As

filed with the Securities and Exchange Commission on April 17,

2017

Registration

No. 333-__________

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington

D.C. 20549

REGISTRATION STATEMENT ON

FORM S-1

UNDER THE SECURITIES ACT OF 1933

WRAP TECHNOLOGIES,

INC.

(Exact

name or Registrant as specified in its charter)

|

Delaware

|

|

3480

|

|

98-0551945

|

|

(State

or Other Jurisdiction of Incorporation or

Organization)

|

|

(Primary Standard

Industrial Classification Number)

|

|

(IRS

Employer Identification Number)

|

|

4620

Arville Street, Suite E

Las

Vegas, Nevada 89103

(800)

583-2652

|

|

(Address,

including zip code, and telephone number, including area code, of

registrant’s principal executive offices)

|

James

A. Barnes

President

and Chief Financial Officer

Wrap

Technologies, Inc.

4620

Arville Street, Suite E

Las

Vegas, Nevada 89103

(800) 583-2652

(Name,

address including zip code, and telephone number, including area

code, of agent for service)

Copies of all communications to:

|

Daniel W. Rumsey, Esq.

Jessica R. Sudweeks, Esq.

Disclosure Law Group,

|

|

a Professional Corporation

|

|

600 West Broadway, Suite 700

|

|

San Diego, California 92101

|

|

Tel: (619) 272-7050

|

|

Fax: (619) 330-2101

|

APPROXIMATE DATE OF COMMENCEMENT OF PROPOSED SALE TO THE

PUBLIC:

As

soon as practicable after the effective date of the Registration

Statement

If any

of the securities being registered on this form are to be offered

on a delayed or continuous basis pursuant to Rule 415 under

the Securities Act of 1933, check the following

box. [X]

If this

form is filed to register additional securities for an offering

pursuant to Rule 462(b) under the Securities Act, check the

following box and list the Securities Act registration statement

number of the earlier effective registration statement for the same

offering. [ ]

If this

form is a post-effective amendment filed pursuant to

Rule 462(c) under the Securities Act, check the following box

and list the Securities Act registration statement number of the

earlier effective registration statement for the same

offering. [ ]

If this

form is a post-effective amendment filed pursuant to

Rule 462(d) under the Securities Act, check the following box

and list the Securities Act registration statement number of the

earlier effective registration statement for the same

offering. [ ]

Indicated

by check mark whether the Registrant is large accelerated filer, an

accelerated filer, a non-accelerated filer or a small reporting

company as defined in Rule 12b-2 of the Securities Exchange Act of

1934. (Check one unless a smaller reporting

company.)

|

Large

Accelerated Filer [ ]

|

|

Accelerated

Filer [ ]

|

|

|

|

|

|

Non-accelerated

Filer [ ]

|

|

Smaller

Reporting Company [X]

|

CALCULATION OF REGISTRATION FEE

Title

Of Each Class Of

Securities

To Be Registered

|

Amount to be

Registered

(1)(2)

|

Proposed

Maximum

Offering

Price

Per

Share (1)

|

Proposed

Maximum

Aggregate

Offering

Price (2)

|

Amount

of

Registration

Fee

(1)

|

|

Common Stock, par

value, $0.0001 per share $

|

|

|

$

|

$

|

|

Shares of common

stock to be distributed as a dividend to shareholders of Petro

River Oil Corp.

|

400,838

|

|

|

|

|

Total

|

|

|

$4,000,000

|

$463.60

|

(1)

Estimated solely

for purposes of calculating the registration fee pursuant to Rule

457(o) of the Securities Act of 1933, as amended (the

“Securities Act

”).

(2)

Pursuant to Rule

416 under the Securities Act, there is also being registered such

indeterminable additional securities as may be issued to prevent

dilution as a result of stock splits, stock dividends or similar

transactions.

(3)

Estimated solely for the purpose of calculating the registration

fee pursuant to Rule 457(g) under the Securities Act.

The Registrant hereby amends this Registration Statement on such

date or dates as may be necessary to delay its effective date until

the Registrant shall file an amendment which specifically states

that this Registration Statement shall thereafter become effective

in accordance with Section 8(a) of the Securities Act of 1933 or

until the Registration Statement shall become effective on such

date as the Securities and Exchange Commission, acting pursuant to

said Section 8(a), may determine.

EXPLANATORY NOTE

This registration statement contains two forms of

prospectus. One form of prospectus, which we refer to as the

primary public offering prospectus, is to be used in connection

with a public offering of up to _________ shares of our common

stock. The other form of prospectus, which we refer to as the

resale prospectus, is to be used in connection with the

distribution by Petro River Oil Corp. of 400,838 shares of our

common stock upon the effectiveness of the registration statement

of which such prospectus forms a part. The primary public offering

prospectus and the resale prospectus will be identical in all

respects except for the alternate pages for the resale prospectus

included herein, which are labeled “Alternate Page for Resale

Prospectus.”

The information in this preliminary prospectus is not complete and

may be changed. These securities may not be sold until the

registration statement filed with Securities and Exchange

Commission is effective. This prospectus is not an offer to sell

these securities and is not soliciting an offer to buy these

securities in any state or other jurisdiction where the offer or

sale is not permitted.

|

Prospectus

|

|

____________, 2017

|

_________ shares of Common Stock

Wrap Technologies, Inc. (the “Company”) is offering up to ________ shares of

common stock, par value of $0.0001(“Common

Stock”)

(“Shares”). There is currently no public market for

our Common Stock. In addition:

1.

This

is a "self-underwritten" public offering, with no minimum purchase

requirement;

2.

The

Company is not using an underwriter for this offering;

and

3.

There

is no arrangement to place the proceeds from this offering in an

escrow, trust or similar account.

The offering will commence on the effective date of this prospectus

and will terminate on or before _______, 2017. We will not

extend the offering beyond the termination date. In our sole

discretion, we may terminate the offering before all of Shares are

sold.

We will sell the Shares ourselves, on a best efforts basis for a

period of up to twelve months from the effective date of this

prospectus. We do not plan to use underwriters or pay any

commissions. There is no minimum number of Shares we must

sell. As such, no funds raised from the sale of Shares will

go into escrow, trust or another similar arrangement. Because

there is no minimum to our offering, if we fail to raise sufficient

capital to execute our business plan, investors could lose their

entire investment and will not be entitled to a

refund.

There is currently no established public trading market for our

Common Stock and an active trading market in our Common Stock may

not develop or, if it is developed, may not be sustained. We

anticipate having a market maker file an application with the

Financial Industry Regulatory Authority (“FINRA”) on our behalf so that our Common Stock

may be quoted on an inter-dealer quotation system such as the OTC

Markets or the Nasdaq OMX; however, to date, we do not have a

market maker who has agreed to file an

application.

Due to the uncertainty of our ability to meet our current operating

and capital expenses, our independent auditors have included a

going concern opinion in their report on our audited financial

statements for the period ending December 31, 2016. The notes to

our financial statements contain additional disclosure describing

the circumstances leading to the issuance of a going concern

opinion by our auditors.

An investment in

our securities involves a high degree of risk. We urge you to read carefully

the “Risk Factors” section beginning on page 5 where we

describe specific risks associated with an investment in Wrap

Technologies, Inc. and our securities before you make your

investment decision. You should purchase our securities only if you

can afford a complete loss of your purchase.

Neither the Securities and Exchange Commission nor any state

securities commission has approved or disapproved these securities,

or determined if this prospectus is truthful or

complete. Any representation to the contrary is a

criminal offense.

|

|

|

|

|

Net

Proceeds

to

Us if 25% of

Shares

Sold

(_______

Shares) ($)

|

Net

Proceeds

to

Us if 50% of

Shares

Sold

(________

Shares) ($)

|

Net

Proceeds

to

Us if 75% of

Shares

Sold

(________

Shares) ($)

|

Net

Proceeds

to

Us if 100% of

Shares

Sold

(________

Shares) ($)

|

|

|

|

|

|

|

|

|

|

|

Per

Share

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Total (2)

|

|

|

(3)

|

|

|

|

|

(1)

The total amount of offering expenses is

estimated to be $50,000. See “ Use of

Proceeds” for

additional information.

(2)

There are no underwriting discounts or commissions being paid in

connection with this offering. Our officers and directors will not

receive any compensation for their role in offering or selling the

Shares in this offering.

(3)

Net Proceeds includes the deduction of offering expenses estimated

to be $50,000.00.

The information in this prospectus is not complete and may be

changed. The Company may not sell the Shares until the registration

statement filed with the Securities and Exchange Commission (the

“SEC”) is effective. This prospectus is not an

offer to sell the Shares nor is it a solicitation of an offer to

buy the Shares in any state where the offer or sale is not

permitted.

We are an “emerging growth company” under the Federal

securities laws and will therefore be subject to reduced public

company reporting requirements. Investment in the Shares offered by

this prospectus involves a high degree of risk. You may lose your

entire investment.

The date of this Prospectus is __, 2017

|

|

|

|

|

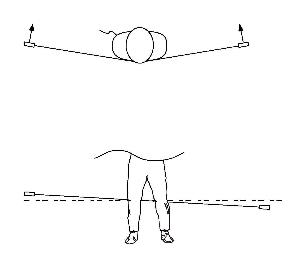

Generation 2

Pre-Production Functioning Version of BolaWrap™ Model

100

|

|

Artist Rendering of

Planned Production Version of the BolaWrap 100

|

|

|

Illustration of

Hand-Held Size of BolaWrap 100

|

TABLE OF CONTENTS

|

Descriptive

Title

|

|

Page

|

|

|

|

|

|

PROSPECTUS

SUMMARY

|

|

2

|

|

RISK

FACTORS

|

|

5

|

|

JUMPSTART

OUR BUSINESS STARTUPS ACT

|

|

11

|

|

SPECIAL

NOTE ABOUT FORWARD-LOOKING STATEMENTS

|

|

12

|

|

USE OF

PROCEEDS

|

|

14

|

|

MARKET

PRICE OF COMMON STOCK AND RELATED

MATTERS

|

|

15

|

|

ABSENCE

OF PUBLIC MARKET AND DIVIDEND POLICY

|

|

15

|

|

CAPITALIZATION

AND FINANCING

|

|

16

|

|

DILUTION

|

|

17

|

|

MANAGEMENT’S

DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND RESULTS OF

OPERATIONS

|

|

18

|

|

BUSINESS

|

|

23

|

|

MANAGEMENT

|

|

31

|

|

EXECUTIVE

COMPENSATION

|

|

32

|

|

SECURITY

OWNERSHIP BY CERTAIN BENEFICIAL OWNERS AND MANAGEMENT

|

|

33

|

|

CERTAIN

RELATIONSHIPS AND RELATED PARTY TRANSACTIONS

|

|

34

|

|

DESCRIPTION

OF OUR SECURITIES

|

|

35

|

|

SHARES

ELIGIBLE FOR FUTURE SALES

|

|

37

|

|

PLAN OF

DISTRIBUTION

|

|

38

|

|

DETERMINATION

OF OFFERING PRICE

|

|

38

|

|

LEGAL

MATTERS

|

|

39

|

|

EXPERTS

|

|

39

|

|

WHERE

YOU CAN FIND MORE INFORMATION

|

|

39

|

|

INDEX

TO FINANCIAL STATEMENTS

|

|

F-1

|

|

|

|

|

|

|

ABOUT THIS PROSPECTUS

You

should rely only on the information contained in or incorporated by

reference into this prospectus and any prospectus supplement or

free writing prospectus authorized by us. To the extent the

information contained in this prospectus differs or varies from the

information contained in any document filed prior to the date of

this prospectus and incorporated by reference, the information in

this prospectus will control. We have not authorized any other

person to provide you with different information. If anyone

provides you with different or inconsistent information, you should

not rely on it. The information in this prospectus is accurate only

as of the date it is presented. You should read this prospectus,

and any prospectus supplement or free writing prospectus that we

have authorized for use in connection with this offering, in their

entirety before investing in our securities.

We

are offering to sell, and seeking offers to buy, the securities

offered by this prospectus only in jurisdictions where offers and

sales are permitted. The distribution of this prospectus and the

offering of the securities offered by this prospectus in certain

jurisdictions may be restricted by law. This prospectus does not

constitute, and may not be used in connection with, an offer to

sell, or a solicitation of an offer to buy, any securities offered

by this prospectus in any jurisdiction in which it is unlawful for

such person to make such an offer or solicitation.

Unless the context

otherwise requires, the words “Wrap

Technologies, Inc.,”

“Wrap

Technologies,”

“Wrap

Tech,”

“we,”

“the

Company,”

“us”

and “our”

refer to Wrap Technologies, Inc., a Delaware

corporation.

|

|

|

|

|

|

|

|

|

|

|

|

PROSPECTUS

SUMMARY

The following is a summary of the material terms of the offering

described in this prospectus. This summary is qualified

in its entirety by the more detailed information set forth

elsewhere in this prospectus, including our financial statements

and notes thereto. We urge you to read carefully the entire

prospectus, especially the risks discussed under “Risk

Factors” and our financial statements.

Our Company

We are a development stage security technology company focused on

delivering innovative solutions to customers, primarily law

enforcement and security personnel. We plan to introduce our first

product, the BolaWrap™ 100, during 2017.

The

BolaWrap™ 100 is a hand-held remote restraint device that

discharges an eight-foot bola style Kevlar® tether to

entangle an individual at a range of 10-25 feet. Inspired by law

enforcement professionals, the small but powerful BolaWrap™

100 assists law enforcement to safely and effectively control

encounters. Law enforcement agencies authorize a continuum of force

options:

●

physical control

– soft techniques of grabs and holds progressing to hard

techniques such as punches and kicks;

●

less-lethal weapons

- batons, pepper spray, impact munitions and CEWs (conducted

electrical weapons); and

●

lethal force

– deadly weapons such as firearms.

BolaWrap™

100 offers law enforcement a new tool to remotely and temporarily

control an individual or impede flight by targeting and wrapping an

individual’s legs.

The

small, light but rugged BolaWrap™ 100 is designed for weak

hand operation to provide remote restraint while other use of force

continuum options remain open. The design offers wide latitude of

accuracy to engage and restrain targeted legs of a subject. Quick

eject and rapid reload of bola cartridges allows one device to be

reused in a single encounter or in multiple

encounters.

There

are limited effective options for remote engagement so when verbal

commands go unheeded law enforcement is faced with either hands on

engagement or other potentially injurious less lethal or lethal

force. We believe our new tool is essential to meet modern policing

requirements with individuals frequently not responding to verbal

commands and to assuage public demands for less lethal policing. We

believe our device minimizes the need to employ other uses of force

including combat and less-lethal weapons. Many less-lethal weapons

rely on “pain compliance” often escalating encounters

with potential for injury.

We intend to commercialize the BolaWrap™ 100 by initially

targeting sales to the approximate 18,000 United States law

enforcement agencies with approximately 765,000 full time officers

and to the United States Border Patrol with 21,000 border patrol

agents. Thereafter we intend to target law enforcement agencies and

security personnel worldwide.

Our Strengths and Challenges

We believe the following competitive strengths position us for

future operating success, growth and ultimately,

profitability:

●

We

are pioneering the BolaWrap™ 100 device. There has been no

restraint or less-lethal product broadly accepted by law

enforcement since the 1994 introduction of the Taser CEW (conducted

electrical weapon also referred to as CED, or conducted energy

device);

●

We

believe we are creating important intellectual property around our

product;

|

|

|

|

|

|

|

|

|

|

|

|

●

Our

initial focus on BolaWrap™ 100 affords us great sales and

marketing flexibility to respond to and meet customer requirements;

and

●

Our

management team has developed a strong technical base in this

technology and is experienced in innovating and bringing products

to market. We plan to develop a line of BolaWrap™

entanglement products and develop additional security technology

products.

We expect to face significant challenges and uncertainties in

executing our business plan, including but not limited to the

following:

●

We

need to rapidly, profitably and successfully commercialize the

BolaWrap™ 100 product and develop additional versions of the

technology, and develop new technologies and products;

●

Our

products must meet the needs of customers and we need to generate

sufficient revenues to sustain profitable operations;

●

We

have limited personnel and financial resources to develop required

business functions, including development, production, marketing,

sales, distribution, service and administration;

●

We

will be required to obtain additional financing until we are able

to produce sufficient revenues and profitability to sustain future

operations; and

●

We face the uncertainties and risks facing any

development stage company, including but not limited to, the risk

factors described in the section entitled

“Risk

Factors” starting on page

5.

Our Strategy

Our goal is to realize the potential of a new remote restraint

device targeting law enforcement and security personnel. We aim to

produce a product line starting with the BolaWrap™ 100 to

meet the requirements of these customers. The key elements of our

strategy include:

●

Produce

a product line meeting customer requirements as a new tool to aid

in the retention of individuals to make encounters more effective

and less dangerous to law enforcement and the public;

●

Develop

a robust production and supply system to support our customers;

and

●

Develop

relationships with customers requiring large numbers of products,

mainly larger city police departments and large

agencies.

We also plan to explore markets for use by security and related

personnel and develop international distribution.

Corporate Information

Our

principal executive offices are located at 4620 Arville Street,

Suite E, Las Vegas, Nevada 89104, and our telephone number is

(800) 583-2652. Our website addresses are

www.wraptechnologies.com and www.bolawrap.com. Information

contained on, or that can be accessed through, our websites, is not

incorporated by reference into this prospectus, and you should not

consider information on our website to be part of this

prospectus.

|

|

|

|

|

|

|

|

|

|

|

|

The Offering

Securities we are

offering

______ shares of Common

Stock

Common Stock outstanding after this

offering

__________ shares

of Common Stock.

Use of proceeds

We estimate that

the maximum net proceeds to us from this offering, after deducting

the estimated offering expenses payable by us, and based on the

assumed combined public offering price of $____ per Share will be

approximately $____ million. We intend to use the net proceeds of

this offering principally for research, development and tooling,

and sales and marketing. See “Use of Proceeds” for a more

complete description of the intended use of proceeds from this

offering.

|

|

|

|

|

|

RISK FACTORS

In addition to the information contained elsewhere in this

prospectus, you should consider carefully the following risk

factors related to Wrap Tech. If any of the risks described below

actually occur, our business, financial condition, results of

operations, cash flows and stock price could be materially

adversely affected. This prospectus also contains forward-looking

statements that involve risks and uncertainties. Our actual results

could differ materially from those anticipated in these

forward-looking statements as a result of certain factors,

including the risks faced by us described below and elsewhere in

this prospectus. See “Special Note About Forward-Looking

Statements” on page

12.

Risk Factors Relating to Our Business

We have a history of operating losses, expect additional losses and

may not achieve or sustain profitability.

We have a history of operating losses and expect additional losses

as we introduce our new product line and until we achieve revenues

and resulting margins to offset our operating costs. Our net

loss for the period from inception (March 2, 2016) to December 31,

2016 was $234,356 and for the three months ended March 31, 2017 was

$201,755. Our ability to achieve future profitability is dependent

on a variety of factors, many outside our control. Failure to

achieve profitability or sustain profitability, if achieved, may

require us to continue to raise additional financing which could

have a material negative impact on the market value of our Common

Stock.

Our independent auditors have expressed substantial doubt about our

ability to continue as a going concern.

In their audit opinion issued in connection with our balance sheet

as of December 31, 2016 and our related statements of operations,

changes in owners equity and cash flows for the period then ended,

our independent registered public accounting firm stated that our

net losses and our requirement to secure additional financing

raised substantial doubt about our ability to continue as a going

concern. We have prepared our financial statements on a

going concern basis which contemplates the realization of assets

and the satisfaction of liabilities in the normal course of

business for the foreseeable future. Our financial statements do

not include any adjustments that would be necessary should we be

unable to continue as a going concern and, therefore, be required

to liquidate our assets and discharge our liabilities in other than

the normal course of business, and at amounts different from those

reflected in our financial statements. If we are unable

to continue as a going concern, our shareholders may lose a

substantial portion or all of their investment.

We need additional capital to execute our business plan, and

raising additional capital, if possible, by issuing additional

equity securities may cause dilution to existing shareholders. In

addition, raising additional capital by issuing additional debt

financing may restrict our operations.

While

we may be able to generate some funds from product sales, existing

working capital will not be sufficient due to product introduction

costs, operating losses and other factors. Principal factors

affecting the availability of internally generated funds

include:

●

failure of product

sales to meet planned projections;

●

working capital

requirements to support business growth;

●

our ability to

control spending; and

●

acceptance of our

product in planned markets.

In the

event we are required to raise additional capital through the

issuance of equity or convertible debt securities, the percentage

ownership of our shareholders could be diluted significantly, and

these newly issued securities may have rights, preferences or

privileges senior to those of our existing shareholders. In

addition, the issuance of any equity securities could be at a

discount to the market price.

If we

incur debt financing, the payment of principal and interest on such

indebtedness may limit funds available for our business activities,

and we could be subject to covenants that restrict our ability to

operate our business and make distributions to our

shareholders. These restrictive covenants may include

limitations on additional borrowing and specific restrictions on

the use of our assets, as well as prohibitions on our ability to

create liens, pay dividends, redeem stock or make

investments. There is no assurance that any equity or debt

financing transaction will be available on acceptable terms, or at

all.

Our principal product remains under development, and has not yet

been produced in any commercial quantities. We we may incur

significant and unpredictable warranty costs as our products are

introduced and produced.

Our principal product remains under development, and has not been

formally introduced into the marketplace. No assurance can be

provided that we can successfully produce commercial quantities of

our principal product. We generally expect to warrant our products

to be free from defects in materials and workmanship for a period

of up to one year from the date of purchase. We may incur

substantial and unpredictable warranty costs from post-production

product or component failures. Future warranty costs could further

adversely affect our financial position, results of operations and

business prospects.

We are materially dependent on the acceptance of our product by the

law enforcement market. If law enforcement agencies do not purchase

our product, our revenues will be adversely affected and we may not

be able to expand into other markets, or otherwise continue as a

going concern.

A

substantial number of law enforcement agencies may not purchase our

remote restraint product. In addition, if our product is not widely

accepted by the law enforcement market, we may not be able to

expand sales of our product into other markets. Law enforcement

agencies may be influenced by claims or perceptions that our

product is not effective or may be used in an abusive manner. Sales

of our product to these agencies may be delayed or limited by such

claims or perceptions.

We will be dependent on sales of the BolaWrap™ 100 product,

and if this product is not widely accepted, our growth prospects

will be diminished.

We

expect to depend on sales of the BolaWrap™ 100 and related

cartridges for the foreseeable future. A lack of demand for this

product, or its failure to achieve broad market acceptance, would

significantly harm our growth prospects, operating results and

financial condition.

If we are unable to manage our projected growth, our growth

prospects may be limited and our future profitability may be

adversely affected.

We

intend to expand our sales and marketing programs and our

manufacturing capability. Rapid expansion may strain our

managerial, financial and other resources. If we are unable to

manage our growth, our business, operating results and financial

condition could be adversely affected. Our systems, procedures,

controls and management resources also may not be adequate to

support our future operations. We will need to continually improve

our operational, financial and other internal systems to manage our

growth effectively, and any failure to do so may lead to

inefficiencies and redundancies, and result in reduced growth

prospects and profitability.

We may face personal injury and other liability claims that harm

our reputation and adversely affect our sales and financial

condition.

Our

product is intended to be used in confrontations that could result

in injury to those involved, whether or not involving our product.

Our product may cause or be associated with such injuries. A person

injured in a confrontation or otherwise in connection with the use

of our product may bring legal action against us to recover damages

on the basis of theories including personal injury, wrongful death,

negligent design, dangerous product or inadequate warning. We may

also be subject to lawsuits involving allegations of misuse of our

product. If successful, personal injury, misuse and other claims

could have a material adverse effect on our operating results and

financial condition. Although we carry product liability insurance,

significant litigation could also result in a diversion of

management’s attention and resources, negative publicity and

an award of monetary damages in excess of our insurance

coverage.

Our future success is dependent on our ability to expand sales

through direct sales or distributors, and our inability to grow our

sales force or recruit new distributors would negatively affect our

sales.

Our

distribution strategy is to pursue sales through multiple channels

with an emphasis on direct sales and, in the future, independent

distributors. Our inability to recruit and retain sales personnel

and police equipment distributors who can successfully sell our

products could adversely affect our sales. If we do not

competitively price our products, meet the requirements of any

future distributors or end-users, provide adequate marketing

support, or comply with the terms of any distribution arrangements,

such distributors may fail to aggressively market our product or

may terminate their relationships with us. These developments would

likely have a material adverse effect on our sales. Should we

employ distributors our reliance on the sales of our products by

others also makes it more difficult to predict our revenues, cash

flow and operating results.

We expect to expend significant resources to generate sales due to

our lengthy sales cycle, and such efforts may not result in sales

or revenue.

Generally,

law enforcement agencies consider a wide range of issues before

committing to purchase a product, including product benefits,

training costs, the cost to use our product in addition to, or in

place of other use of force products, product reliability and

budget constraints. The length of our sales cycle may range from

30 days to a year or more. We may incur substantial selling

costs and expend significant effort in connection with the

evaluation of our product by potential customers before they place

an order. If these potential customers do not purchase our product,

we will have expended significant resources without corresponding

revenue.

Most of our intended end-users are subject to budgetary and

political constraints that may delay or prevent sales.

Most of

our intended end-user customers are government agencies. These

agencies often do not set their own budgets and therefore have

little control over the amount of money they can spend. In

addition, these agencies experience political pressure that may

dictate the manner in which they spend money. As a result, even if

an agency wants to acquire our product, it may be unable to

purchase due to budgetary or political constraints. Some government

agency orders may also be canceled or substantially delayed due to

budgetary, political or other scheduling delays which frequently

occur in connection with the acquisition of products by such

agencies.

Government regulation of our products may adversely affect

sales.

Our

device may be a firearm regulated by the Bureau of Alcohol, Tobacco

and Firearms involving substantial regulatory compliance. Our

device may also face state restrictions especially regarding sales

to security agencies. Our product sales may be significantly

affected by federal, state and local regulation. Failure to comply

with regulations could also result in the impostion of fines,

penalties and other actions that could adversely impact our

financial position, cash flows and operating results.

Our

product may also be controlled by the United States Department of

Commerce (“DOC”), for export directly from

the United States. Consequently, we may need to obtain an export

license from the DOC for the export of our product from the United

States other than to Canada. Compliance with or changes in U.S.

export regulations could significantly and adversely affect any

future international sales.

Certain

foreign jurisdictions may restrict the sale of our device limiting

our international sales opportunities.

If we are unable to protect our intellectual property, we may lose

a competitive advantage or incur substantial litigation costs to

protect our rights.

Our

future success depends in part upon our proprietary technology. Our

protective measures, including pending patents, trademarks and

trade secret laws, may prove inadequate to protect our proprietary

rights. There can be no assurance we will be granted any patent

rights from pending patents. The scope of any possible patent

rights may not prevent others from developing and selling competing

products. The validity and breadth of claims covered in any

possible patents involve complex legal and factual questions, and

the resolution of such claims may be highly uncertain, lengthy, and

expensive. In addition, any patents, if granted, may be held

invalid upon challenge, or others may claim rights in or ownership

of our patents.

Our competitive position will be seriously damaged if our products

are found to infringe on the intellectual property rights of

others.

Other companies and our competitors may currently own or obtain

patents or other proprietary rights that might prevent, limit or

interfere with our ability to make, use or sell our

products. Any intellectual property infringement claims

against us, with or without merit, could be costly and

time-consuming to defend and divert our management’s

attention from our business. In the

event of a successful claim of infringement against us and our

failure or inability to license the infringed technology, our

business and operating results could be adversely affected. Any

litigation or claims, whether or not valid, could result in

substantial costs and diversion of our resources. An adverse result

from intellectual property litigation could force us to do one or

more of the following:

●

cease

selling, incorporating or using products or services that

incorporate the challenged intellectual property;

●

obtain

a license from the holder of the infringed intellectual property

right, which license may not be available on reasonable terms, if

at all; and

●

redesign

products or services that incorporate the disputed

technology.

If we are forced to take any of the foregoing actions, we could

face substantial costs and shipment delays and our business could

be seriously harmed. Although we carry general liability insurance,

our insurance may not cover potential claims of this type or be

adequate to indemnify us for all liability that may be

imposed.

In addition, it is possible that our customers may seek indemnity

from us in the event that our products are found or alleged to

infringe the intellectual property rights of others. Any such claim

for indemnity could result in substantial expenses to us that could

harm our operating results.

Competition in the law enforcement market could reduce our sales

and prevent us from achieving profitability.

The law

enforcement market is highly competitive. We face competition from

numerous larger, better capitalized and more widely known companies

that make restraint devices, less-lethal weapons and other law

enforcement products. Increased competition could result in greater

pricing pressure, lower gross margins and reduced sales, and

prevent us from achieving profitability.

We cannot predict our future operating results. Our quarterly and

annual results will likely be subject to fluctuations caused by

many factors, any of which could result in our failure to achieve

our expectations.

We currently expect our BolaWrap™ 100 product will be the

source of all of any future revenues. Revenues, if any, are

expected to vary significantly due to a number of factors. Many of

these factors are beyond our control. Any one or more of these

factors, including those listed below, could cause us to fail to

achieve our revenue expectations. These factors

include:

●

our

ability to develop and supply product to customers;

●

market

acceptance of, and changes in demand for, our

products;

●

gains

or losses of significant customers, distributors or strategic

relationships;

●

unpredictable

volume and timing of customer orders;

●

the

availability, pricing and timeliness of delivery of components for

our products;

●

fluctuations

in the availability of manufacturing capacity or manufacturing

yields and related manufacturing costs;

●

timing

of new technological advances, product announcements or

introductions by us and by our competitors;

●

unpredictable

warranty costs associated with our product;

●

budgetary

cycles and order delays by customers or production delays by us or

our suppliers;

●

regulatory

changes affecting the marketability of our products;

●

general

economic conditions that could affect the timing of customer orders

and capital spending and result in order cancellations or

rescheduling; and

●

general

political conditions in this country and in various other parts of

the world that could affect spending for the products that we

intend to offer.

Some or all of these factors could adversely affect demand for our

products and, therefore, adversely affect our future operating

results. As a result of these and other factors, we believe

that period-to-period comparisons of our operating results may not

be meaningful in the near term and accordingly you should not rely

upon our performance in a particular period as indicative of our

performance in any future period.

Our expenses may vary from period to period, which could affect

quarterly results and our stock price.

If we incur additional expenses in a quarter in which we do not

experience increased revenue, our results of operations will be

adversely affected and we may incur larger losses than anticipated

for that quarter. Factors that could cause our expenses to

fluctuate from period to period include:

●

the

timing and extent of our research and development

efforts;

●

investments

and costs of maintaining or protecting our intellectual

property;

●

the

extent of marketing and sales efforts to promote our products and

technologies; and

●

the

timing of personnel and consultant hiring.

Our dependence on third-party suppliers for key components of our

product could delay shipment of our products and reduce our

sales.

We will

depend on certain domestic and foreign suppliers for the delivery

of components used in the assembly of our product. Our reliance on

third-party suppliers creates risks related to our potential

inability to obtain an adequate supply of components or

subassemblies and reduced control over pricing and timing of

delivery of components and subassemblies. Specifically, we will

depend on suppliers of sub-assemblies, machined parts, injection

molded plastic parts, and other miscellaneous custom parts for our

product. We do not have any long-term supply agreements with any

planned suppliers. Any interruption of supply for any material

components of our products could significantly delay the shipment

of our products and have a material adverse effect on our revenues,

profitability and financial condition.

Foreign currency fluctuations may reduce our competitiveness and

sales in foreign markets.

The

relative change in currency values creates fluctuations in product

pricing for future potential international customers. These changes

in foreign end-user costs may result in lost orders and reduce the

competitiveness of our products in certain foreign markets. These

changes may also negatively affect the financial condition of some

foreign customers and reduce or eliminate their future orders of

our products.

Loss of key management and other personnel could impact our

business.

Our business is substantially dependent on our officers and other

key personnel. The loss of an officer or any key personnel could

materially adversely affect our business, financial condition,

results of operations and cash flows. In addition, competition for

skilled and non-skilled employees among companies like ours is

intense, and the future loss of skilled or non-skilled employees or

an inability to attract, retain and motivate additional skilled and

non-skilled employees required for the operation and expansion of

our business could hinder our ability to conduct research

activities successfully, develop new products, attract customers

and meet customer shipments.

Inadequate internal controls and accounting practices could lead to

errors, which could negatively impact our business, financial

condition, results of operations and cash flows.

We will need to establish internal controls and management

oversight systems. Our small size and limited personnel and

consulting resources will make doing so more challenging than for

more established entities. We may not be able to prevent or detect

misstatements in our reported financial statements due to system

errors, the potential for human error, unauthorized actions of

employees or contractors, inadequacy of controls, temporary lapses

in controls due to shortfalls in transition planning and oversight

resource contracts and other factors. In addition, due to their

inherent limitations, such controls may not prevent or detect

misstatements in our reported financial results as required under

SEC rules, which could increase our operating costs or impair our

ability to operate our business. Controls may also become

inadequate due to changes in circumstances. It will be necessary to

replace, upgrade or modify our internal information systems from

time to time. If we are unable to implement these changes in a

timely and cost-effective manner, our ability to capture and

process financial transactions and support our customers as

required may be materially adversely impacted, which could harm our

business, financial condition, results of operations and cash

flows.

Risk Factors Relating to Our Common Stock

There may not be an active trading market for shares of our Common

Stock.

There is no public trading market for shares of our Common Stock.

We cannot predict the extent to which investor interest in the

Company will lead to the development of an active trading market in

our Common Stock or how liquid such a market might become. It is

possible that, after the offering, an active trading market will

not develop or continue, and there can be no assurance as to the

price at which our Common Stock will trade. The initial share price

of our Common Stock may not be indicative of prices that will

prevail in the future.

We do not expect to be the subject of research analyst coverage.

The absence of research analyst coverage can adversely affect the

market value and liquidity of an equity security.

We cannot predict the price range or volatility of our Common

Stock, and sales of a substantial number of shares of our Common

Stock may adversely affect the market price of our Common

Stock.

From time to time, the market price and volume of shares traded of

companies in the industy in which we operate experience periods of

significant volatility. Company-specific issues and developments

generally affecting our industries or the economy may cause this

volatility. The market price of our Common Stock may fluctuate in

response to a number of events and factors, including:

●

general

economic, market and political conditions;

●

quarterly

variations in results of operations or results of operations that

are below public market analyst and investor

expectations;

●

changes

in financial estimates and recommendations by securities

analysts;

●

operating

and market price performance of other companies that investors may

deem comparable;

●

press

releases or publicity relating to us or our competitors or relating

to trends in our markets; and

●

sales

of Common Stock or other securities by insiders.

In addition, broad market and industry fluctuations, investor

perception and the depth and liquidity of the market for our Common

Stock may adversely affect the trading price of our Common Stock,

regardless of actual operating performance.

Sales or distributions of a substantial number of shares of our

Common Stock in the public market or otherwise following the

distribution, or the perception that such sales could occur, could

adversely affect the market price of our Common Stock. Many of the

shares of our Common Stock, other than the shares held by executive

officers and directors, will be eligible for immediate resale in

the public market following the effectiveness of the registration

statement, of which this prospectus is a part. Investment criteria

of certain investment funds and other holders of our Common Stock

may result in the immediate sale of our Common Stock after such

effectiveness to the extent such stock no longer meets these

criteria. Substantial selling of our Common Stock, whether as a

result of the effectiveness of the registration statement or

otherwise, could adversely affect the market price of our Common

Stock.

We cannot assure you as to the price at which our Common Stock will

trade as a result of the offering. Until our Common Stock is fully

distributed and an orderly market develops in our Common Stock, the

price at which our Common Stock trades may fluctuate significantly

and may be lower or higher than the price that would be expected

for a fully distributed issue.

We may issue additional Common Stock in the future. The issuance of

additional Common Stock may reduce the value of your Common

Stock.

We may issue additional shares of Common Stock without further

action by our shareholders. Moreover, the economic and voting

interests of each stockholder will be diluted as a result of such

issuances. Although the number of shares of Common Stock that

shareholders presently own will not decrease, such shares will

represent a smaller percentage of the total shares that will be

outstanding after the issuance of additional shares. The

issuance of additional shares of Common Stock may cause the market

price of our Common Stock to decline.

Sales of Common Stock issuable on the exercise of any future

options or warrants may lower the price of our Common

Stock.

We adopted a stock option plan on March 31, 2017, which will

authorize the grant of options or restricted stock awards to

purchase up to 2.0 million shares of our Common Stock to our

employees, directors and consultants. The issuance of shares of

Common Stock issuable upon the exercise or conversion of options

could cause substantial dilution to existing holders of Common

Stock, and the sale of those shares in the market could cause the

market price of our Common Stock to decline. The potential dilution

from the issuance of these shares could negatively affect the terms

on which we are able to obtain equity financing.

We may issue preferred stock in the future, and the terms of the

preferred stock may reduce the value of your Common

Stock.

We are authorized to issue up to 5,000,000 shares of preferred

stock in one or more series. Our Board of Directors may determine

the terms of future preferred stock offerings without further

action by our shareholders. If we issue preferred stock, it could

affect your rights or reduce the value of your Common Stock. In

particular, specific rights granted to future holders of preferred

stock could be used to restrict our ability to merge with or sell

our assets to a third party. Preferred stock terms may include

voting rights, preferences as to dividends and liquidation,

conversion and redemption rights and sinking fund

provisions.

The payment of dividends will be at the discretion of our Board of

Directors.

The declaration and amount of future dividends, if any, will be

determined by our Board of Directors and will depend on our

financial condition, earnings, capital requirements, financial

covenants, regulatory constraints, industry practice and other

factors our Board deems relevant. See “Dividend

Policy” on page 15

for additional information

on our dividend policy following the

distribution.

JUMPSTART OUR BUSINESS STARTUPS ACT

We

qualify as an “emerging growth company” as defined in

Section 101 of the Jumpstart our Business Startups Act

(“JOBS Act”) as

we do not have more than $1.0 billion in annual gross revenue and

did not have such amount as of December 31, 2016, our last fiscal

year. We are electing to use the extended transition period for

complying with new or revised accounting standards under Section

102(b)(1) of the JOBS Act.

We may

lose our status as an emerging growth company on the last day of

our fiscal year during which (i) our annual gross revenue exceeds

$1.0 billion or (ii) we issue more than $1.0 billion in

non-convertible debt in a three-year period. We will lose our

status as an emerging growth company (i) if at any time we are

deemed to be a large accelerated filer. We will lose our status as

an emerging growth company on the last day of our fiscal year

following the fifth anniversary of the date of the first sale of

common equity securities pursuant to an effective registration

statement.

As an

emerging growth company we are exempt from Section 404(b) of the

Sarbanes-Oxley Act of 2002 and Section 14A(a) and (b) of the

Securities Exchange Act of 1934. Such sections are provided

below:

●

Section 404(b) of

the Sarbanes-Oxley Act of 2002 requires a public company’s

auditor to attest to, and report on, management’s assessment

of its internal controls.

●

Sections 14A(a) and

(b) of the Securities and Exchange Act, implemented by Section 951

of the Dodd-Frank Act, require companies to hold shareholder

advisory votes on executive compensation and golden parachute

compensation.

As long

as we qualify as an emerging growth company, we will not be

required to comply with the requirements of Section 404(b) of the

Sarbanes-Oxley Act of 2002 and Section 14A(a) and (b) of the

Securities Exchange Act of 1934.

SPECIAL NOTE ABOUT FORWARD-LOOKING STATEMENTS

This prospectus and other materials filed or to be filed by us, as

well as information in oral statements or other written statements

made or to be made by us, contain statements, including in this

document under the captions “Executive

Summary,” “Questions and Answers About the

Distribution,” “Risk Factors,” “The

Distribution,” “Capitalization and Financing,”

“Management’s Discussion and Analysis of Financial

Condition and Results of Operations,” and “Business”,

that are, or may be considered to be,

forward-looking statements. All statements that are not historical

facts, including statements about our beliefs or expectations, are

forward-looking statements. You can identify these forward-looking

statements by the use of forward-looking words such as

“outlook,” “believes,”

“expects,” “potential,”

“continues,” “may,” “will,”

“should,” “seeks,”

“approximately,” “predicts,”

“intends,” “plans,”

“estimates,” “anticipates,”

“foresees” or the negative version of those words or

other comparable words and phrases. Any forward-looking statements

contained in this information statement are based on our historical

performance and on current plans, estimates and expectations. The

inclusion of this forward-looking information should not be

regarded as a representation by us or any other person that the

future plans, estimates or expectations contemplated by us will be

achieved. There may be events in the future that we are not able to

predict accurately or control. The factors listed under

“Risk

Factors,” as well as any

cautionary language in this information statement, provide examples

of risks, uncertainties and events that may cause our results to

differ materially from the expectations we describe in our

forward-looking statements. You should be aware that the occurrence

of the events described in these risk factors and elsewhere in this

information statement could have a material adverse effect on our

business, results of operations and financial

position.

Forward-looking statements, whether express or implied, are not

guarantees of future performance and are subject to risks and

uncertainties that can cause actual results to differ materially

from those currently anticipated due to a number of factors, which

include, but are not limited to:

●

risks

that we may not have sufficient capital in the amounts and at the

times needed to finance our business;

●

risks

associated with our future revenue source dependent on a new

product line not yet in production;

●

risks

that any future potential revenue opportunities from customers may

not materialize to any meaningful degree or at all;

●

risks

of delays or unforeseen technical obstacles in arranging production

and bringing our new product line to market;

●

absence

of a public market for our Common Stock;

●

our

ability to attract and retain qualified personnel and key

employees;

●

our

ability to establish financial, administrative and other support

functions;

●

difficulty

in predicting the timing or outcome of new product development

efforts;

●

the

amount and timing of costs associated with research and development

of our product line;

●

our

ability to generate operating revenue;

●

market

adoption of our principal product;

●

the

competitive nature of the industry in which we

compete;

●

the

availability and price of acceptable raw materials and components

from third-party suppliers;

●

volatility

in the financial markets;

●

any

adverse outcome in litigation to which we may become a

party;

●

general

economic, political and business conditions that adversely affect

our company or our suppliers or any company to which we sell our

products;

●

changes

in costs, including changes in labor costs and raw material

prices;

●

the

impact on our product development of patents and other proprietary

rights licensed or owned by us; and

●

the

ability to successfully have our products manufactured in an

efficient, time-sensitive and cost-effective manner.

You should read this information statement completely and with the

understanding that actual future results may be materially

different than expectations. All forward-looking statements made in

this prospectus are qualified by these cautionary statements. These

forward-looking statements are made only as of the date of this

prospectus, and we do not undertake any obligation (and we

expressly disclaim any such obligation), other than as may be

required by law, to update or revise any forward-looking statements

to reflect changes in assumptions, the occurrence of unanticipated

events or changes in future operating results over time or

otherwise.

USE OF PROCEEDS

Any

proceeds received from the sale of the Shares will be deposited

directly into the operating account of the Company. We will be

attempting to raise up to $4 million, minus expenses of

approximately $50,000 from the sale of the Shares. These proceeds

will be used as follows:

|

|

|

|

|

|

|

Gross

Proceeds

|

$4,000,000

|

$3,000,000

|

$2,000,000

|

$1,000,000

|

|

Less Offering

Expenses

|

(50,000)

|

(50,000)

|

(50,000)

|

(50,000)

|

|

NET OFFERING

PROCEEDS

|

$3,950,000

|

$2,950,000

|

$1,950,000

|

$950,000

|

|

Research,

Development and Tooling

|

$435,000

|

$435,000

|

$435,000

|

$435,000

|

|

Sales and

Marketing

|

$410,000

|

$410,000

|

$410,000

|

$210,000

|

|

General Corporate

Expense

|

$305,000

|

$305,000

|

$305,000

|

$305,000

|

|

Working

Capital

|

$2,800,000

|

$1,800,000

|

$800,000

|

$-0-

|

Our

offering expenses are comprised of legal and accounting

expenses. Our officers and directors will not receive

any compensation for their efforts in selling the

Shares.

Research

and development expense primarily relates to developing new

security products while tooling costs consist primarily of upfront

tooling costs to reduce the cost of BolaWrap™ 100 components.

Sales and marketing expense includes staffing costs, product

promotion costs and travel and customer support activities. General

corporate expense includes staffing and Working capital may also

consist of capacity and staffing expansion and administrative

expense.

In the

event we are not successful in selling Shares resulting in gross

proceeds of at least $1.0 million, we would utilize any available

funds raised in the following order of priority:

●

For general and

administrative expenses, including legal and accounting fees and

administrative support expenses incurred in connection with our

reporting obligations with the Securities and Exchange Commission

(“SEC”);

●

For research,

development and tooling;

●

For general

corporate expenses.

We

estimate the need to raise a minimum of $1.5 million to implement

our plan of operations and provide sufficient working capital for

production and to finance sales operations.

MARKET PRICE OF COMMON STOCK AND RELATED MATTERS

Market Information

There

has been no public trading market for the shares of the

Company’s Common Stock. We intend to apply to list

our Common Stock on the OTCBB such that a secondary market will

commence following the offering.

Holders

As of

April 14, 2017, there were approximately 14 shareholders of record

of the Company’s Common Stock and no holders of

record of its preferred stock. Our transfer agent is

_____________, ________. Their telephone number is

_________.

ABSENCE OF PUBLIC MARKET AND DIVIDEND POLICY

Public Market

While

not currently a reporting company, we will become a Section 15(d)

reporting company as a result of the consummation of the

offering.

Dividend Policy

The payment of dividends is subject to the discretion of our board

of directors and will depend, among other things, upon our

earnings, our capital requirements, our financial condition and

other relevant factors. We have not paid or declared any dividends

upon our Common Stock since our inception and, by reason of our

present financial status and our contemplated financial

requirements do not anticipate paying any dividends upon our Common

Stock in the foreseeable future. Therefore, there can be no

assurance that any dividends on the Common Stock will ever be

paid.

CAPITALIZATION AND FINANCING

The

following sets forth our capitalization as of March 31, 2017 that

is derived from our unaudited financial information included

elsewhere in this prospectus:

●

On an actual basis;

and

●

On a pro forma

basis, giving affect to the sale and issuance by us of ______

shares of Common Stock in this offering, at an assumed offering

price of $__ per share,, and after deducting estimated offering

expenses payable by us.

|

|

|

|

|

|

|

|

|

|

|

|

|

Cash

|

$344,629

|

$ ________

|

|

|

|

|

|

Stockholders’

equity:

|

|

|

|

Preferred

stock

|

-0-

|

-0-

|

|

Common

stock

|

2,000

|

________

|

|

Additional

paid-in capital

|

665,500

|

________

|

|

Accumulated

deficit

|

(436,111)

|

________

|

Total

stockholders’ equity

|

$231,389

|

$________

|

|

|

|

|

|

|

$231,389

|

$________

|

This

table should be read in conjunction with “Management’s Discussion and Analysis of

Financial Condition and Results of Operations” and our

historical financial statements, notes and pro forma information

included elsewhere in this prospectus.

DILUTION

Dilution

represents the difference between the offering price and the net

tangible book value per share immediately after completion of this

offering. Net tangible book value is the amount that results from

subtracting total liabilities and intangible assets from total

assets. Dilution arises mainly as a result of our arbitrary

determination of the offering price of the shares of Common Stock

being offered. Dilution of the value of the Common Stock you

purchase is also a result of the lower book value of the shares

held by our existing shareholders.

As of March 31, 2017, the net tangible book value of our Common

Stock was $231,389 or approximately $0.01 per share based upon 20.0

million shares of Common Stock issued and outstanding.

If 100% of the Shares Are Sold:

Upon

completion of this offering, in the event all of the shares are

sold, the net tangible book value of the _________ shares of Common

Stock to be outstanding will be (______) or approximately $______

per share. The net tangible book value of the shares of Common

Stock held by our existing shareholders will be increased by $____

per share without any additional investment on their part.

Investors in the offering will incur an immediate dilution from

$_____ per share of Common Stock to $______ per share.

After

completion of this offering, if _______ shares of Common Stock are

sold, investors in the offering will own __% of the total number of

shares then outstanding for which they will have made cash

investment of $____ million, or $_____ per share. Our existing

shareholders will own ___% of the total number of shares of Common

Stock then outstanding, for which they have made contributions of

cash totaling $0.00 per share.

Upon

completion of this offering, in the event all Shares are not sold,

the following table details the range of possible outcomes from the

offering assuming the sale of 100%, 75%, 50% and

25%.

|

Funding

Level

|

|

$4,000,000

|

|

$3,000,000

|

|

$2,000,000

|

$

|

$1,000,000

|

|

|

|

|

|

|

|

|

|

|

Offering

price

|

|

$

|

|

$

|

|

$

|

|

$

|

|

Net tangible book

value per common share before offering

|

|

$(0.01)

|

|

$(0.01)

|

|

$(0.01)

|

|

$(0.01)

|

|

Pro forma net

tangible book value per common share after

|

|

$

|

|

$

|

|

$

|

|

$

|

|

Dilution to

investors

|

|

$

|

|

$

|

|

$

|

|

$

|

|

Dilution as a

percentage of offering price

|

|

|

|

|

|

|

|

|

Based

on 20,000,000 shares of Common Stock outstanding as of March 31,

2017 and total stockholder's equity of $231,389 utilizing unaudited

financial statements.

Since

inception, the officers, directors, promoters and affiliated

persons have paid an aggregate average price of $.034 per share of

Common Stock in comparison to the offering price of $____ per share

of Common Stock.

Further Dilution

The

Company may issue equity and debt securities in the future.

These issuances and any sales of additional Common Stock may

have a depressive effect upon the market price of the Company's

Common Stock and investors in this offering.

MANAGEMENT’S DISCUSSION AND ANALYSIS OF

FINANCIAL CONDITION AND RESULTS OF OPERATIONS

You should read the following discussion in conjunction with the

financial statements and other financial information included

elsewhere in this information statement. The following discussion

may contain forward-looking statements that reflect our plans,

estimates and beliefs. Our actual results could differ materially

from those discussed in these forward-looking statements. Factors

that could cause or contribute to these differences include, but

are not limited to, those discussed below and elsewhere in this

information statement, particularly in “Risk Factors”

and “Special Note About Forward-Looking

Statements.”

We are a security technology company organized in March 2016

focused on delivering solutions to customers, primarily law

enforcement and security personnel. We plan to introduce our first

product, the BolaWrap™ 100, during 2017. We do not expect to report

revenues until production quantities are available for sale to

customers. There can be no assurance regarding the timing or amount

of future revenues from this product, if any.

Organization and Reverse Capitalization

Our

Company resulted from the March 31, 2017 merger of Wrap

Technologies, LLC (“Wrap

LLC”) with and into our wholly-owned subsidiary

MegaWest Energy Montana Corp. (“MegaWest”). Wrap LLC ceased

separate existence with MegaWest continuing as the surviving

entity. MegaWest changed its name to Wrap Technologies, Inc. and

amended and restated new articles of incorporation authorizing

150,000,000 shares of Common Stock, par value $0.0001, and

5,000,000 shares of preferred stock, par value $0.0001. All issued

and outstanding 835.75 membership units of Wrap LLC were exchanged

for 20.0 million shares of Common Stock of the

Company.

Wrap

LLC acquired privately held MegaWest from Petro River Oil Corp.

(“Petro River”)

on March 22, 2017 through the issuance of 16.75 membership units,

representing a 2% membership interest in Wrap LLC. Petro River is

owned 11% by Scot Cohen, its Executive Chairman, who also was a

Manager and the owner of a 26% membership interest in Wrap LLC, and

is a director and officer of the Company. MegaWest had no assets or

liabilities at the date of acquisition nor at December 31, 2016,

and is not considered an operating business.

Wrap

LLC’s acquisition of MegaWest and its subsequent merger with

and into MegaWest as a wholly-owned subsidiary of the Company, and

exchange of membership interests for Common Stock has been

accounted for as a reverse recapitalization of Wrap LLC (the

“Recapitalization”). Wrap LLC, now

the Company as a result of the Recapitalization, is deemed the

accounting acquirer with MegaWest the accounting acquiree. Our

financial statements are in substance those of Wrap LLC and are

deemed to be a continuation of its business from its inception date

of March 2, 2016. The Company’s balance sheet continues at

historical cost as the accounting acquiree had no assets or

liabilities and no goodwill or intangible assets were recorded as

part of the Recapitalization.

To reflect the Recapitalization, historical shares of Common Stock

and additional paid-in capital have been retroactively adjusted

using the exchange ratio of approximately 23,930.60 shares of

Common Stock for each membership unit of Wrap LLC.

Basis of Presentation – Going Concern

Since

inception in March 2016, we have generated significant losses from

operations and anticipate that we will continue to generate

significant losses from operations for the foreseeable future. In

order to continue as a going concern, our business will require

substantial additional investment that has not yet been

secured. Our loss from operations was $234,356 for the period

ended December 31, 2016 and $201,755 for the three months ended

March 31, 2017. The net cash used from operations and investing was

$187,428 for the period ended December 31, 2016 and $135,443 for

the three months ended March 31, 2017. On March 31, 2017, we had

$344,629 in cash. As of March 31, 2017, our obligations

included $155,050 of current liabilities and lease commitments of

approximately $48,300.

Our

management has concluded that due to the conditions described

above, there is substantial doubt about our ability to continue as

a going concern through April 17, 2018.

Management

has evaluated the significance of the conditions in relation to our

ability to meet our obligations and believes that the current cash

balance will provide sufficient capital to continue operations

through approximately June 2017. While we plan to raise capital to

address our capital deficiencies and meet our operating cash

requirements, there is no assurance that our plans will be

successful. Management cannot assure you that financing will be

available on favorable terms or at all. Additionally, if additional

capital is raised through the sale of equity or convertible debt

securities, the issuance of such securities would result in