UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

SCHEDULE 14A

Proxy Statement Pursuant to Section 14(a)

of the Securities Exchange Act of 1934

Filed by the

Registrant [X]

Filed by a

Party other than the Registrant [ ]

Check the

appropriate box:

|

[

]

|

|

Preliminary

Proxy Statement

|

|

[

]

|

|

Confidential,

for Use of the SEC Only (as permitted by

Rule 14a-6(e)(2))

|

|

[X]

|

|

Definitive

Proxy Statement

|

|

[

]

|

|

Definitive

Additional Materials

|

|

[

]

|

|

Soliciting

Material Pursuant to 14a-12

|

WRAP TECHNOLOGIES, INC.

(Name of

Registrant as Specified in Its Charter)

_________________________________

(Name of

Person(s) Filing Proxy Statement, if other than the

Registrant)

Payment of

Filing Fee (Check the appropriate box):

[X]

No fee required.

[

] Fee computed on table below per

Exchange Act Rules 14a-6(i)(4) and 0-11.

|

1.

|

|

Title of each

class of securities to which transaction applies:

|

|

2.

|

|

Aggregate

number of securities to which transaction applies:

|

|

3.

|

|

Per unit price

or other underlying value of transaction computed pursuant to

Exchange Act Rule 0-11 (set forth the amount on which the

filing fee is calculated and state how it was

determined):

|

|

4.

|

|

Proposed

maximum aggregate value of transaction:

|

|

5.

|

|

Total fee

paid:

|

[

] Fee paid previously with

preliminary materials.

[

] Check box if any part of the fee is

offset as provided by Exchange Act Rule 0-11(a)(2) and

identify the filing for which the offsetting fee was paid

previously. Identify the previous filing by registration statement

number, or the Form or Schedule and the date of its

filing.

|

1.

|

|

Amount

Previously Paid:

|

|

2.

|

|

Form, Schedule

or Registration Statement No.:

|

|

3.

|

|

Filing

Party:

|

|

4.

|

|

Date

Filed:

|

|

|

Tom

Smith

CEO and President

|

|

Dear Valued

Stockholders:

We are just

getting started. When WRAP was founded in 2016, we felt our

innovative public safety

technologies and services could help a broad range of

enforcement and apprehension personnel. This included police,

military, private security, and general control situations, such as

a bouncer at a bar or professionals in an education facility. From

day one, we recognized this was a global market. To ultimately

deliver to all markets, we began with the police. The law

enforcement market alone is massive. In the U.S., there are over

18,000 agencies with 900,000 full-time sworn local, state, and

federal officers. Internationally, the market is 12x larger. Our

expectation is bold – every single officer will benefit from

our technology platform.

With our first

product, we believe we have filled a critical gap in how police

handle situations in conflict. After verbal commands, other options

available to an officer included some use of force relying on

varying degrees of pain for compliance. Moreover, the industry was

in desperate need of innovation. The BolaWrap® Remote Restraint device

was the first advancement in police tools since conducted

electrical weapons (CEW’s) were introduced over 25 years

ago.

There was no

way to predict back in 2016 the significant events that occurred in

2020. A global pandemic, protests, riots, and calls for police

reform and even to defund the police. These unfortunate events

triggered unprecedented levels of community outcry, global media

attention, and government call-to-action.

This, combined

with the continued education and significant awareness of how to

handle individuals with mental health issues, or those suffering a

crisis, added to the need for more modern solutions. We believe we

are at the beginning stage of significant police reform that

demands de-escalation and better training for officers. Within

police reform, “de-escalation” is a popular buzz word.

Certainly, de-escalation is important, and we offer tools and

training to do this. However, WRAP is driven by the goal of

avoiding escalation in the first place. To us, outcomes are far

more successful if they end before they escalate and turn volatile

and unpredictable. In policing, unpredictable encounters can turn

catastrophic quickly.

Our growth

strategy of delivering effective and safe devices and robust

training is positioned extremely well to create long-term

shareholder value.

Our near-term

focus is simple in concept:

●

Having already shipped to

41 countries, continue to drive further global adoption and use of

the BolaWrap® Remote

Restraint device.

●

Bring to market the most

advanced training system in the world. WRAP Reality, the Company’s

virtual reality training system, is an immersive training simulator

and comprehensive public safety training platform designed to

empower first responders with the necessary knowledge to perform in

the field.

With successful execution of our growth strategy, we will build a

platform for a strong and reliable recurring revenue stream.

Cartridge replacement is one aspect, but the more significant

opportunity is our training system that is intended to allow

officers real-time training for all types of situations any time

they want. We believe the industry is headed in the direction of

continuous education, training and certification.

We intend to maintain our first-mover

advantage. Our team is strong and matches the vision for our

product and service portfolio. We appreciate your trust and

support. We never take it for granted.

Tom

Smith

CEO and

President

Wrap Technologies, Inc.

1817 W 4th Street

Tempe, Arizona 85281

(800) 583-2652

NOTICE OF VIRTUAL ANNUAL MEETING OF STOCKHOLDERS

To Be Held on June 22,

2021

Dear

Stockholders of Wrap Technologies, Inc.:

It is our

pleasure to invite you to the 2021 Annual Meeting of Stockholders

(the “Annual

Meeting”) of Wrap Technologies, Inc., a Delaware

corporation (the “Company”). Due to the public

health impact of the coronavirus (“COVID-19”) pandemic, and out of

concern for the health and safety of our stockholders, directors,

and members of management, the Annual Meeting will be held

on June 22, 2021 at 9:00 A.M., Pacific

Time in a virtual meeting format only. There will be no

physical location for stockholders to attend the Annual Meeting.

Stockholders will be able to listen,

vote, and submit questions, regardless of their physical location,

via the internet by registering at a live webcast

http://www.colonialstock.com/wrap2021.

If you plan to participate in the

virtual Annual Meeting, please see the “Instructions for the Virtual

Annual Meeting” section

in the attached Proxy Statement. The purpose of the Annual Meeting

is to vote on the following:

1.

to elect

nine directors to our Board of Directors, each to serve until our

next annual meeting of stockholders, or until their respective

successor is duly elected and qualified;

2.

to approve an amendment to

our 2017 Equity Compensation Plan (the “2017 Plan ”) to increase the

number of shares of Company common stock, par value $0.0001 per

share (“Common

Stock”), available for issuance thereunder from 6.0

million shares to 7.5 million

shares (the “Plan

Amendment”);

3.

to ratify the appointment

of Rosenberg Rich Baker Berman,

P.A. as our independent auditors for the year ending

December 31, 2021; and

4.

to vote upon such other

matters as may properly come before the Annual Meeting and any

adjournment or postponement thereof.

The foregoing

items of business are more fully described in the Proxy Statement

accompanying this Notice. Other detailed information about us

and our operations, including our audited financial statements, are

included in our Annual Report on Form 10-K (the “Annual Report”), a copy of which

is enclosed. This Proxy Statement

and the Annual Report are also available online at:

www.colonialstock.com/wrap2021. You will also

have the opportunity to hear what has happened in our business in

the past year and to ask questions.

We have elected to

provide access to our proxy materials primarily over the Internet,

pursuant to the Securities and Exchange Commission’s

“notice and access” rules. We strongly encourage

you to sign up for electronic delivery of our future annual reports

and proxy materials in order to conserve natural resources and help

us save costs in producing and distributing these materials. For

more information, please see “Electronic Delivery of Proxy Materials and

Annual Report” on page 1 of the Proxy Statement.

The Board of

Directors has fixed the close of business on April 26, 2021 as the record date for the

determination of stockholders entitled to notice of and to vote at

the Annual Meeting and at any adjournment or postponement thereof.

Stockholders of record present via live webcast at the Annual

Meeting or who have submitted a valid proxy via the Internet, by

telephone or by mail will be deemed to be present, to vote at the

Annual Meeting.

Your vote is

very important to us. Please act as soon as possible to vote your

shares, even if you plan to participate in the virtual annual

meeting. Regardless of whether

you plan to virtually attend the Annual

Meeting, please

read this Proxy Statement and vote your shares by Internet,

telephone or e-mail as promptly as possible. Please

refer to the Notice for instructions on submitting your vote.

Voting promptly will save us additional expense in further

soliciting proxies and will ensure that your shares are represented

at the Annual Meeting.

By Order of the

Board of Directors,

|

Scot

Cohen

|

Thomas P.

Smith

|

|

Chair of the

Board

|

Chief Executive

Officer

|

|

|

|

Tempe,

Arizona

April 30, 2021

YOUR

VOTE IS IMPORTANT

AS STOCKHOLDERS ARE CORDIALLY INVITED TO ATTEND THE ANNUAL MEETING

VIA LIVE WEBCAST. HOWEVER, TO ENSURE

YOUR REPRESENTATION AT THE ANNUAL MEETING, YOU ARE URGED TO VOTE BY

INTERNET, TELEPHONE OR E-MAIL AS SOON AS POSSIBLE. RETURNING YOUR

PROXY WILL HELP US ASSURE THAT A QUORUM WILL BE PRESENT AT THE

ANNUAL MEETING AND AVOID THE ADDITIONAL EXPENSE OF DUPLICATE PROXY

SOLICITATIONS. EVEN IF YOU HAVE GIVEN YOUR PROXY, YOU MAY

STILL VOTE VIA LIVE WEBCAST IF YOU ATTEND THE VIRTUAL MEETING.

PLEASE NOTE, HOWEVER, THAT IF YOUR SHARES ARE HELD OF RECORD BY A

BROKER, BANK OR OTHER NOMINEE AND YOU WISH TO VOTE AT THE MEETING,

YOU MUST OBTAIN FROM THE RECORD HOLDER A PROXY ISSUED IN YOUR

NAME.

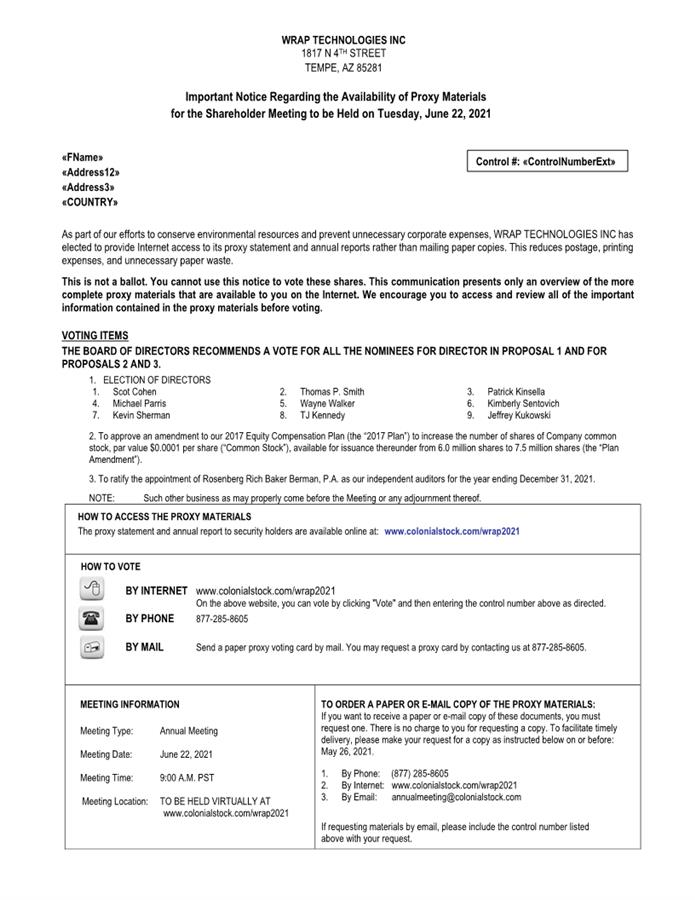

IMPORTANT NOTICE REGARDING THE AVAILABILITY OF

PROXY MATERIALS FOR THE ANNUAL MEETING TO BE HELD ON

JUNE

22, 2021: THE ANNUAL REPORT

AND PROXY STATEMENT ARE AVAILABLE ONLINE AT: www.colonialstock.com/wrap2021.

Wrap Technologies, Inc.

1817 W 4th Street

Tempe, Arizona 85281

(800) 583-2652

PROXY STATEMENT

This Proxy

Statement is furnished in connection with the solicitation of

proxies by the Board of Directors (the “Board”) of Wrap Technologies,

Inc., a Delaware corporation (the “Company”), for use at the

Company’s 2021 Annual Meeting of Stockholders (the

“Annual

Meeting”) to be held on June 22, 2021 at 9:00 A.M., Pacific Time, via virtual

meeting by accessing http://www.colonialstock.com/wrap2021, and any

adjournment or postponement thereof.

Instructions for Virtual Annual Meeting

A virtual meeting format offers the same

participation opportunities as those opportunities available to

stockholders at in-person meetings. Stockholders will be able to

listen, vote, and submit questions. To participate in the Annual

Meeting webcast, you must register at http://www.colonialstock.com/wrap2021

by 5:00 P.M. (Pacific Time) on June

21, 2021 using your desktop or mobile device.

The Annual

Meeting will begin promptly at 9:00 A.M. (Pacific Time) on June 22,

2021. We encourage you to access the virtual meeting website prior

to the start time. Online check-in will begin 30 minutes prior to

the start of the Annual Meeting. You should allow ample time to

ensure your ability to access the meeting.

We will hold our

question-and-answer session with management immediately following

the conclusion of the Annual Meeting. You may submit a question in

advance of the Annual Meeting during the registration process by

visiting http://www.colonialstock.com/wrap2021. You may also submit

a question at any time during the Annual Meeting by typing the

questions into the questions box on the screen once the virtual

meeting starts. The Chairman of the Annual Meeting has broad

authority to conduct the meeting in an orderly

manner.

Technicians

will be available to assist you if you experience technical

difficulties accessing the virtual meeting website. If you

encounter any difficulties accessing the virtual meeting during the

check-in or meeting time, send an email to

meeting-annualmeeting@colonialstock.com or call (801) 355-5740 for

assistance.

Electronic Delivery of Proxy Materials and Annual

Report

We have elected

to provide access to this year’s proxy materials primarily

over the Internet under the Securities and Exchange

Commission’s (“SEC”) “notice and

access” rules. We intend to mail a Notice of Internet

Availability of Proxy Materials (the “Notice”) on or

about May 1, 2021 to each of our

stockholders entitled to notice of and to vote at the Annual

Meeting, which will contain instructions for accessing this Proxy

Statement, our Annual Report on Form 10-K for the fiscal year ended

December 31, 2020 (“Annual

Report”) and voting

instructions. The Notice will also include instructions on how you

can receive a paper copy of your proxy

materials.

This Proxy Statement and the Annual Report can

also be accessed free of charge online as of May 1, 2021 at: www.colonialstock.com/wrap2021.

Voting

The specific proposals to

be considered and acted upon at our Annual Meeting are each

described in this Proxy Statement. Only holders of our common

stock, par value $0.0001 per share (“Common Stock’’), as of the

close of business on April 26,

2021 (the “Record

Date”) are entitled to notice of and to vote at the

Annual Meeting. On the Record Date, there were 37,948,413 shares of Common Stock

issued and outstanding. Each holder of Common Stock is entitled to

one vote for each share held as of the Record Date.

Quorum

In order for any business to be conducted at the

Annual Meeting, a quorum must be present. The presence at the

Annual Meeting, either in attendance virtually or by proxy, of

holders of the Company’s Common Stock entitled to vote and

representing at least a majority of the Company’s outstanding

voting power will constitute a quorum for the transaction of

business. If you submit a properly executed proxy, regardless of

whether you abstain from voting on one or more matters, your shares

will be counted as present at the Annual Meeting for the purpose of

establishing a quorum. Shares that constitute broker non-votes will

also be counted as present at the Annual Meeting for the purpose of

establishing a quorum. If a quorum is not present at the scheduled

time of the Annual Meeting, the stockholders who are present may

adjourn the Annual Meeting until a quorum is present. The time and

place of the adjourned Annual Meeting will be announced at the time

the adjournment is taken, and no other notice will be given. An

adjournment will have no effect on the business that may be

conducted at the Annual Meeting.

Required Vote for Approval

Proposal No. 1: Election of Directors.

Directors are elected by a plurality

vote. This means that the nine director nominees who receive

the greatest number of affirmative votes cast at the Annual Meeting

by the shares present, either in attendance virtually or by proxy

and entitled to vote, will be elected. Abstentions and broker non-votes will have no

effect on the outcome of the election of the

directors.

Proposal No. 2:

Plan Amendment, [and Ratification of all Issuances Made Thereunder

to Date]. To approve the

amendment to our 2017 Equity Compensation Plan (the

“2017 Plan”)

to increase

the number of shares of Common Stock authorized for issuance

thereunder from 6.0 million shares to 7.5 million shares (the

“Plan

Amendment’), and to ratify

all issuances made thereunder to date, the number of votes cast

“FOR” must exceed the number of votes cast

“AGAINST” this Proposal. A properly executed proxy marked

“ABSTAIN” will not be voted, although it will be

counted as present and entitled to vote for purposes of the

Proposal. Accordingly, an abstention will have the effect of a

vote against this Proposal. A broker or nominee will not have

discretionary authority to vote on this Proposal because it is

considered a non-routine matter. Accordingly, broker non-votes will

have no effect on the outcome of this Proposal.

Proposal No. 3: Ratification of Appointment of

Auditors. To ratify the

appointment of Rosenberg Rich

Baker Berman, P.A. as our independent

auditors for the fiscal year ending December 31, 2021, the number

of votes cast “FOR” must exceed the number of votes

cast “AGAINST” this Proposal. A properly executed proxy marked

“ABSTAIN” will not be voted, although it will be

counted as present and entitled to vote for purposes of the

Proposal. Accordingly, an abstention will have the effect of a

vote against this Proposal. A broker or other nominee will

generally have discretionary authority to vote on this Proposal

because it is considered a routine matter, and therefore we do not

expect broker non-votes with respect to this Proposal. However, any

broker non-votes received will have no effect on the outcome of

this Proposal.

Broker Non-Votes

A

“broker non-vote” occurs when a nominee (typically a

broker or bank) holding shares for a beneficial owner (typically

referred to as shares being held in “street name”)

submits a proxy for the Annual Meeting, but does not vote on a

particular proposal because the nominee has not received voting

instructions from the beneficial owner and does not have

discretionary authority to vote the shares with respect to that

proposal.

Brokers and other nominees

may vote on “routine” proposals on behalf of beneficial

owners who have not furnished voting instructions, subject to the

rules applicable to broker nominees concerning transmission of

proxy materials to beneficial owners, and subject to any proxy

voting policies and procedures of those firms. The ratification of

the independent registered public accountants, for example, is a

routine proposal. Brokers and other nominees may not vote on

“non-routine” proposals, unless they have received

voting instructions from the beneficial owner. The election of

directors and approval of the Plan Amendment are considered

“non-routine” proposals. This means that brokers and

other firms must obtain voting instructions from the beneficial

owner to vote on these matters;otherwise, they will not be able to

cast a vote for such “non-routine” proposals. If your

shares are held in the name of a broker, bank or other nominee,

please follow their voting instructions so you can instruct your

broker on how to vote your shares.

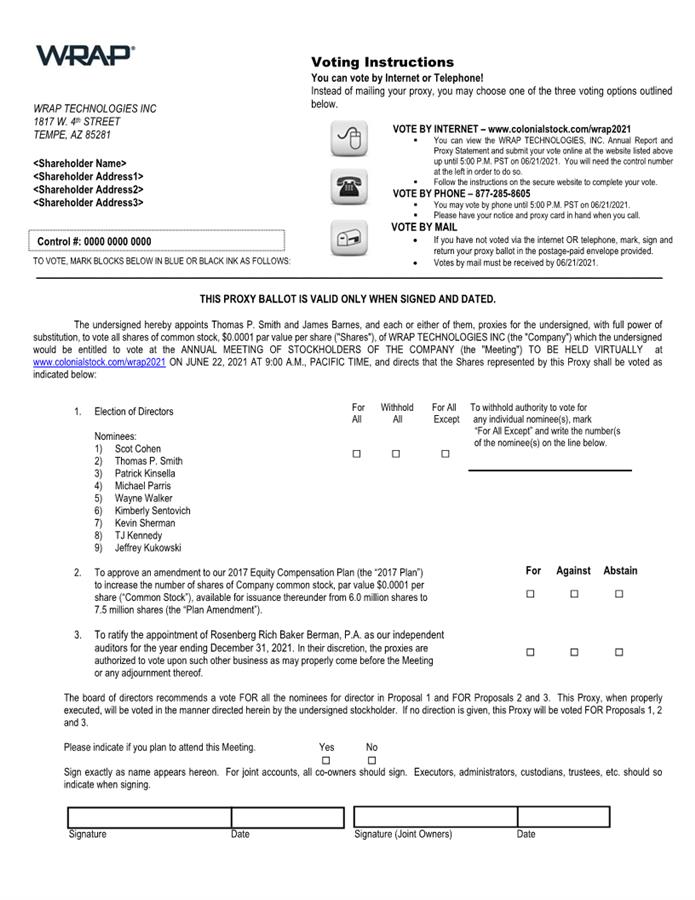

Voting and Revocation of Proxies

If your proxy

is properly returned to the Company, the shares represented thereby

will be voted at the Annual Meeting in accordance with the

instructions specified thereon. If you return your proxy without

specifying how the shares represented thereby are to be voted, the

proxy will be voted (i) FOR the election of the nine

director nominees named in this Proxy Statement, (ii) FOR the Plan Amendment,

(iii) FOR ratification of the appointment

of Rosenberg Rich Baker Berman, P.A. as our independent auditors

for the current fiscal year, and (iv) at the discretion of the

proxy holders on any other matter that may properly come before the

Annual Meeting or any adjournment or postponement

thereof.

You may revoke

or change your proxy at any time before the Annual Meeting by (i)

filing, with our Corporate Secretary at our executive offices,

located at 1817 W 4th Street, Tempe, Arizona 85281, a notice of

revocation or another signed proxy with a later date, or (ii) by

voting online at the virtual Annual Meeting. Attendance at the

virtual Annual Meeting by itself will not revoke a proxy. Shares

can be voted at the Annual Meeting only if the holder is present or

represented by proxy. If you are a stockholder whose shares are not

registered in your own name, you will need additional documentation

from your broker or record holder to vote personally at the Annual

Meeting.

No Appraisal Rights

The stockholders of the Company have no dissenter’s or

appraisal rights in connection with any of the proposals described

herein.

Solicitation

We will bear

the entire cost of solicitation, including the preparation,

assembly, printing and mailing of the Notice, as well as the

preparation and posting of this Proxy Statement, the Annual Report

and any additional solicitation materials furnished to

stockholders. Copies of any solicitation materials will be

furnished to brokerage houses, fiduciaries and custodians holding

shares in their names that are beneficially owned by others so that

they may forward this solicitation material to such beneficial

owners. In addition, we may reimburse such persons for their costs

in forwarding the solicitation materials to such beneficial owners.

The original solicitation of proxies may be supplemented by a

solicitation by telephone, e-mail or other means by our directors,

officers or employees. No additional compensation will be paid to

these individuals for any such services. Except as described above,

we do not presently intend to solicit proxies other than by e-mail,

telephone and mail.

MATTERS TO BE CONSIDERED AT THE ANNUAL MEETING

PROPOSAL NO. 1

ELECTION OF DIRECTORS

General

Our Bylaws

provide that that the

number of

directors that constitute the entire Board of Directors (the

“Board”)

shall be fixed from time to time by resolution adopted by a

majority of the entire Board, but that in no event shall the number

be less than three. A director elected by the Board to fill a

vacancy shall serve for the remainder of the term of that director

and until the director’s successor is duly elected and

qualified. Our Board currently consists of nine directors, each of

whom has been nominated by our Nominating and Governance Committee

for election at the Annual Meeting. The nine director nominees for

election at the Annual Meeting consist of Messrs. Scot Cohen,

Patrick Kinsella, Michael Parris, Wayne Walker, Thomas Smith,

Kevin Sherman, Thomas J.

Kennedy and Jeffrey Kukowski,

and Ms. Kimberly Sentovich.

Each director nominee, if elected at the Annual

Meeting, will hold office for a one-year term until the next annual

meeting of stockholders or until their successor is duly elected,

unless prior thereto the director resigns, or the director’s

office becomes vacant by reason of death or other cause. If

any such person is unable or unwilling to serve as a director

nominee at the date of the Annual Meeting or any postponement or

adjournment thereof, the proxies may be voted for a substitute

director nominee, designated by the proxy holders or by the present

Board to fill such vacancy, or for the balance of those director

nominees named without nomination of a substitute, and the Board

may be reduced accordingly. The Board has no reason to believe

that any of such director nominees will be unwilling or unable to

serve if elected as a director.

Required Vote and Recommendation

The election of

directors requires the affirmative vote of a plurality of the

voting shares present virtually or represented by proxy and

entitled to vote during the Annual Meeting. The nine nominees

receiving the highest number of affirmative votes will be elected.

Abstentions and broker non-votes will

have no effect on the outcome of the election of the

directors. Unless otherwise instructed or unless authority

to vote is withheld, shares represented by executed proxies will be

voted “FOR” the election of the director nominees

listed above.

The

Board recommends that the stockholders vote “FOR” the election of

Messrs. Cohen, Kinsella, Thomas, Parris, Walker, Sherman, Kennedy and Kukowski, and Ms. Sentovich.

Director Nominees

The following

section sets forth certain information regarding the nominees for

election as directors of the Company. There are no family

relationships between any of the director nominees and the

Company’s executive officers.

|

Name

|

Age

|

Positions

|

Independent

|

|

Scot

Cohen

|

52

|

Executive Chair

|

|

|

Thomas P.

Smith

|

53

|

Chief Executive Officer and President

|

|

|

Patrick

Kinsella

|

67

|

Director

|

X

|

|

Michael

Parris

|

62

|

Director

|

X

|

|

Wayne

Walker

|

62

|

Lead

Independent Director

|

X

|

|

Kimberly

Sentovich

|

53

|

Director

|

X

|

|

Kevin

Sherman

|

51

|

Director

|

X

|

|

TJ

Kennedy

|

49

|

Director

|

X

|

|

Jeffrey

Kukowski

|

53

|

Director

|

X

|

|

|

|

Scot

Cohen cofounded

the Company with Messrs. James Barnes and Elwood Norris in March

2016, and currently serves as its Executive Chairman since July

2017. Prior to July 2017, he served as a Manager until the

Company’s incorporation in March 2017 at which time he was

appointed as the Company’s Corporate Secretary until January

2018. Mr. Cohen has over 20 years of experience in institutional

asset management, wealth management, and capital markets. He

currently manages several operating partnerships that actively

invest in the energy sector in addition to maintaining an active

investment portfolio in various public companies, early-stage

private companies, hedge funds and alternative assets including

real estate. Some of these include serving as principal of the

Iroquois Capital Opportunity Fund, a closed end private equity fund

he founded in 2010 which focuses on investments in North American

oil and gas assets; as the Manager of V3 Capital, LLC, an investor

in public and private companies that he founded in 2015, and was

the co-founder of Iroquois Capital Investment Group, LLC. Mr. Cohen

currently sits on the board of directors of Charlie’s

Holding, Inc., and serves as Executive Chair of the Board of Petro

River Oil Corp. since 2012. Mr. Cohen earned his Bachelor of

Science degree from Ohio University.

The Board

believes Mr. Cohen’s success with multiple private investment

firms, his extensive contacts within the investment community and

financial expertise strengthens the Company’s efforts to

raise capital to fund the continued implementation of its business

plan.

|

|

|

|

|

Thomas P. Smith

joined the Company in

March 2019 as President. In October 2020 he was appointed as

Interim Chief Executive Officer and in March 2021 he was appointed

as Chief Executive Officer. As an experienced international and

business savvy executive Mr. Smith serves as the Company’s

primary spokesperson responsible for communicating with various

constituencies including shareholders, investors, media,

governments and customers. Mr. Smith co-founded TASER International (now Axon

Enterprise, Inc.) in 1993 (“TASER”). He served as President of TASER until

October 2006, and as Chairman of the Board of Directors of TASER

from October 2006 until he retired to pursue entrepreneurial

activities in February 2012. Among his most significant roles and

responsibilities at TASER, Mr. Smith managed domestic and

international export sales, significantly expanding the sale and

distribution of TASER’s products, including sales to more

than 17,200 federal, state and local law enforcement agencies in

over 100 countries. He also had roles at TASER managing

manufacturing and operations and served as a key spokesperson. His

prior entrepreneurial activities after TASER included working with

entities engaged in aviation, beverages and law enforcement

products. He co-founded and had management roles with Achilles

Technology Solutions, LLC (2012-January 2020) and its wholly-owned

subsidiary ATS Armor, LLC (2015-2019) and research company ATS MER

(2015-2019). ATS Armor filed a petition for Chapter 7 Bankruptcy in

March 2019, and ATS MER filed a petition for Chapter 7 Bankruptcy

in February 2019. Mr. Smith holds a B.S. degree in Ecology and

Evolutionary Biology from the University of Arizona and a M.B.A.

degree from Northern Arizona

University.

The

Board believes Mr. Smith’s extensive experience in senior

leadership positions with TASER, especially managing domestic and

international sales, together with his executive experience and

experience working with law enforcement and the markets in which

the Company operates, bring valuable experience to the Company and

the Board.

|

|

|

|

|

Patrick Kinsella

was

appointed as a director of the Company in November 2018.

Mr. Kinsella previously served as an adjunct professor at the

USC Marshall School of Business, from August 2011 to December 2019.

In 2014, he was appointed as a director and the Chairman of the

Audit Committee of PennyMac Financial Services, Inc.

(“PennyMac”).

Prior to his retirement as a senior audit partner in May 2013,

Mr. Kinsella spent over 37 years at KPMG LLP serving clients

generally concentrated in the financial services sector, including

banks, thrifts, mortgage companies, automotive finance companies,

alternative investment and real estate companies. Mr. Kinsella

received a Bachelor of Science Degree in Accounting from California

State University, Northridge, and is a licensed certified public

accountant in the State of California.

The Board believes that Mr. Kinsella’s extensive

experience in providing professional accounting and auditing

services and his experience serving as Chair of the Audit Committee

of PennyMac contributes to his designation as a financial and

accounting expert, and therefore as an asset to the

Board.

|

|

|

|

|

Michael

Parris was appointed as a director of the Company in

November 2017. Mr. Parris has been a

partner at Perry Rogers Partners Inc. (“Perry

Rogers”), a sports

management firm, since 1996, where he primarily oversees the SHAQ

Brand and other strategic alliances. His role at Perry Rogers

encompasses business development, worldwide brand management,

marketing and public relations. Prior to joining Perry Rogers, Mr.

Parris had a successful career in law enforcement with the Newark

Police Department in Newark, New Jersey, rising to the rank of

Lieutenant. During his career in law enforcement, he worked and

commanded several specialized units, including Homicide, Robbery,

and Internal Affairs. Mr. Parris holds a Bachelor of Science degree

in Business Management from the University of

Phoenix.

The Board believes that given his

background in law enforcement and

worldwide marketing and brand experience, Mr. Parris’

broad experience and insights into the markets served by the

Company benefits the Board and the Company.

|

|

|

|

|

Wayne

Walker was appointed as a

director of the Company in November 2018 and Lead Independent

Director in January 2021. Mr. Walker has more than 30 years of

experience in corporate law, governance and corporate

restructuring, including 15 years at the DuPont Company in the

Securities and Bankruptcy Group, where he worked in the Corporate

Secretary’s office and served as Senior Counsel. In 2003, Mr.

Walker founded Walker Nell Partners, Inc.

(“Walker Nell”), an international business consulting

firm providing corporate governance and restructuring, fiduciary

services, litigation support, and other services to client

corporations and law firms, where he continues to serve as

President. Mr. Walker currently serves on the board of directors of

Petro Pharmaceuticals, Inc. (NASDAQ: PTPI) and AYRO, Inc. (NASDAQ:

AYRO), as well as Pitcairn Company, a multi-family office wealth

management firm. He is the former Vice President of Board of

Education of the City of Philadelphia, Chairman of the Board of

Trustees of National Philanthropic Trust, a public charity that

holds over $11.0 billion of assets under management, and the Board

of Directors for Humanity International, a global non-profit,

non-governmental housing organization. He holds a Bachelor of Arts

Degree from Loyola University New Orleans and a Juris Doctorate

from Catholic University of America. He also studied finance for

non-financial managers at the University of Chicago’s

Graduate School of Business.

The Board believes that Mr.

Walker’s substantial knowledge and more than 30 years of

experience in corporate governance, restructuring and corporate

litigation enhances the Board’s corporate governance and

related experience.

|

|

|

|

|

Kimberly

Sentovich was appointed as a

director of the Company in April 2021. Ms. Sentovich is a seasoned

merchandising, operations, IT and supply chain executive with 30

years of experience with multi-billion-dollar profit and loss

responsibility. From 2017 to 2019, Ms. Sentovich served as the

Senior Vice President of Operations for Torrid, an apparel

retailer. From 2015 to 2017, Ms. Sentovich was Executive

Vice President of Stores and Logistics at Gymboree, responsible for

all 1300 company owned stores in North America. Ms.

Sentovich previously spent seven years (2008-2015) at Walmart

rising from Regional Vice President of Operations –

California to Divisional Senior Vice President of Operations

– Pacific Division and fifteen years at The Home Depot

(1993-2008) rising to the level of Regional Vice President of

Operations. Ms. Sentovich has served on the board of directors

of One Stop Systems (NASDAQ: OSS) from 2019 to present, the

Children's Hospital of Orange County from 2016 to present, on which

she serves on the Executive Committee, Compensation Committee,

Nominating Committee, and Finance Committee. Ms. Sentovich obtained

her MBA from The Paul Merage School of Business, University of

California, Irvine and her B.A. in Philosophy and Political Science

with a Minor in economics from Bryn Mawr

College.

Ms.

Sentovich’s extensive executive and operations experience, as

well as her independence, judgment and exceptional leadership

experience makes her a valuable addition to the

Board.

|

|

|

|

|

Kevin

Sherman was appointed as a director of the Company in

April 2021. Mr. Sherman currently serves as the Interim Chief

Executive Officer, Chief Marketing Officer, and Chief Revenue

Officer of Tractor Beverages, Inc. (“Tractor”), where he has served since 2018. Mr.

Sherman has served as a member of the board of directors of Tractor

since 2015. From 2012 to 2017, Mr. Sherman served as a member of

the board of directors, Chief Executive Officer, President, and

Chief Marketing Officer of True Drinks, Inc. Mr. Sherman holds a

Bachelor of Arts in Philosophy from Gordon College and a Master of

Arts in Educational Administration from Loyola Marymount

University.

The Board

believes that Mr. Sherman's extensive experience in marketing

products and driving revenue growth enhances the Board's experience

and makes him a valuable member of the Board and as a resource for

the management team.

|

|

|

|

|

TJ

Kennedy was appointed as a

director of the Company in April 2021. Mr. Kennedy has served as

the Chief Executive Officer, president, and member of the board of

directors of Qumu, Inc. (NASDAQ: QUMU) (“Qumu”) since July 2020. Qumu provides the tools

to create, manage, secure, distribute and measure the success of

live and on-demand video for enterprises. From January 2019 to July

2020, Mr. Kennedy served as the Chief Executive Officer and member

of the board of directors of Allerio, Inc., and a director of the

Public Safety Network from January 2018 to July 2020. From July

2013 to January 2018, Mr. Kennedy served as the President/Deputy

Executive Director of FirstNet – First Responder Network

Authority. Mr. Kennedy holds a Bachelor of Science in Health

Promotion and Education from the University of Utah, and a Master's

of Business Administration from Johns Hopkins

University.

The Board believes that Mr. Kennedy's extensive experience in the

fields of technology, public safety, manufacturing, and

communications, across both domestic and international markets,

make him a valuable member of the Board.

|

|

|

|

|

Jeff

Kukowski, was appointed as a

director of the Company in April 2021. Mr. Kukowski is currently

the Chief Executive Officer and a director of Cloudbolt Software,

an enterprise cloud management leader, having served in that

capacity since April 2020. From May 2019 to January 2020, Mr.

Kukowski was the Chief Revenue Officer of Yubico, the leading

provider of hardware authentication security keys. He was the Chief

Executive Officer and a member of the board of directors of

SecureAuth from August 2015 to November 2018. SecureAuth is a

leader in the identity and access management space. Prior to

joining SecureAuth, Mr. Kukowski was the Chief Operating Officer of

Axon (formerly Taser International: Nasdaq: AXON)

(“Axon”), from June 2010 to December 2014. Prior

to Axon, Mr. Kukowski was the Chief Executive Officer and a

director of Sellit Social Commerce, from March 2009 to June 1010.

Mr. Kukowski has also served as the Chief Operating Officer and a

director of Destinator Technologies (TSX: ICS), from April 2005 to

October 2008. Mr. Kukowski graduated from the University of Chicago

Booth School of Business with a Master's in Business Administration

and holds a Bachelor of Arts in Economics from Northwestern

University.

The Board believes that Mr. Kukowski’s experience with Axon

and his extensive experience in senior executive roles and as a

director will assist management in managing the Company’s

growth and will contribute to the Company’s corporate

governance and oversight.

|

|

Director Nominations

The Board

nominates directors for election at each annual meeting of

stockholders, appoints new directors to fill vacancies when they

arise, and has the responsibility to identify, evaluate and recruit

qualified director candidates to the Board for such nomination or

appointment.

The Board

identifies director nominees by first considering those current

members of the Board who are willing to continue service. Current

members of the Board with skills and experience that are relevant

to our business and who are willing to continue service are

considered for re-election, balancing the value of continuity of

service by existing members of the Board with that of obtaining a

new perspective. Director nominees are selected by a majority of

the members of the Board. Although the Company does not have a

formal diversity policy, in considering the suitability of director

nominees, the Board considers such factors as it deems appropriate

to develop a Board that is diverse in nature and comprised of

experienced and seasoned advisors. Factors considered by the Board

include judgment, knowledge, skill, diversity, integrity,

experience with businesses and other organizations of comparable

size, including experience in law enforcement, the use of force

product industry, intellectual property, business, corporate

governance, marketing, finance, administration or public service,

the relevance of a candidate’s experience to our needs and

experience of other Board members, experience with accounting rules

and practices, the desire to balance the considerable benefit of

continuity with the periodic injection of the fresh perspective

provided by new members, and the extent to which a candidate would

be a desirable addition to the Board and any committees of the

Board.

A

stockholder who wishes to suggest a prospective director nominee

for the Board may notify the Corporate Secretary of the Company in

writing with any supporting material the stockholder considers

appropriate. Director nominees suggested by stockholders are

considered in the same way as director nominees recommended by

other sources.

Director Independence

Our Board has reviewed the independence of our

directors based on the listing standards of the Nasdaq Stock Market

(“Nasdaq”). Based on this review, the Board of

Directors determined that Messrs. Kinsella, Parris, Walker,

Sherman, Kennedy and Kukowski, and Ms. Sentovich, are independent,

as defined in Rule 5605(a)(2) of the Nasdaq Rules. In making this

determination, our Board considered the relationships that each of

these non-employee directors has with us and all other facts and

circumstances our Board deemed relevant in determining their

independence.

Board Meetings

Directors

hold office until the next annual meeting of the stockholders or

until their successors have been elected or appointed and duly

qualified. Vacancies on the Board that are created by the

retirement, resignation or removal of a director, may be filled by

the vote of the majority of the remaining members of the Board,

with such new director serving the remainder of the term or until

his/her successor shall be elected and qualified.

The Board

is elected by and is accountable to our stockholders. The

Board establishes Company policy and provides strategic direction,

oversight, and control. The Board met sixteen times during the

year ended December 31, 2020 and all incumbent directors attended

at least 75% of the aggregate number of meetings of the Board and

of the committees on which each of the directors served. The Board

also acted by unanimous written consent five times during the year

ended December 31, 2020.

Committees of the Board of Directors

Our Board

currently has three standing committees which consist of the Audit

Committee, Compensation Committee, and Nominating and Governance

Committee. Our Board has adopted

written charters for each of the foregoing committees, copies of

which are publicly available on our website at www.wrap.com

under the “Investors” tab.

Our Board may establish other committees from time to time as it

deems necessary or appropriate. The chart below reflects the

standing committees of our Board and the composition of each

committee as of the date of this Proxy Statement. On April 19,

2021, Messrs. Sherman, Kennedy and Kukowski, and Ms. Sentovich,

were appointed to the Board. On or after the Annual Meeting, the

Board intends to meet to consider the composition of each committee

that will result in different committee composition from the

composition of each committee set forth below:

|

|

|

|

|

|

|

Nominating and Governance

|

|

Scot Cohen

|

|

|

|

|

Patrick Kinsella

|

CC

|

X

|

X

|

|

David Norris (1)

|

|

|

|

|

Michael Parris

|

X

|

X

|

X

|

|

Wayne Walker

|

X

|

CC

|

CC

|

|

Recent appointees and

nominees:

|

|

|

|

|

Kimberly

Sentovich

|

|

|

|

|

Kevin Sherman

|

|

|

|

|

TJ Kennedy

|

|

|

|

|

Jeff Kukowski

|

|

|

|

CC – Committee Chair

X – Member

(1)

Mr. Norris has been a

director since January 2018 and is not standing for re-election to

the Board at the Annual Meeting.

Audit

Committee

The Audit

Committee assists our Board in fulfilling its legal and fiduciary

obligations in matters involving our accounting, auditing,

financial reporting, internal control and legal compliance

functions by approving the services performed by our independent

accountants and reviewing their reports regarding our accounting

practices and systems of internal accounting controls. The Audit

Committee also oversees the audit efforts of our independent

accountants and takes those actions as it deems necessary to

satisfy that the accountants are independent of management. The

Audit Committee currently consists of Messrs. Kinsella, Parris and

Walker, each of whom is a non-management member of our Board that

we believe meets the criteria for independence under the applicable

Nasdaq Rules and SEC rules and regulations. Mr. Kinsella is also

our designated Audit Committee financial expert, as defined under

SEC rules. We believe that the composition of our Audit

Committee meets the criteria for independence under the applicable

Nasdaq Rules and SEC rules and regulations, and the functioning of

our Audit Committee complies with the applicable Nasdaq Rules and

SEC rules and regulations.

The Audit

Committee met seven times during the year ended December 31, 2020,

with all members of the Audit Committee in attendance. The

Audit Committee met with our Chief Financial Officer and with our

independent registered public accounting firm and evaluated the

responses by the Chief Financial Officer, both to the facts

presented and to the judgments made by our independent registered

public accounting firm.

Compensation Committee

The

Compensation Committee determines our general compensation policies

and the compensation provided to our directors and officers. The

Compensation Committee also reviews and determines bonuses for our

officers and other employees. In addition, the Compensation

Committee reviews and determines equity-based compensation for our

directors, officers, employees and consultants and administers our

2017 Plan. The Compensation Committee currently consists of

Messrs. Kinsella, Parris and Walker, each of whom is a

non-management member of our Board of Directors that we believe

meets the criteria for independence under the applicable Nasdaq

Rules and SEC rules and regulations. We believe that the

composition of our Compensation Committee meets the criteria for

independence under the applicable Nasdaq Rules and SEC rules and

regulations, and the functioning of our Compensation Committee

complies with the applicable Nasdaq Rules and SEC rules and

regulations.

In March 2019, the Compensation Committee,

retained RCL Compensation Consulting (“RCL”) as its independent compensation

consultant in connection with the compensation paid to executive

officers and to review director compensation. RCL does not provide

any material services to management or the Board and has determined

that RCL does not have any business or personal relationships with

any member of the Board or management.

In

determining executive compensation, the Compensation Committee

obtains input and advice from RCL, and reviews recommendations from

our Chief Executive Officer with respect to the performance metrics

or objectives as it pertains to the compensation paid to our other

executive officers. The Board of Directors, upon recommendation

from the Compensation Committee, reviews and approves the

compensation paid to the Company’s Chief Executive Officer

and other executive officers.

The

Compensation Committee, formed in November 2018, met eight times

during the year ended December 31, 2020, with all members of the

Compensation Committee in attendance. The Compensation also acted

by Unanimous Written Consent nine times during the year ended

December 31, 2020.

Nominating and

Governance Committee

The

Nominating and Governance Committee is responsible for making

recommendations to our Board of Directors regarding candidates for

directorships and the size and composition of our Board. In

addition, the Nominating and Governance Committee is responsible

for overseeing our corporate governance guidelines and reporting

and making recommendations to the full Board of Directors

concerning corporate governance matters. The Nominating and

Governance Committee currently consists of Messrs. Kinsella, Parris

and Walker.

The

Nominating and Governance Committee held four meetings during the

year ended December 31, 2020, with all members of the Nominating

and Governance Committee in attendance.

Board Role in Risk Assessment

Management,

in consultation with outside professionals, as applicable,

identifies risks associated with the Company’s operations,

strategies and financial statements. Risk assessment will also be

performed through periodic reports received by the Audit Committee

from management, counsel and the Company’s independent

registered public accountants relating to risk assessment and

management. Audit Committee members meet privately in executive

sessions with representatives of the Company’s independent

registered public accountants. The Board also provides risk

oversight through its periodic reviews of the financial and

operational performance of the Company.

Board Leadership Structure

Currently, Thomas Smith

serves as the Company’s Chief Executive Officer and

President, Scot Cohen serves as the Executive Chair of our Board,

and Wayne Walker serves as Lead Independent Director. Our

Board has determined that it is in the best interests of the Board

and the Company to separate the roles of the Chief Executive

Officer and Chair of the Board, and to appoint a Lead Independent

Director to serve in a lead capacity to coordinate the activities

of the other independent directors and to perform such other duties

and responsibilities as the Board of Directors may determine. Our

Board believes this structure increases the Board’s

independence from management, serves to facilitate independent

Board discussions and governance and, in turn, leads to better

monitoring and oversight of management. Although our Board believes

the Company is currently best served by separating the role of

Chair of the Board of Directors and Chief Executive Officer, and by

appointing a Lead Independent Director, it will review and

consider the continued appropriateness of this structure at least

annually.

Indemnification of Officers and Directors

As

permitted by the Delaware General Corporation Law, the

Company will indemnify its directors and officers against

expenses and liabilities they incur to defend, settle, or

satisfy any civil or criminal action

brought against them on account of their being or

having been Company directors or officers

unless, in any such action, they are adjudged to have acted

with gross negligence or willful misconduct.

Code of Business Conduct and Ethics

We have adopted a Code of Business Conduct and

Ethics (the “Code”) applicable to all of our employees,

including our principal executive officer, principal financial

officer and principal accounting officer. We will provide any

person, without charge, a copy of our Code upon written request to

Investor Relations, Wrap Technologies, Inc., at 1817 W 4th

Street, Tempe, Arizona 85281. A copy

of the Code is publicly available by visiting our website at

www.wraptechnologies.com.

Stockholder Communications

If you wish to

communicate with the Board of Directors, you may send your

communication in writing to:

Wrap

Technologies, Inc.

1817 W 4th Street

Tempe, Arizona 85281

Attn: Corporate

Secretary

You must

include your name and address in the written communication and

indicate whether you are a stockholder of the Company. Our

Corporate Secretary will review any communication received from a

stockholder, and all material and appropriate communications from

stockholders will be forwarded to the appropriate director or

directors or committee of the Board of Directors based on the

subject matter.

Section 16(a) Beneficial Ownership Reporting

Compliances

Section 16(a) of the Securities Exchange Act of

1934, as amended (the “Exchange

Act”) requires our

officers, directors, and persons who beneficially own more than 10%

of our Common Stock to file reports of ownership and changes in

ownership with the SEC. Officers, directors, and

greater-than-ten-percent stockholders are also required by the SEC

to furnish us with copies of all Section 16(a) forms that they

file.

Based

solely on a review of copies of such reports furnished to our

Company and representation that no other reports were required

during the year ended December 31, 2020, we believe that

all

persons subject

to the reporting requirements pursuant to Section 16(a) filed the

required reports on a timely basis with the SEC, other than James

A. Barnes who was late reporting one transaction for the transfer

of shares of Common Stock from his family trust to his individual

name; Marc Thomas who was late reporting his initial Form 3 filing

of no ownership and his initial Form 4 reporting a stock option

grant; David G. Norris who was late reporting the cancellation of

restricted stock units (“RSUs”)

issued to Mr. Norris and the grant of director RSUs; and Scot Cohen

who was late reporting the charitable gift of Common

Stock.

EXECUTIVE OFFICERS AND EXECUTIVE COMPENSATION

Executive Officers

Our executive

officers are appointed by the Board and serve at the discretion of

the Board, subject to the terms of any employment agreements they

may have with the Company. The following is a brief description of

the present and past business experience of each of the

Company’s current executive officers.

|

Name

|

Age

|

Positions

|

|

Thomas P.

Smith

|

53

|

Chief

Executive Officer and President

|

|

James A.

Barnes

|

66

|

Chief Financial Officer, Corporate

Secretary and

Treasurer

|

|

Elwood G.

Norris

|

82

|

Chief

Technology Officer

|

|

Scot

Cohen

|

52

|

Executive

Chairman

|

|

|

|

|

Thomas P. Smith.

Please see Mr. Smith’s biography under “Director

Nominees”

above in this Proxy

Statement.

James A.

Barnes cofounded the Company

with Messrs. Elwood Norris and Cohen in March 2016, and currently

serves as Chief Financial Officer, Secretary and Treasurer. He

served as Manager until the Company’s incorporation in March

2017 when he was appointed President and Chief Financial Officer.

He served as a member of the Company’s Board of Directors

from March 2017 to November 2018. In January 2018 he was appointed

to the additional positions of Secretary and Treasurer and resigned

as President. He has served as the President of Sunrise Capital,

Inc., a private venture capital and financial and regulatory

consulting firm, since 1984. He was Chief Financial Officer of

Parametric Sound Corporation (now Turtle Beach Corporation) from

2010 to February 2015, and from February 2015 to February 2017

served as Vice President Administration at Turtle Beach

Corporation. Since 1999, he has been Manager of Syzygy Licensing

LLC, a private technology invention and licensing company he owns

with Mr. Elwood Norris. He previously practiced as a certified

public accountant and management consultant with Ernst & Ernst,

Touche Ross & Co., and as a principal in J. McDonald & Co.

Ltd., Phoenix, Arizona. He graduated from the University of

Nebraska with a Bachelor of Arts Degree in Business Administration

in 1976 and is a certified public accountant (status:

inactive).

Elwood G.

Norris cofounded the Company

with Mr. Barnes and Mr. Cohen in March 2016 and currently serves as

the Company’s Chief Technology Officer. He served as a

director on the Company’s Board of Directors from March 2017

to January 2018. He was previously a director and President of

Parametric Sound Corporation (now Turtle Beach Corporation) from

2010 to February 2015, and from February 2015 to September 2016 he

served as Chief Scientist, a non-executive position, at Turtle

Beach. He was a director of LRAD Corporation (now Genasys Inc.)

from August 1980 to June 2010. He served as Chairman of LRAD

Corporation’s Board of Directors, an executive position, in

which he served in a technical advisory role and acted as a product

spokesman from September 2000 to April 2009. He is an inventor, and

has authored more than 80 U.S. patents, primarily in the fields of

electrical and acoustical engineering, and has been a frequent

speaker on innovation to corporations and government organizations.

He is the inventor of our BolaWrap technology. Mr. Elwood Norris is

a majority owner of Syzygy, but has no employment or management

relationship with Syzygy.

Scot

Cohen. Please see Mr.

Cohen’s biography under “Director

Nominees” above in this

Proxy Statement.

There are

no arrangements or understandings between our Company and any other

person pursuant to which he was or is to be selected as a director,

executive officer or nominee. David Norris, director, is the son of

Elwood G. Norris, the Company’s Chief Technology Officer and

a former director.

Summary Compensation Table

The following table sets forth information

regarding the compensation awarded to or earned by the current and

former executive officers listed below during the years ended

December 31, 2020 and 2019. As an emerging growth company, we have

opted to comply with the reduced executive compensation disclosure

rules applicable to “smaller reporting companies,” as

such term is defined in the rules promulgated under the Securities

Act of 1933, as amended (the “Securities

Act”), which require

compensation disclosure for only our principal executive officers,

the two most highly compensated executive officers other than our

principal executive officer and up to two additional executive

officers during the year. Throughout this document, the six

officers below are referred to as our “named executive

officers”.

|

|

|

|

|

|

|

|

|

Name and Principal Position

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Thomas P.

Smith (3)

|

2020

|

$250,000

|

$463,800

|

$-(4)

|

$199,876

|

$-

|

$913,676

|

|

Current Chief Executive Officer and President

|

2019

|

$197,917

|

$-

|

$-

|

$2,060,088

|

$10,416

|

$2,268,421

|

|

|

|

|

|

|

|

|

|

Marcel

Thomas (5)

|

2020

|

$166,667

|

$-

|

$-

|

$1,611,175

|

$-

|

$1,777,842

|

|

Former Chief Executive Officer and current Chief Government Affairs

Officer

|

2019

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

David

Norris (6)

|

2020

|

$207,500

|

$133,000

|

|

$199,876

|

$-

|

$540,376

|

|

Former Chief Executive Officer and current Director

|

2019

|

$180,000

|

$-

|

$618,325

|

$-

|

$-

|

$798,325

|

|

|

|

|

|

|

|

|

|

James A.

Barnes (7)

|

2020

|

$180,000

|

$100,000

|

$-

|

$77,951

|

$-

|

$357,951

|

|

Chief Financial Officer, Secretary and Treasurer

|

2019

|

$180,000

|

$-

|

$123,666

|

$-

|

$-

|

$303,666

|

|

|

|

|

|

|

|

|

|

Scot Cohen

(8)(9)

|

2020

|

$136,667

|

$-

|

$249,995

|

$-

|

$265,000

|

$651,662

|

|

Executive Chairman and Director

|

2019

|

$120,000

|

$-

|

$-

|

$-

|

$-

|

$120,000

|

|

|

|

|

|

|

|

|

|

Michael

Rothans (10)

|

2020

|

$180,000

|

$70,000

|

$-

|

$99,306

|

$-

|

$349,306

|

|

Former Chief Operating Officer and current Chief Strategy

Officer

|

2019

|

$120,000

|

$-

|

$173,130

|

$-

|

$-

|

$293,130

|

|

(1)

|

Amounts

reported in this column do not reflect the amounts actually

received by our named executive officers. Instead, these amounts

reflect the aggregate grant date fair value of RSUs granted to the

named executive officers during the fiscal year ended December 31,

2020, as computed in accordance with the Financial Accounting

Standards Board Accounting Standards Codification 718

(“ASC 718”).

Assumptions used in the calculation of these amounts are included

in the notes to our financial statements included in our Annual

Report. As required by SEC rules, the amounts shown exclude the

impact of estimated forfeitures related to service-based vesting

conditions.

|

|

(2)

|

Amounts

reported in this column do not reflect the amounts actually

received by our named executive officers. Instead, these amounts

reflect the aggregate grant date fair value of each stock option

granted to the named executive officers during each fiscal year, as

computed in accordance with the Financial Accounting Standards

Board Accounting Standards Codification 718 (“ASC 718”). Assumptions used in

the calculation of these amounts are included in the notes to our

financial statements included in our Annual Report. As required by

SEC rules, the amounts shown exclude the impact of estimated

forfeitures related to service-based vesting conditions. Our named

executive officers will only realize compensation to the extent the

trading price of our Common Stock is greater than the exercise

price of such stock options.

|

|

(3)

|

Mr. Smith became an employee and was appointed

President in March 2019, Interim Chief Executive Officer in October

2020 and Chief Executive Officer in March 2021. Total cash bonuses

for the year included $150,000 paid in September 2020 for execution

of an At-Will Employment, Confidential Information,

Non-Compete/ Non-Solicitation, Invention Assignment, and

Arbitration Agreement.

|

|

|

|

|

(4)

|

In the year

ended December 31, 2020, RSUs subject to performance conditions

were granted with an aggregate grant date fair value of $150,000

computed in accordance with ASC 718. This amount represents the

highest level of achievement possible under the terms of the grant.

These RSUs were not vested and were cancelled and settled as part

of cash bonuses paid to Mr. Smith for 2020.

|

|

(5)

|

Mr. Thomas

served as Chief Executive Officer July 30, 2020 until October 29,

2020.

|

|

(6)

|

Mr. Norris, a

member of the Board of Directors, served as Chief Executive Officer

of the Company until July 30, 2020 and was an employee through

September 15, 2020. The compensation for services solely as a

director after his employment not included in the table above. See

“Non-Executive Director

Compensation” below.

|

|

|

|

|

(7)

|

Syzygy, an entity controlled by and partially

owned by Mr. Barnes, receives a royalty as described below in

“Certain Relationships and

Related Transactions” in

consideration for the license of certain technology necessary for

the development of BolaWrap 100. Mr. Barnes’ participation in

royalty payments is unrelated to employment, not considered

executive compensation and not included in the table

above.

|

|

(8)

|

A firm

wholly-owned by Mr. Cohen was paid $265,000 for certain investor, shareholder and marketing

services as described in “Certain Relationships and

Related Transactions”.

This amount is included as Other Compensation in the table

above.

|

|

(9)

|

On April 1, 2021 Mr. Cohen

was granted 31,250 RSUs at a grant date value of $173,750 for prior

services as a member of the board of directors. On April 1, 2021 he

was also granted a ten-year stock option on 100,000 shares of

Common Stock exercisable at $5.56 per share with a grant date value

of $254,294 for his services as Executive Chairman. These amounts

are not included in the table above as they were issued in 2021 and

considered compensation for 2021.

|

|

(10)

|

Mr. Rothans

served as Chief Operating Officer until August 1, 2020 when he was

appointed in a new role as Chief Strategy Officer, not considered

an executive officer position.

|

Employment Arrangements

Marcel

Thomas. On October 29,

2020, the Company entered into an

employment agreement with Marc Thomas, the Company’s

Chief Government Affairs Officer (the

“Agreement”). The Agreement provides

for an annual base salary of $400,000. In addition, Mr. Thomas

shall be eligible to receive an additional cash bonus (the

“Annual

Bonus”) based upon Mr.

Thomas’s attainment of certain goals and objectives to be

established by the Board or Compensation Committee, as defined in

the Agreement, on an annual basis. The Agreement shall continue for

a period of one year from the Effective Date, unless terminated

early or further extended by the parties. The Company may terminate

the Agreement at any time, with or without Cause, as such term is

defined the Agreement. If the Agreement is terminated by the

Company for Cause, Mr. Thomas will be entitled to Termination

Amounts, as defined in the Agreement. If the Agreement is

terminated by the Company without Cause, the Company shall pay Mr.

Thomas: (i) the Termination Amounts; (ii) severance in the form of

continuation of the Base Salary for the remaining term of the

Agreement; (iii) payment of Mr. Thomas’s premiums to cover

COBRA for the remaining term of the term of the Agreement; and (iv)

a prorated annual bonus equal the target Annual Bonus, if any, for

the year of termination multiplied by a fraction, the numerator of

which shall be the number of full and partial months Mr. Thomas

worked for the Company, and the denominator of which shall

be the number of remaining months through the term of the Agreement.

Upon entering into the Agreement, a prior employment agreement

between the Company and Mr. Thomas, dated as of July 30, 2020 (the

“Prior

Agreement”), was

terminated and is no longer in effect; however,

Mr.

Thomas’ options to purchase Common Stock dated as of July 30,

2020 issued in connection with the Prior Agreement continue

in full force in accordance with their original terms and

conditions.

Thomas Smith. Mr. Smith and the

Company are parties to an At-Will Employment, Confidential

Information, Non-Compete/Non-Solicitation, Invention Assignment,

and Arbitration Agreement, dated September 9, 2020 (“Smith

Agreement”). Under the

terms of the Smith Agreement, Mr. Smith’s employment by the

Company is at-will, and is for no specified period. The Smith

Agreement also provides for the payment to Mr. Smith of $150,000 in

consideration for Mr. Smith’s agreement to, among other

covenants, not to compete with the Company following his

termination of employment with the Company for a period of 12

months, or solicit customers, employees or others. The $150,000

required to be paid to Mr. Smith under the terms of the Smith

Agreement were paid to Mr. Smith in September

2020.

Outstanding

Equity Awards as of December 31, 2020

The following

table provides information regarding each unexercised stock option

to purchase our Common Stock and unvested shares underlying RSUs

held by our named executive officers as of December 31,

2020.

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Option

|

|

|

|

|

|

|

Grant

|

|

|

|

Expiration

|

|

|

|

|

|

Name

|

Date

|

|

|

|

Date

|

(#)

|

|

(#)

|

|

|

|

|

|

|

|

|

Thomas

Smith

|

4/1/2020

|

-

|

-

|

|

|

-

|

-

|

35,211(1)

|

$170,069

|

|

4/1/2020

|

|

110,193(2)

|

$4.26

|

4/1/2030

|

-

|

-

|

-

|

-

|

|

3/18/2019

|

583,334

|

416,666(3)

|

$5.41

|

3/18/2024

|

-

|

-

|

-

|

-

|

|

|

|

|

|

|

|

|

|

|

|

Marcel

Thomas

|

7/30/2020

|

-

|

350,000(9)

|

$11.22

|

7/30/2030

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

David

Norris

|

9/16/2020

|

-

|

-

|

|

|

7,160(10)

|

$34,583

|

|

|

|

4/1/2020

|

-

|

110,193(11)

|

$4.26

|

4/1/2030

|

-

|

-

|

-

|

-

|

|

5/23/2018

|

492,500

|

- (12)

|

$1.50

|

5/23/2023

|

-

|

-

|

-

|

-

|

|

|

|

|

|

|

|

|

|

|

|

James A.

Barnes

|

4/1/2020

|

|

42,975(4)

|

$4.26

|

4/1/2030

|

|

|

|

|

|

5/23/2019

|

|

|