securities present, either in attendance virtually or represented by proxy, at the Special Meeting and entitled to vote on the Issuance Proposal is required to ratify such proposal. An abstention will have the effect of a vote against the Issuance Proposal and broker non-votes will have no effect on the outcome of the vote with respect to the Issuance Proposal.

Unless otherwise instructed or unless authority to vote is withheld, shares represented by executed proxies will be voted “FOR” the Issuance Proposal.

Board of Directors Recommendation

The Board recommends that the stockholders vote “FOR” the Issuance Proposal.

PROPOSAL NO. 2

THE DIRECTOR PARTICIPATION PROPOSAL

Background and Description of Proposal

The stockholders of the Company are being asked to approve, in accordance with Nasdaq Listing Rule 5635(c), the issuance of Preferred Shares and Warrants, as well as Conversion Shares upon conversion of the Preferred Shares and Warrant Shares upon exercise of the Warrants, in each case to a director of the Company.

Description of the Offering

On June 29, 2023, we entered into the Purchase Agreement with the Investors, including Mr. Cohen, a director of the Company, and V4, an entity over which Mr. Cohen exercises control and whose securities are beneficially owned by Mr. Cohen (the “Affiliated Offering”), pursuant to which we issued to Mr. Cohen and V4 an aggregate of 3,000 Preferred Shares and Investor Warrants to purchase up to an aggregate of 2,068,966 Investor Warrant Shares for aggregate gross proceeds of $3,000,000.70 (excluding the proceeds we may receive from the exercise of the warrants issued in the Affiliated Offering) (the “Affiliated Proceeds”). For further information about the Affiliated Offering, see the section titled “Proposal No. 1” above, the relevant portions of which are incorporated herein by reference. The Certificate of Designation provides that Preferred Shares held by a holder who serves as a director, officer or is an employee of the Company shall only be convertible into shares of Common Stock following receipt of the Nasdaq Stockholder Approval. Similarly, any Warrant issued to one of our directors may not be exercised prior to date that is the later of (x) the date on which we receive Nasdaq Stockholder Approval and (y) the date that is six months from the date of issuance).

Use of Proceeds

We expect to use the proceeds from the from the sale of the Affiliated Offering for working capital and other general corporate purposes.

Reasons for the Financing Transaction

See the section titled “Proposal No. 1—Reasons for the Financing Transaction” above, the relevant portions of which are incorporated herein by reference.

Reasons for Stockholder Approval

Nasdaq Listing Rule 5635(c) deems the issuance of common stock, or securities convertible into or exercisable for common stock, to a Nasdaq-listed company’s officers, directors, employees or consultants at a price less than the market value of such stock, calculated as the closing bid price for such shares on the trading day immediately prior to entry into the signing of a binding agreement to issue such common stock, or securities convertible into or exercisable for common stock, as equity compensation requiring stockholder approval unless the issuance is part of a public offering. Because (i) the Purchase Agreement and related transaction documents provided for the sale and issuance of Preferred Shares and Investor Warrants to Mr. Cohen, who is a director of the Company, and V4, an entity over which Mr. Cohen exercises control and whose securities are beneficially owned by Mr. Cohen, (ii) the Offering was not a public offering, and (iii) under certain circumstances, the effective per-share price of the Preferred Shares and Warrants sold to Mr. Cohen and V4 may be less than the closing bid price of our Common Stock as reported on the Nasdaq Stock Market on the trading day immediately prior to the date of the Purchase Agreement, stockholder approval is required pursuant to Nasdaq Listing Rule 5635(c) for such issuances to Mr. Cohen and V4.

When you consider our Board’ recommendation to vote in favor of the Director Participation Proposal, you should be aware that certain of our directors and executive officers and existing stockholders may have interests that may be different from, or in addition to, the interests of other stockholders. In particular, if stockholder approval is obtained with respect to the Director Participation Proposal, Mr. Cohen and V4 will purchase securities pursuant to the Purchase Agreement and be entitled to received securities pursuant to the terms of the Certificate of Designations and the Warrants, including the anti-dilution provisions contained therein, at an effective per-share price that may be below the closing bid price of our Common Stock on the day prior to the execution of the Purchase Agreement.

Potential Adverse Effects; Dilution and Impact of the Offering on Existing Stockholders

The potential issuance of the Common Shares, including any Common Shares issued pursuant to the anti-dilution provisions contained in the Certificate of Designations and Warrants, in the Affiliated Offering will have a dilutive effect on current stockholders in that the percentage ownership of the Company held by such current stockholders will decline as a result of the issuance of such Common Shares. This means also that current stockholders will own a smaller interest in the Company as a result of such issuances and will therefore have less ability to influence significant corporate decisions requiring stockholder approval. The potential issuance of the Common Shares, including any Common Shares issued pursuant to the anti-dilution provisions contained in the Certificate of Designations and Warrants, in the Affiliated Offering could also have a dilutive effect on book value per share and any future earnings per share. Dilution of equity interests could also cause prevailing market prices for our Common Stock to decline. For further information, see the section titled “Proposal No. 1—Effect of Issuance of Securities” above, the relevant portions of which are incorporated herein by reference.

Potential Consequences if the Director Participation Proposal is Not Approved

After extensive efforts to raise capital on more favorable terms, we believed that Mr. Cohen and V4’s participation in the Offering necessary to raising the amount of capital that we deemed necessary to sustain our business. If our stockholders do not approve this proposal, we will redeem the securities issued to Mr. Cohen and V4 and refund the aggregate gross proceeds received from Mr. Cohen and V4 in connection their participation in the Offering.

Interests of Certain Persons

When you consider our Board’s recommendation to vote in favor of this proposal, you should be aware that our directors and executive officers and existing stockholders may have interests that may be different from, or in addition to, the interests of other of our stockholders. In particular, Mr. Cohen is a member of our Board and Mr. Cohen will not be able to convert his Preferred Shares (or those issued to V4) or exercise his Warrants (or those issued to V4) unless the Company approves this proposal.

Vote Required

If a quorum is present and voting, the affirmative vote of a majority of the voting securities present, either in attendance virtually or represented by proxy, at the Special Meeting and entitled to vote on the Director Participation Proposal is required to ratify such proposal. An abstention will have the effect of a vote against the Director Participation Proposal and broker non-votes will have no effect on the outcome of the vote with respect to the Director Participation Proposal.

Unless otherwise instructed or unless authority to vote is withheld, shares represented by executed proxies will be voted “FOR” the Director Participation Proposal.

Board of Directors Recommendation

The Board recommends that the stockholders vote “FOR” the Director Participation Proposal.

PROPOSAL NO. 3

THE ADJOURNMENT PROPOSAL

Background and Description of Proposal

Our Board has approved a proposal to adjourn the Special Meeting to a later date or dates, if necessary or appropriate, to permit further solicitation and vote of proxies in the event that there are insufficient votes for, or otherwise in connection with, the approval of the Issuance Proposal or the Director Participation Proposal.

The approval of each of the Issuance Proposal and the Director Participation Proposal requires the affirmative vote of a majority of the voting securities present, either in attendance virtually or represented by proxy, at the Special Meeting and entitled to vote on such proposal. The Board believes that if the number of votes received with respect to the either proposal is less than said majority and is therefore insufficient to approve such proposal, then it may be in the best interests of the stockholders to adjourn the Special Meeting to enable the Board to continue to seek to obtain a sufficient number of additional votes to approve the Issuance Proposal or the Director Participation Proposal, as applicable.

In the Adjournment Proposal, we are asking stockholders to authorize the holder of any proxy solicited by the Board to vote in favor of adjourning or postponing the Special Meeting or any adjournment or postponement thereof. If our stockholders approve this proposal, we could adjourn or postpone the Special Meeting, and any adjourned session of the Special Meeting, to use the additional time to solicit additional proxies in favor of the Issuance Proposal or the Director Participation Proposal, as applicable.

Additionally, approval of the Adjournment Proposal could mean that, in the event we receive proxies indicating that a majority of votes represented by the outstanding stock entitled to vote at the Special Meeting will be against the Issuance Proposal or the Director Participation Proposal, we could adjourn or postpone the Special Meeting without a vote on the Issuance Proposal or the Director Participation Proposal and use the additional time to solicit the holders of those shares to change their vote in favor of the Issuance Proposal or the Director Participation Proposal, as applicable.

Vote Required

If a quorum is present and voting, the affirmative vote of a majority of the voting securities present, either in attendance virtually or represented by proxy, at the Special Meeting and entitled to vote on the Adjournment Proposal is required to approve such proposal. An abstention will have the effect of a vote against the Adjournment Proposal.

Board of Directors Recommendation

The Board recommends that the stockholders vote “FOR” the Adjournment Proposal.

SECURITY OWNERSHIP OF CERTAIN BENEFICIAL OWNERS AND MANAGEMENT AND RELATED STOCKHOLDERS’ MATTERS

As of the Record Date, we had one class of voting stock outstanding: Common Stock. The following table sets forth information concerning shares of our Common Stock beneficially owned as of the Record Date (unless otherwise noted), by:

|

● |

each person or entity known by us to be the beneficial owner of 5% or more of the outstanding shares of Common Stock; |

|

● |

each person currently serving as director; and |

|

● |

(i) each of our principal executive officers during the year ended December 31, 2022, (ii) the two most highly compensated executive officers other than our principal executive officer during that year, and (iii) up to two additional executive officers for whom disclosure would have been provided but for the fact that each such officer was not serving as an executive officer at the end of that year (collectively, our “Named Executive Officers”). |

The share amounts in the table below are based on shares of Common Stock issued and outstanding as of the Record Date. To our knowledge, except as otherwise indicated in the footnotes below, each person or entity has sole voting and investment power with respect to the shares of Common Stock set forth opposite such person’s or entity’s name. Beneficial ownership is determined in accordance with the rules of the SEC and generally includes voting or investment power with respect to the securities.

For the purpose of calculating the number of shares beneficially owned by a stockholder and the percentage ownership of that stockholder, shares of Common Stock subject to options that are currently exercisable or exercisable within sixty (60) days of the Record Date by that stockholder are deemed outstanding.

|

Common Stock |

|||||

|

Name and Address of Beneficial Owner (1) |

Amount and |

Percent of |

|||

|

Named Executive Officers and Directors: |

|||||

|

Scot Cohen |

5,095,511 |

(2) | |||

|

Kevin Mullins |

365,096 |

(3) | |||

|

Chris DeAlmeida |

214,934 |

(4) | |||

|

Michael Parris |

277,528 |

(5) | |||

|

Kevin Sherman |

93,336 |

(6) | |||

|

Wayne R. Walker |

137,885 |

(7) | |||

|

Bruce Bernstein |

38,183 |

(8) | |||

|

Marc Savas |

38,083 |

(9) | |||

|

TJ Kennedy |

262,430 |

(10) | |||

|

Glenn Hickman |

166,605 |

(11) | |||

|

LW Varner, Jr. |

21,186 |

(12) | |||

|

Thomas P. Smith |

- |

||||

|

All directors and executive officers as a group (8 persons) |

6,260,556 |

||||

|

5% Shareholders |

|||||

|

Elwood G. Norris |

6,472,457 |

(13) | |||

* less than 1%

|

(1) |

Except as otherwise indicated, the business address for these beneficial owners is c/o the Company, 1817 W 4th Street, Tempe, Arizona 85281. |

|

(2) |

Includes 4,985,511 shares held by Mr. Cohen and 100,000 shares underlying stock options. |

|

(3) |

Includes 246,151 shares held by Mr. Mullins and 118,915 shares underlying stock options. |

|

(4) |

Includes 156,601 shares held by Mr. DeAlmeida and 58,333 shares underlying stock options. |

|

(5) |

Includes 277,528 shares held by Mr. Parris and 0 shares underlying stock options. |

| (6) |

Includes 63,336 shares held by Mr. Sherman and 30,000 shares underlying stock options. |

| (7) |

Includes 102,885 shares held by Mr. Walker directly and 35,000 shares underlying stock options. |

| (8) |

Includes 8,183 shares held by Mr. Bruce Bernstein directly and 30,000 shares underlying stock options. |

| (9) |

Includes 8,083 shares held by Mr. Savas directly and 30,000 shares underlying stock options held by Mr. Marc Savas. |

| (10) |

Includes 232,430 shares held by Mr. Kennedy directly and 30,000 shares underlying stock options. Mr. Kennedy served as the Company’s Chief Executive Officer from April 18, 2022, to April 14, 2023. |

| (11) |

Includes 96,605 shares held by Mr. Hickman and 70,000 shares underlying stock options. Mr. Hickmann served as the Company’s Chief Operating Officer from July 2021 to April 17, 2023. |

| (12) |

Includes 21,186 shares held by Mr. Varner directly. Mr. Varner served as the Company’s Interim Chief Executive Officer from January 24, 2022, until his resignation effective April 18, 2022 |

|

(13) |

Includes 1,000,904 shares held by Mr. Elwood Norris directly and 5,471,553 shares beneficially owned by Mr. Elwood Norris through his family trust. |

WHERE YOU CAN FIND MORE INFORMATION

We file annual, quarterly and special reports, proxy statements and other information with the SEC. The periodic reports and other information we have filed with the SEC, may be inspected and copied at the SEC’s Public Reference Room at 100 F Street, N.E., Washington DC 20549. You may obtain information as to the operation of the Public Reference Room by calling the SEC at +1 (800) SEC‑0330. The SEC also maintains a Web site that contains reports, proxy statements and other information about issuers, like the Company, who file electronically with the SEC. The address of that site is www.sec.gov. Copies of these documents may also be obtained by writing our secretary at the address specified above.

If you would like additional copies of this Proxy Statement, or if you have questions about the Proposals to be presented at the Special Meeting, please contact the Company’s proxy solicitor, Morrow Sodali, at:

Morrow Sodali LLC

470 West Avenue

Stamford, CT 06902

Telephone: +1 (800) 662-5200

(banks and brokers can call collect at +1 (203) 658-9400)

Toll-free at +1 (800) 662-5200

WRAP@investor.morrowsodali.com

STOCKHOLDER PROPOSALS FOR THE

2024 ANNUAL MEETING OF STOCKHOLDERS

Pursuant to Rule 14a-8 under the Exchange Act, a stockholder who intends to present a proposal at our next annual meeting of stockholders (the “2024 Annual Meeting”) and who wishes the proposal to be included in the proxy statement and form of proxy for that meeting must submit the proposal in writing no later than the close of business on January 19, 2024, or 120 calendar days before the date on which the proxy statement was released to stockholders in connection with the previous year’s annual meeting, to us at our executive offices. However, pursuant to Rule 14a‑8, if the 2024 Annual Meeting is held on a date that is before May 29, 2024 or after July 28, 2024, then a stockholder proposal submitted for inclusion in our proxy statement and form of proxy for the 2024 Annual Meeting must be received by us a reasonable time before we begin to print and mail our proxy statement for the 2024 Annual Meeting.

Stockholders wishing to submit proposals to be presented directly at the 2024 Annual Meeting instead of by inclusion in next year’s proxy statement must follow the notice procedures set forth in our Bylaws. Such proposals will be ineligible for presentation at the meeting unless the stockholder gives timely notice of the proposal in writing to the Corporate Secretary of the Company at the executive offices of the Company. To be timely, the Company must have received the stockholder’s notice not less than 90 days nor more than 120 days in advance of the date the proxy statement was released to stockholders in connection with the previous year’s annual meeting of stockholders. However, if the date of the 2024 Annual Meeting of Stockholders is changed by more than 30 days from the date of this year’s Annual Meeting, the Company must receive the stockholder’s notice no later than the close of business on (i) the 90th day prior to such annual meeting and (ii) the 10th day following the day on which public announcement of the date of such meeting is first made.

For the 2024 Annual Meeting, we will be required pursuant to Rule 14a-19 under the Exchange Act to include on our proxy card all nominees for director for whom we have received notice under the rule, which must be received no later than 60 calendar days prior to the anniversary of this year’s annual meeting. For any such director nominee to be included on our proxy card for the 2024 Annual Meeting, notice must be received no later than April 29, 2024. Please note that the notice requirement under Rule 14a-19 is in addition to the applicable notice requirements under the advance notice provisions of our Bylaws described above.

We reserve the right to reject, rule out of order, or take other appropriate action with respect to any proposal that does not comply with these and all other applicable requirements.

HOUSEHOLDING OF PROXY MATERIALS

The SEC has adopted rules that permit companies and intermediaries (e.g., brokers) to satisfy the delivery requirements for proxy statements with respect to two or more stockholders sharing the same address by delivering a single proxy statement addressed to those stockholders. This process, which is commonly referred to as “householding,” potentially means extra convenience for stockholders and cost savings for companies.

A number of brokers with account holders who are stockholders of the Company will be “householding” the Company’s proxy materials. A single set of the Company’s proxy materials will be delivered to multiple stockholders sharing an address unless contrary instructions have been received from the affected stockholders. Once you have received notice from your broker that they will be “householding” communications to your address, “householding” will continue until you are notified otherwise or until you revoke your consent. If, at any time, you no longer wish to participate in “householding” and would prefer to receive a separate set of the Company’s proxy materials (or if stockholders sharing an address and currently receiving separate sets of the Company’s proxy materials would prefer to receive a single set), please notify your broker or direct a written request to Morrow Sodali at 333 Ludlow Street, 5th Floor, South Tower, Stamford, CT 06902, or contact them at +1 (800) 662-5200. The Company undertakes to deliver promptly, upon any such oral or written request, a separate copy of its proxy materials to a stockholder at a shared address to which a single copy of these documents was delivered. Stockholders who currently receive multiple copies of the Company’s proxy materials at their address and would like to request “householding” of their communications should contact their broker, bank or other nominee, or contact the Company at the above address or phone number.

OTHER MATTERS